Nvidia (NVDA) is reportedly delaying the launch of its next-generation artificial intelligence chips by at least three months, with volume shipments likely not happening until early 2025.

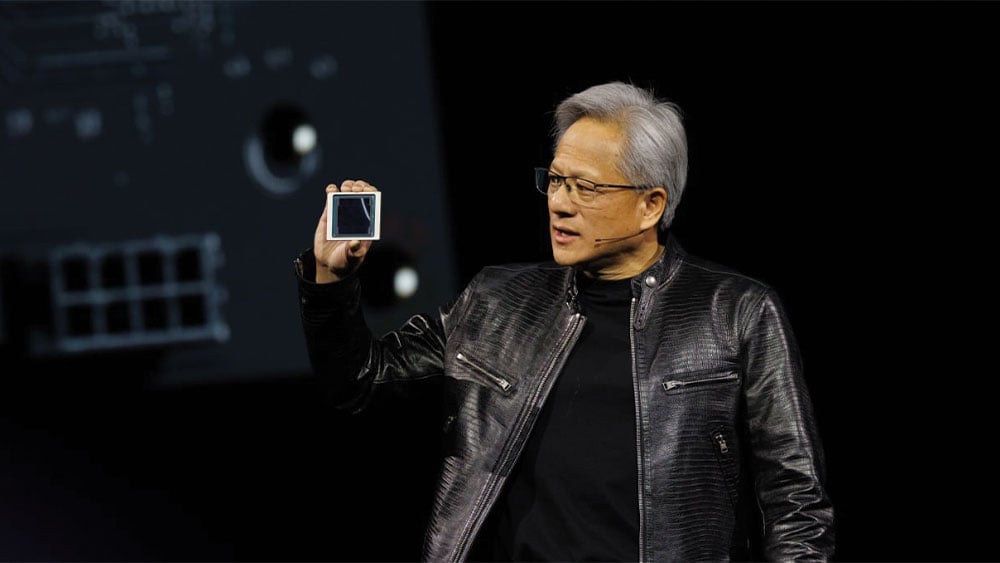

Nvidia has told Microsoft (MSFT) and another major cloud customer that the launch of its Blackwell B200 AI chips will be delayed because of a design flaw discovered late in the production process, The Information reported Saturday, citing Microsoft employees and other sources.

↑

X

Palantir heads for gains as tech stocks remain under pressure

The B200 chip was planned as a replacement for the hugely popular H100 chip, which has sent Nvidia’s sales, profits and stock price soaring.

The AI leader is now conducting new test runs with Taiwan Semiconductor Manufacturing (TSM), which makes Nvidia chips.

An Nvidia spokesperson would not comment on the delay, telling The Information that “production is expected to ramp up later this year.”

The delay could impact Nvidia’s earnings and NVDA’s stock price later this year. It could also impact TSMC and rival Advanced Micro Devices (AMD), which was set to fall behind Nvidia with its new Blackwell chips. Major customers including Microsoft, Google parent Alphabet (GOOGL) and Meta Platforms (META) have ordered tens of billions of dollars’ worth of next-generation chips for their AI ambitions.

What to do after stock price crash: Nvidia’s next AI chip delayed

Nvidia stock

NVDA shares fell 5.1% last week to 107.27 and are now firmly below their 50-day and 10-week lines. Chip and AI stocks performed poorly last week, along with the broader market, and there were multiple reports over the weekend that the Department of Justice is investigating Nvidia over its AI advantages.

AMD shares fell 5.35% last week, hitting their lowest price in 2024. The stock initially rose on AMD’s strong earnings but has since started to fall.

TSM shares fell 7.5% last week and are now well below their 50-day and 10-week lines. Taiwan Semiconductor is scheduled to report its July sales on Friday.

Microsoft shares fell 3.95% last week after Azure cloud computing growth fell short of expectations, but the stock found support at its 200-day line.

Meta shares rose 4.8% this week to 488.14, but closed below their 50-day line after surging on profits on Thursday.

Google shares fell 0.2% last week, following a steep drop following the company’s earnings report the previous week.

Microsoft, Meta and Google have also signaled continued strength in AI-driven capital spending, much of which is expected to go into Nvidia chips.

For stock market updates and more, follow Ed Carson on Threads at @edcarson1971 and on X/Twitter at @IBD_ECarson.

You might also like:

Want to make quick profits and avoid big losses? Try SwingTrader

Best growth stocks to buy and watch

IBD Digital: Get IBD’s premium stock lists, tools, and analysis now

Copper prices are a bet you can’t miss. Why power-hungry AI and EVs will power FCX and TECK.

Apple leads 5 stocks near buy points