Nvidia (NVDA) shares and shares of datacenter hardware vendors tumbled on Monday amid reports of delays to the company’s next-generation AI processor, deepening a stock correction and exacerbating the decline.

↑

X

Nasdaq enters correction after market disappoints; look to CBOE, Ferrari, MercadoLibre

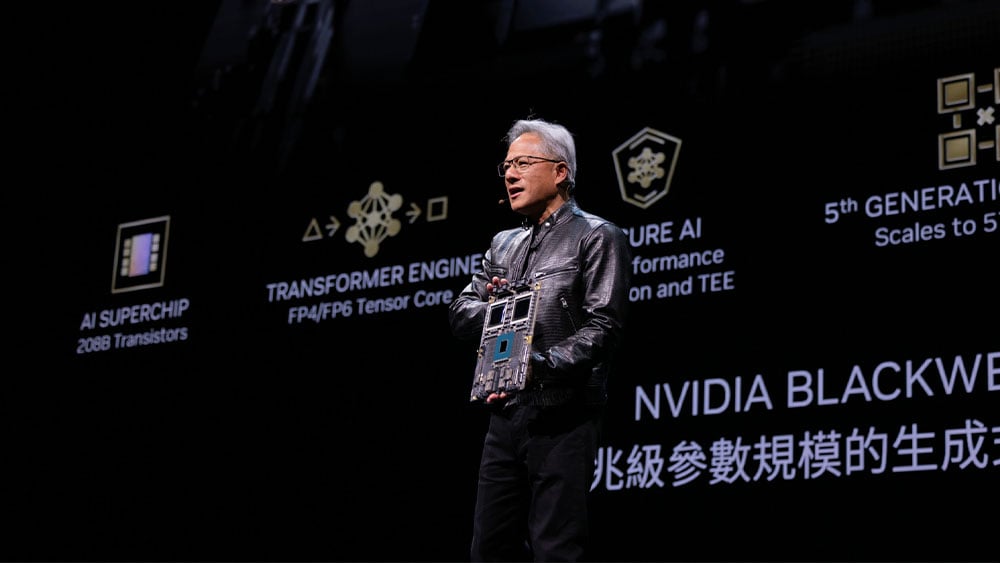

Nvidia has told Microsoft (MSFT) and another major cloud customer that the launch of its Blackwell B200 AI chip will be delayed due to a design flaw discovered late in production, The Information reported late Friday. The issue could delay the product launch by at least three months.

“Amid the recent shift in sentiment around AI, this latest news is unlikely to improve the situation,” Bernstein analyst Stacey Rasgon said in a client note on Monday. “But while the likelihood of a delay is far from remote, there’s no need to panic just yet.”

He added, “NVIDIA’s competitive margin is very large at this point, so we don’t expect the three-month delay to have a significant impact on its market share.”

Rasgon reiterated his outperform rating on Nvidia shares and set a price target of 130.

Nvidia shares plummet

On the stock market today, Nvidia shares fell 6.4% to close at 100.45.

Meanwhile, U.S. shares of Taiwan Semiconductor Manufacturing Co. (TSM), which makes Nvidia chips, fell 1.3% to close at 147.95.

Data center specialist Supermicro Computer (SMCI) shares fell 2.5% to 608.83. Industry peer Dell Technologies (DELL) shares fell 4% to 98.18.

Meanwhile, Nvidia rival Advanced Micro Devices (AMD) rose 1.8% to close at 134.82.

AMD may benefit

Raymond James analyst Srini Pajuri maintained a “strong buy” rating on Nvidia shares and an “outperform” rating on AMD.

“A delay of several months will have only a limited impact on Nvidia’s near-term outlook,” Pajuri said in a client note. In the meantime, customers may switch to plans that use Nvidia’s current-generation Hopper AI chips, he said.

“At the same time, I think it’s reasonable to expect AMD to see some benefits or at least see more customer interest,” Pajuri said.

Loop Capital analyst Ananda Baruah said he expects the overall impact of the Nvidia chip delays to be “relatively minor.”

He reiterated his buy recommendation on Nvidia shares with a $175 price target.

Demand for AI chips remains strong

Baruah said shipments of the Blackwell series of chips will likely be limited to 2024 anyway. The quarterly delay will push bulk shipments of Blackwell chips from the July quarter to the October quarter, he said.

Bernstein’s Rasgon said demand for AI processors from hyperscale cloud-computing service providers remains strong, and if Blackwell’s shipments are delayed, those customers could use Hopper chips to fill the gap, he said.

Nvidia shares appear on the IBD Leaderboard and Tech Leaders lists.

To read more coverage on consumer technology, software and semiconductor stocks, follow Patrick Seitz on X (formerly Twitter) at @IBD_PSeitz.

You may also like:

Warren Buffett cuts his holdings: Apple stock: buy or sell?

AMD appears to be profiting from Intel’s woes

Giant company called ‘shining lighthouse’ during semiconductor industry’s weak earnings season

Stocks to buy and watch: Top IPOs, large and small caps, growth stocks

See stocks on the Leaders list that are nearing a buy point