NVIDIA Corporation and NVDA In this week’s featured earnings report, analysts highlight key trends such as the rise of artificial intelligence, strong demand from China, and geopolitical constraints as key drivers for the semiconductor industry.

Nvidia Revenue: According to Benzinga Pro data, analysts expect Nvidia to report revenue of $28.7 billion in the second quarter, up from $13.5 billion in the second quarter last year.

The company has beaten revenue expectations for eight consecutive quarters and has surpassed expectations in nine of the past 10 quarters.

Analysts expect Nvidia to post second-quarter earnings of 64 cents a share, up from 27 cents a year ago. The company has beaten analysts’ earnings expectations for six consecutive quarters and in eight of the past 10 quarters.

Cantor Fitzgerald analyst CJ Muse called Nvidia one of his top picks for the second half of 2024 ahead of the earnings report.

“We will be focused on AI first and foremost” in the semiconductor division, Muse said.

When it comes to semiconductor companies and AI, “you either have it or you don’t,” Muse said.

“Q2 continued to show the disconnect between the haves and have-nots, with AI-related things thriving while other sectors remain in cyclical stagnation.”

Analysts said relatively strong demand in China could be a positive for Nvidia and the industry.Geopolitical tensions, which are at the forefront of investor concerns, appear to be having a minimal impact on the company based on its results and guidance, analysts said.

Muse said Nvidia’s Blackwell delays are certainly a concern, but not as severe as some might expect.

“A delay of a month or two will have little impact on our view of this name. Demand remains strong and supply remains tight.”

Muse said Blackwell’s concerns are overblown, making Nvidia’s valuation “too cheap to ignore.”

Related article: NVIDIA is a top stock to buy next week, says market strategist: Best long-term idea is to ‘buy and keep’ NVIDIA

Other semiconductor stocks: Muse ranks Nvidia as a top semiconductor winner in the second half of 2024, along with Broadcom. AVGOMicron Technology MWestern Digital Corporation World BankNXP Semiconductors NXPIASML Holdings ASML Teradyne Tell As a top pick.

Broadcom, Micron, Teradyne, Marvel Technology MRVR According to analysts, the stock is attracting attention as one that has the potential to achieve outstanding performance in the AI space.

“Spending patterns remain strong and we don’t see a slowdown in the medium term given the materiality of investment. This group has experienced the biggest declines in the recent SOX rollercoaster,” Muse said, naming NVDA, AVGO, MU, MRVL and TER as AI choices.

Analysts are referring to Intel Corporation International Trade Commission Its book value is attractive and it could be considered a potential value stock, but there aren’t enough factors to drive the stock price higher.

“I have to believe that the risks and rewards are skewed towards the higher side, and that’s going to be the argument that a lot of people here will make.”

Muse said this is the cheapest Intel shares have traded on a book value basis in the past 30 years. “At the same time, the company currently faces significant structural headwinds and remains in a very uphill battle to bounce back,” Muse added.

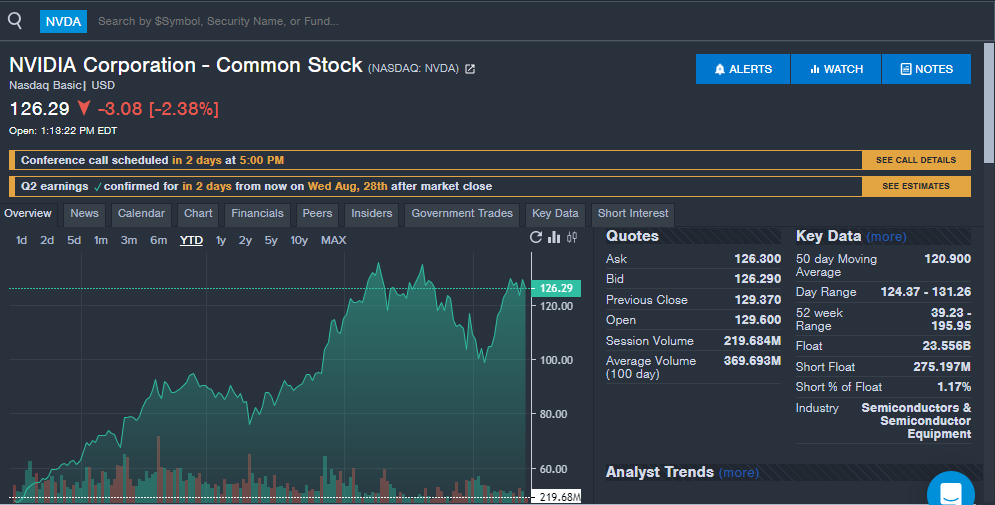

NVDA Price Action: Nvidia shares fell 3% to $126.90 on Monday, but its 52-week trading range has been $39.23 to $195.95. Nvidia shares are up more than 150% year-to-date in 2024.

Read next:

Photo: Shutterstock

Market news and data provided by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.