Key Takeaways

Anticipation is building for Nvidia’s (NVDA) earnings on Wednesday, which could make it tough for the artificial intelligence (AI) darling to impress investors.

According to estimates compiled by Visible Alpha, consensus estimates for NVIDIA’s second-quarter revenue have increased by $170 million in the last 48 hours alone to $28.84 billion, while net profit forecasts have increased by $120 million to $14.95 billion.

Some analysts have long expressed concern that investor expectations will exceed Wall Street forecasts, meaning the whispered figure could be even higher.

Looking forward to another “Drop the Mic” performance

Wedbush analysts said Thursday they expect “Nvidia’s performance to weaken again,” citing “surging demand for enterprise AI” and signs of spending by cloud giants such as Amazon (AMZN) and Alphabet Inc.’s Google (GOOGL) — all trends that benefit Nvidia.

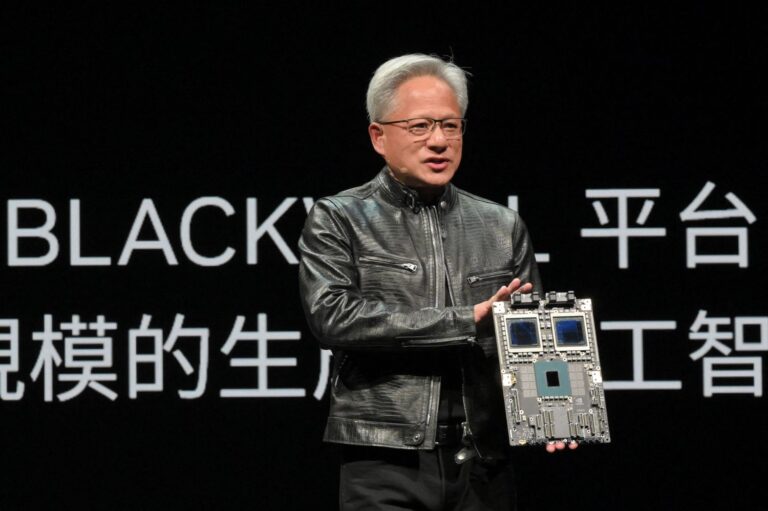

They’re not alone: Analysts at Raymond James, KeyBanc and others also recently said they expect the chipmaker to have a strong quarter, despite concerns over reported delays to Nvidia’s Blackwell AI chips.

More than 95% of analysts tracked by Visible Alpha rate the stock a “buy,” and the consensus price target is $144.83, 12% above Friday’s closing price.

Trading View

Nvidia shares rose 4.6% to close at $129.37 on Friday. The stock is up about 160% since the beginning of the year.