Taiwan Semiconductor Manufacturing TSMC Samsung Electronics continues to lead the global foundry market with a 62% share in the second quarter of 2024. SSNLFwill be followed by , which has a 3% market share.

Taiwan Semiconductor’s $877 billion market capitalization reflects strong demand for artificial intelligence (AI) and a powerful semiconductor ecosystem.

Related article: Taiwan Semiconductor expands overseas investment with $1.95 billion subsidy to target long-term growth

The company also plans to double its production capacity for CoWoS (Chip on Wafer on Substrate) technology by 2024.

In addition, Taiwan Semiconductor plans to raise prices of its 3-nanometer and 5-nanometer process products by up to 8%, a strategic move that could further strengthen its market position and increase profitability.

Taiwan Semiconductor reported second-quarter sales rose 40.1% year-over-year, beating analyst expectations, helped by strong demand for 3-nanometer and 5-nanometer technologies.

Samsung Electronics is making strategic advancements, especially in AI and high-performance computing (HPC) applications, as the company focuses on evolving its 2nm process to meet the high performance, low power consumption and high bandwidth requirements of future technologies.

Intel International Trade Commission The company announced plans to introduce a 1.4nm ultrafine process by 2027. Second-quarter sales rose 0.9% year-over-year, below analyst expectations. The company revealed plans to cut its workforce by more than 15%.

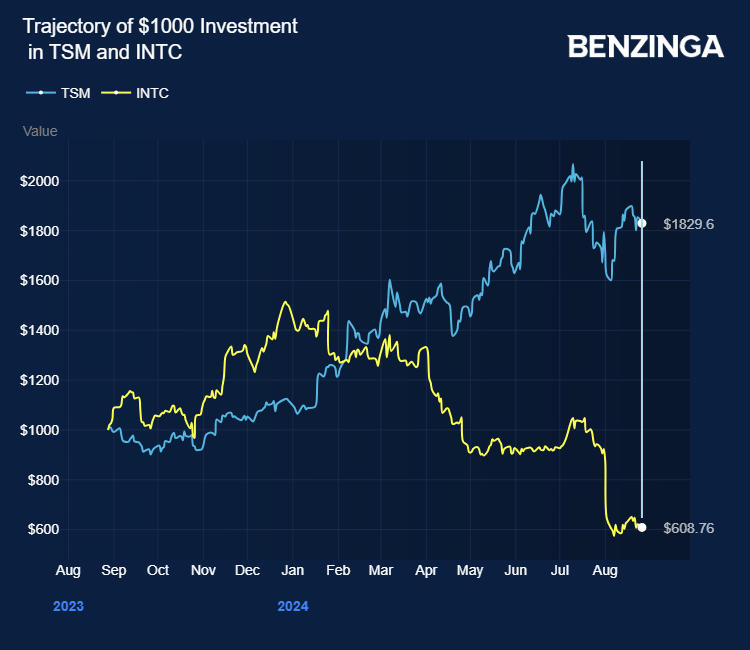

Taiwan Semiconductor shares have risen 80% over the past 12 months, while Intel has fallen more than 40%.

Investors can gain exposure to the semiconductor sector through the SPDR S&P Semiconductor ETF. XSD and ProShares Ultra Semiconductors USD.

Price Action: TSM shares were down 0.81% at last check on Tuesday, trading at $167.70 in pre-market trading.

Disclaimer: This content was created in part with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Jack Hong, Shutterstock

Market news and data provided by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.