Get your free copy of Editor’s Digest

FT editor Roula Khalaf picks her favourite stories in this weekly newsletter.

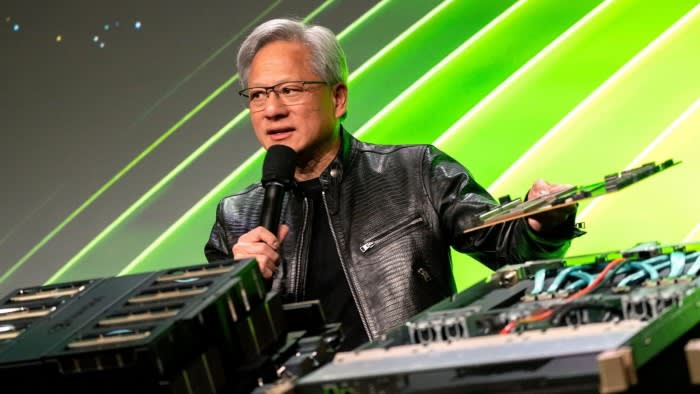

Delays to Nvidia’s next-generation artificial intelligence processors will not disrupt the company’s plans to produce a new version of its flagship product every year, Chief Executive Jensen Huang told the Financial Times.

Production issues affecting Nvidia’s highly anticipated new chip platform, Blackwell, are “not a problem” for plans to accelerate its release schedule from every two years to a “one-year cycle,” said Huang, who announced the ambitious new schedule last October.

Nvidia’s accelerating pace of innovation is seen as key to maintaining its dominance in AI chips in a market estimated to be worth hundreds of billions of dollars over the next few years.

Earlier this month, last-minute complications forced Nvidia and its partner Taiwan Semiconductor Manufacturing Co. to change how Blackwell is manufactured, forcing Nvidia to delay the full release of the chip until the end of this year.

The delay sent Nvidia shares down 2.8% in premarket trading on Thursday as investors worried about slowing growth and shrinking profit margins after the chipmaker rode the AI boom to a market capitalization of more than $3 trillion.

The ability of U.S. tech giants to meet ambitious production and profit targets has taken on outsized importance in the U.S. stock market, with their share price surge accounting for a quarter of the S&P 500’s gains so far this year.

Although manufacturing advanced chips has become increasingly complex, Huang said Blackwell’s successor will remain on schedule with annual upgrades. The company’s engineers are working on the next two generations, he said. “We’ll have it done on a one-year cycle.”

Nvidia has been accelerating the pace of product improvements as it seeks to stay ahead of rivals such as AMD and Intel in the graphics processing unit market.

Companies like Meta and OpenAI rely on Nvidia’s GPUs to train large language models – the AI systems behind chatbots such as ChatGPT – and for almost two years demand for the most powerful chips has far outstripped supply.

As investors debated how long big tech companies can keep spending tens of billions of dollars each quarter on data center equipment, Hwang was peppered with questions from analysts on Wednesday about how Nvidia’s customers are benefiting from their huge investments in AI infrastructure.

Huang told the FT that Nvidia itself is using AI to speed up data processing and help design and build products, resulting in huge productivity gains.

Recommendation

“We couldn’t design[our chips]without generative AI,” he said. “We couldn’t design Blackwell, and we can’t write software without AI anymore.”

He said that with the help of AI, NVIDIA’s 20,000 engineers have “effectively become about 60,000.”

“I think NVIDIA is the smallest big company in the world,” he said. “We can do things that you can’t do with hand-written software. NVIDIA is not a big-labor company.”

Hwang told analysts on Wednesday that Blackwell’s production problems were mainly related to “masks,” or the templates that imprint chip designs onto silicon wafers in a process called photolithography. The adjustments were needed to improve Blackwell’s manufacturing yields, which are crucial to Nvidia’s profit margins.

“The mask change is complete,” Huang said. “No functional changes are required.” Blackwell plans to ramp up production and begin shipping to customers during the fourth quarter of Nvidia’s fiscal year, which ends in January 2025, he added.

Asked about the impact on Nvidia’s profit margins, Chief Financial Officer Colette Kress told investors that margins would be slightly lower in the coming months, and that “we will probably see some change[in the fourth quarter]due to the transition as we introduce new products and differences in our cost structure.”

As a result, some Wall Street analysts have already started to cut their estimates for Nvidia’s gross margins, which contributed to the stock price falling on Thursday.

The challenge facing Nvidia and its rivals as they try to mimic the iPhone’s annual release cycle is formidable, TD Cowen analyst Matthew Ramsey said in a client note on Thursday.

“The entire server industry is ramping up production of one of the most complex products in the history of computing,” Ramsay said. “This will undoubtedly put strain on designs and supply chains. We continue to believe that minor changes in production timing do not change the theory, nor do they reflect a broader shift in demand for AI computing solutions overall.”

Additional reporting by Michael Acton