This is The Takeaway from today’s Morning Brief. Sign up to receive it in your inbox every morning, along with:

Are you ready for the most important earnings report of 2024?

Interestingly, this company won the Most Important Earnings Report award for 2024 (and each quarter of 2023) when it reported three months ago.

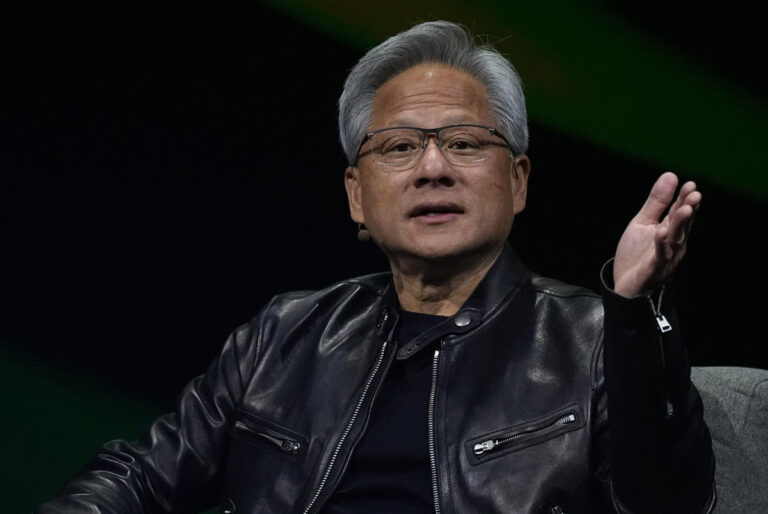

I’m talking about Nvidia (NVDA), whose earnings will be released after the market closes on August 28th, but as Morning Brief co-host Seana Smith points out, could have big implications for AI trading.

I arrive at the office by 4:20 a.m. every day and fire up the software I use to track which stories and ticker pages are generating the most interest from Yahoo Finance readers. Every day, one of the most highly viewed pages on our platform is Nvidia’s page.

The world is on the brink of an alien attack and people will still be refreshing Nvidia’s ticker page. Investors are totally enthralled with a company they had never heard of two years ago.

You can’t blame them.

Nvidia shares have risen 170% in the past year. Nvidia shares have risen 3,000% in the past five years.

These are incredible gains, the kind that tempt inexperienced investors looking to retire early.

And despite the enormous complexity of its business, NVIDIA’s story is surprisingly easy to understand: NVIDIA makes the best artificial intelligence chips in a world that is being radically transformed by AI. It’s simple: When it comes to AI chip performance and future demand, no one comes close to NVIDIA.

I want to warn you that things are a little different for Nvidia this time around as we head into the quarterly report: the market remains very bullish on Nvidia heading into the quarterly report, but is turning a bit cautious following reports of delays to shipments of Nvidia’s powerful new AI chip, Blackwell.

There’s plenty of reason to be bullish based on a number of signals coming from recent earnings reports.

Taiwan Semiconductor (TSM) noted strong demand for AI in its report.

AMD (AMD) recently increased its data center chip sales for the third time in a year.

Supermicro Computer (SMCI) noted strong demand for its liquid cooling solutions.

Nvidia chip customer Meta (META) raised its capital spending outlook for 2024 and 2025 by several billion dollars.

“We expect NVIDIA to report better-than-expected/upward earnings, with the upside driven by strong demand for Hopper GPUs. Given the Blackwell delays, we believe NVIDIA has effectively canceled the B100 in favor of ramping up B200 production for hyperscalers. The B100 will be replaced by a lower-cost/higher-performance GPU (B200A) targeted at enterprise customers,” Keybanc analyst John Vinh said in a client note.

The story continues

For Nvidia’s report to be accepted, I think investors need to be aware of at least two things.

If this happens, it could shake off some of the bears and prove what Eric Jackson, founder of EMJ Capital and tech investor, said on the Opening Bid podcast:

“I’m saying[Nvidia’s value]could double again between now and the end of the year,” Jackson said.

To put this in perspective, Jackson believes Nvidia’s market cap could reach $6 trillion by the end of the year, up from about $3.2 trillion today.

Jackson argues that the company can get there by releasing very strong earnings reports this week or in November (or both) that show continued demand for its H100 and H200 chips, while also touting the potential of its new AI-focused Blackwell chips.

Please get some rest, it’s going to be a busy week.

Three times each week, I have insightful conversations with some of the biggest names in business and markets on the Opening Bid podcast. Find more episodes on our video hub, available on your favorite streaming service, or listen and subscribe on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

Brian Sozzi is Editor-in-Chief of Yahoo Finance. Follow Sozzi at @BrianSozzi and on LinkedIn. Have a tip on a deal, merger, activist situation, or anything else? Email me at brian.sozzi@yahoofinance.com.

For the latest technology news impacting the stock market, click here

Read the latest financial and business news from Yahoo Finance