Semiconductor stocks have captivated Wall Street since the beginning of 2023. Advances in the chip market have enabled many other industries to take their technology to the next level. Fields such as artificial intelligence (AI), cloud computing, virtual/augmented reality, consumer technology and self-driving cars are all benefiting from new chip designs from companies like Nvidia. (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD)As a result, semiconductor companies have become one of the best choices for technology investments.

Since the start of the AI boom in early 2023, Nvidia and AMD stocks have risen 782% and 132%, respectively. Nvidia was ahead of the pack and was able to immediately start supplying chips to AI developers around the world, while AMD needed more time to produce competitive hardware.

However, AMD has seen promising progress in AI in 2024 and could be on track to make big gains in the coming years. It’s one of the semiconductor stocks predicted to catch up with Nvidia’s $3 trillion market cap within a decade.

AMD scales to better meet AI demands

AMD’s shares have risen 12% since the company reported its second-quarter 2024 earnings on July 30, encouraging investors with a win in AI that has proven the market’s biggest growth driver.

Total revenue increased 7% year over year to just under $6 billion, driven by 115% growth in the AI-Driven Data Center division and 49% growth in the Client division. The quarter benefited from increased sales of AI graphics processing units (GPUs) and central processing units (CPUs).

AMD went all-in on AI last year, expanding into several sectors of the industry that could be lucrative over the next decade. The company unveiled its most powerful GPUs yet and announced plans to buy server builder ZT Systems for $5 billion. The two moves give the company a competitive edge over Nvidia, and the acquisition will allow AMD to more quickly deploy AI GPUs at the scale needed by cloud providers.

AMD’s chips have already attracted some of the biggest names in the AI industry, with the company boasting Microsoft Azure, Meta Platforms, and Oracle as customers. These cloud giants are in fierce competition with each other and need powerful hardware to stay competitive. As a result, demand for AI chips is set to continue growing for the foreseeable future, and AMD is well positioned to reap the benefits.

The potential of AI beyond GPUs

In addition to GPUs, AMD is sowing seeds across the AI market, diversifying its position and looking to benefit from growth catalysts well into the future.

The story continues

The company sees a big opportunity in AI central processing units. CPUs have long been AMD’s strong suit, with the company’s CPU market share rising from 18% in 2017 to 34% this year, and it has consistently taken market share from Intel. Meanwhile, the AI CPU sector was valued at $15 billion last year and is projected to reach $410 billion by the end of the decade, expanding at a compound annual growth rate (CAGR) of 29%, according to data from Verified Market Reports.

Its CPU expertise puts AMD in a potentially advantageous position in the rapidly expanding AI-enabled PC market. As the demand for AI services grows, so does the need for more powerful hardware. As a result, AI-enabled PCs are forecasted to account for approximately 40% of global PC shipments in 2025, with the market growing at a CAGR of 44% through 2028.

At the start of 2023, Nvidia’s market cap was $359 billion. However, after a bullish period in which its stock price increased by 738%, it reached $3 trillion just 18 months later in June 2024. The company’s success is mainly due to a significant increase in AI GPU sales. Nvidia has shown what is possible by succeeding in one aspect of AI. Meanwhile, AMD has gained a foothold in multiple areas of the industry, which could lead to a significant increase in its stock price.

AMD’s market cap is currently around $251 billion. For the company’s stock to reach $3 trillion, it would need to grow 1,200% over the next decade. That’s a lofty goal, but not an unattainable one. AMD’s stock has risen over 3,000% since 2014, so it may not be that far off.

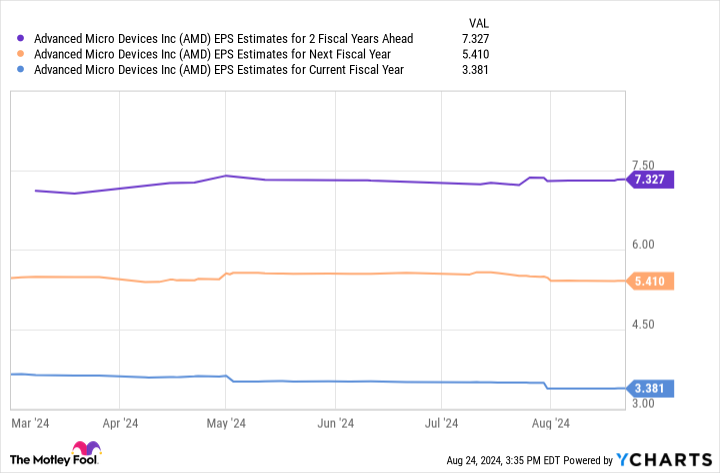

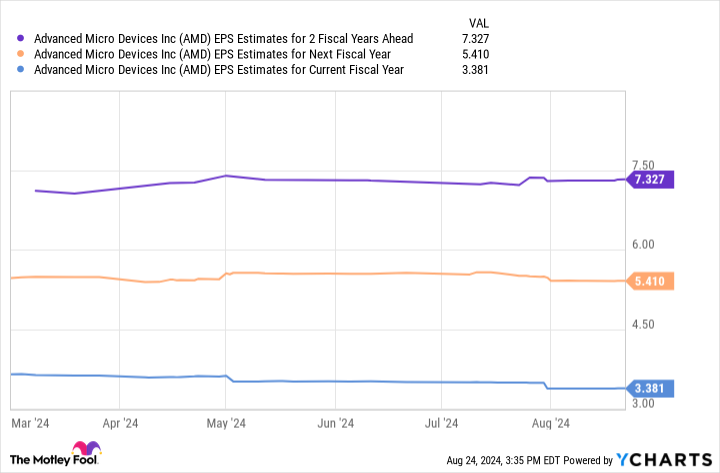

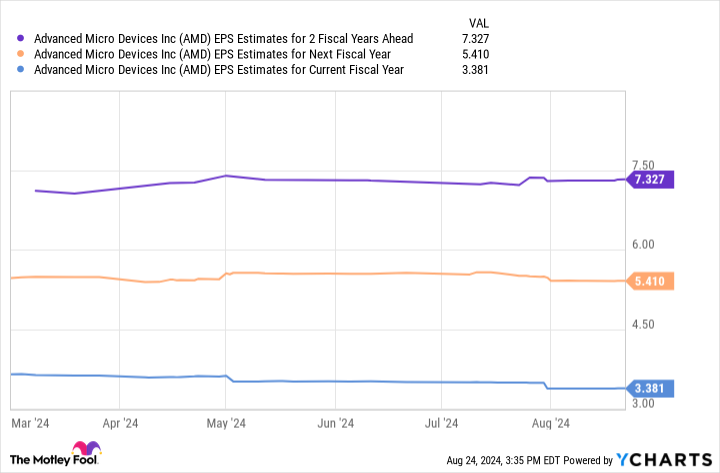

The chart above projects AMD’s earnings to reach just over $7 per share by fiscal 2026. Multiplying this figure by the company’s forward price-to-earnings ratio of 46 gives us a stock price of $336, projecting that the stock could grow nearly 115% by 2026.

However, Nvidia’s impressive growth in AI and AMD’s performance over the past decade suggest that growth may be modest. As a result, AMD may be on a growth trajectory to achieve the coveted $3 trillion market cap in the next decade. The company is expanding rapidly and you don’t want to miss out.

Should you invest $1,000 in Advanced Micro Devices right now?

Before buying Advanced Micro Devices shares, consider the following:

The analyst team at Motley Fool Stock Advisor just identified the 10 best stocks for investors to buy right now, and Advanced Micro Devices wasn’t among them — all of which have the potential to generate big gains over the next few years.

Let’s look back at April 15, 2005, when Nvidia made this list… if you had invested $1,000 at the time of our recommendation, you would have $786,169.!*

Stock Advisor offers investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts and two new stock picks every month. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, former director of market development and communications at Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Advanced Micro Devices, Meta Platforms, Microsoft, NVIDIA, and Oracle. The Motley Fool recommends Intel and recommends the following: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Prediction: The 1 semiconductor stock that will overtake Nvidia within 10 years was originally published by The Motley Fool.