Nvidia (NASDAQ:NVDA) shares continue to enjoy an impressive upward trend, soaring 151% year to date, with the recent announcement of design issues that are delaying volume shipments of Blackwell B200 chips showing little sign of slowing things down.

In fact, according to UBS analyst Timothy Arcuri, who is ranked fourth among thousands of Wall Street stock pros, investors have little to worry about.

According to Arcuri’s research, first customer shipments of Blackwell chips could be delayed by up to four to six weeks, potentially extending until late January 2025. However, this delay is expected to be partially offset as many customers switch to the H200, which has a shorter lead time. Major customers are expected to have the first Blackwell units up and running around April 2025. Meanwhile, AI Labs is “expanding and extending” its instance commitments, and enterprises are rapidly increasing their share of demand, both “bullish indicators.”

Given the four- to six-week delays since mid-December, Arcuri now expects Blackwell units to be sold minimally in FQ4, but shorter lead times and signs of increased sourcing capacity in the supply chain have increased his forecast for Hopper units by about 25%.

As a result, Arcuri lowered his fourth-quarter revenue forecast by about $500 million, bringing it closer to Wall Street’s expectations. The delay also led to a roughly $500 million cut in first-quarter revenue expectations, but his estimate is still $3.5 billion to $4 billion above Wall Street expectations.

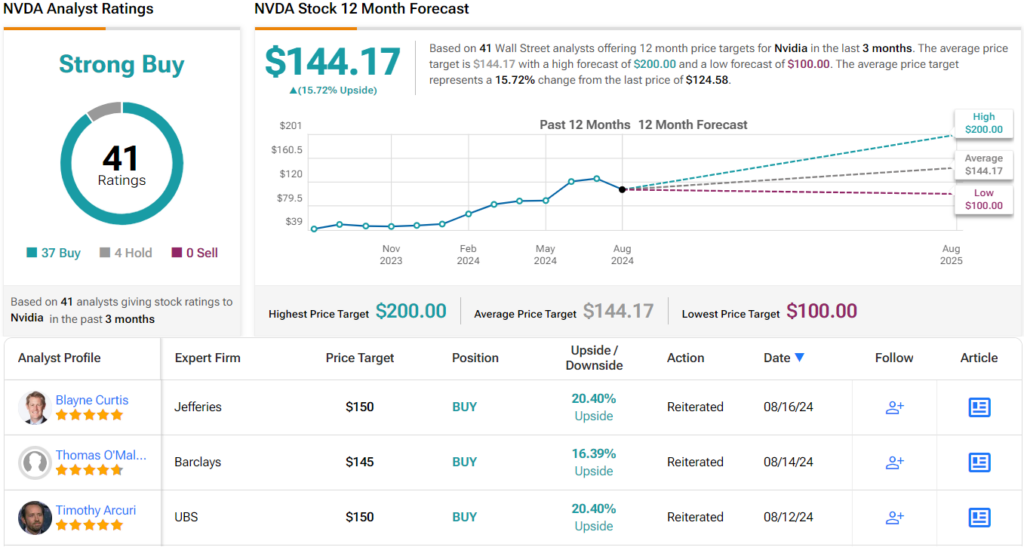

Despite these adjustments, Arcuri has left his target price for NVDA at $150, implying a 20% upside over the next 12 months. It’s no surprise then that he rates the stock a Buy. (To watch Arcuri’s track record, click here)

Arcuri’s outlook is in line with many of his peers. With 37 Buys outnumbering 4 Holds, analysts are in agreement that Nvidia is a Strong Buy. The average target price of $144.17 means the stock will trade at a 16% premium one year from now. (See Nvidia stock price forecast)

To find great ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, our tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is for informational purposes only. It is extremely important that you conduct your own analysis before making any investment.