Chinese AI developers have made strides in gaining access to advanced AI chips as U.S. semiconductor sanctions dent their AI ambitions.

Chinese AI developer acquires cutting-edge Nvidia NVDA By tapping into overseas computing power through brokers, chips can be obtained without having to be imported into China.

According to The Wall Street Journal, developers are turning to techniques from the cryptocurrency world, such as using blockchain technology to maintain anonymity, to get around US semiconductor sanctions.

AI developers are working with overseas data centers and decentralized platforms to rent the computing power they need to run their AI algorithms, avoiding the hassle of importing chips into China.

Former bitcoin miner Derek Au’s company set up more than 300 servers equipped with the chips in a data center in Brisbane, Australia, which then began processing AI algorithms for companies in Beijing, the WSJ reported.

Joseph Tse is a former employee of a Shanghai-based AI startup that, according to the WSJ, has installed more than 400 servers equipped with Nvidia’s H100 chips in a California data center to train AI models.

Edge Matrix Computing has connected more than 3,000 GPUs, including Nvidia chips, into a distributed network for AI training, according to the WSJ.

Alibaba Group Holding BabaTencent Holdings T.C.H.Y.and Baidu Inc. Bidou According to the Financial Times, Chinese companies made a total of 50 billion yuan ($7 billion) in capital expenditures in the first half of the year, focusing on processors and infrastructure for training AI models, up from 23 billion yuan a year earlier.

Chinese tech companies are buying lower-performance processors like Nvidia’s H20, which cost between $12,000 and $13,000 a unit.

Alibaba co-founder and chairman Joe Tsai previously said that U.S. sanctions were causing China to fall behind the U.S. in the AI race, which was also hurting Alibaba’s cloud business.

Analysts expect Nvidia to ship more than 1 million of these processors to the Chinese company in the coming months.

Despite these investments, capital spending by China’s big tech companies still lags far behind its American counterparts, with Alphabet Inc. Google GoogleAmazon.com Inc. AmazonMeta Platforms Inc. MetaMicrosoft MSFT It spent $106 billion over the same period.

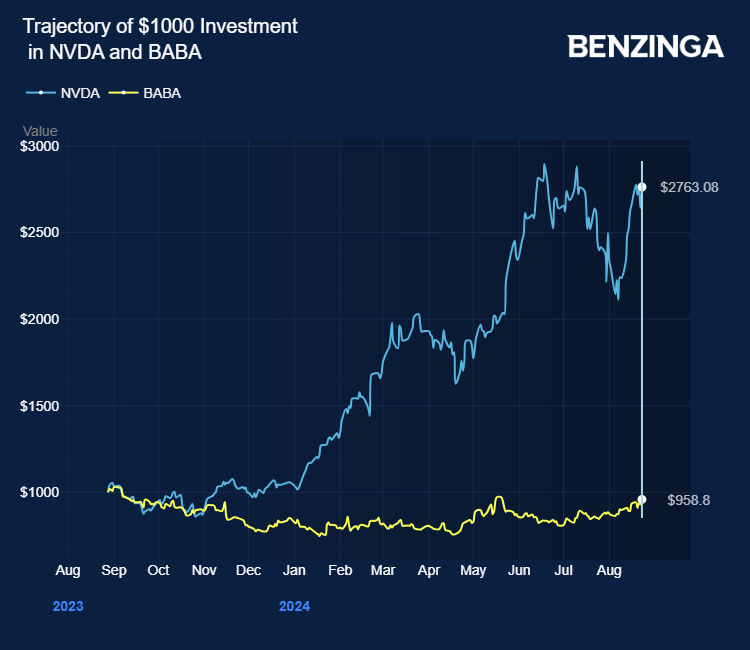

Nvidia’s shares have risen more than 176% in the past 12 months thanks to the AI boom. Alibaba is down more than 7.4% as a weak Chinese economy, growing domestic re-commerce competition and U.S. semiconductor sanctions have hurt the e-commerce giant.

Price Action: NVDA shares were up 0.53% at last check on Monday, trading at $130.05 in pre-market trading.

Disclaimer: This content was created in part with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Shutterstock

Market news and data provided by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.