Volatility continued for Nvidia (NASDAQ: NVDA ) shares in trading on Thursday, as shares of the artificial intelligence (AI) leader ended the day down 6.7%, according to data from S&P Global Market Intelligence.

After posting a big gain on Wednesday, Nvidia shares initially appeared poised for another day of gains thanks to strong demand indicators following the release of Meta Platforms’ second-quarter results and guidance. But the chip specialist’s shares fell sharply as macroeconomic concerns took center stage across the stock market, highlighting related risk factors.

Nvidia stock has been in turmoil lately

NVIDIA’s share price drop today follows an even bigger rise on Wednesday. Microsoft issued encouraging guidance on capital expenditures and AI investments in its recent quarterly report. Advanced Micro Devices also reported second-quarter results that showed strong demand for datacenter processors.

Investors were also feeling bullish ahead of expectations that the Federal Reserve’s meeting yesterday would signal an interest rate cut in September, helping to boost Nvidia’s market cap by $330 billion on Wednesday, the biggest one-day increase ever for a company.

The rally looked set to continue on Thursday, as Nvidia shares rose in premarket and early morning trading on Meta Platforms’ capital spending outlook and comments, but gains tapered as the broader stock market turned bearish.

The Fed’s July meeting signaled that a long-awaited rate cut was likely next month, but some economists see a recent rise in jobless claims and other factors increasing the risk of a recession.The S&P 500, Nasdaq Composite and Dow Jones Industrial Average all fell about 1.4%, 2.3% and 1.2%, respectively.

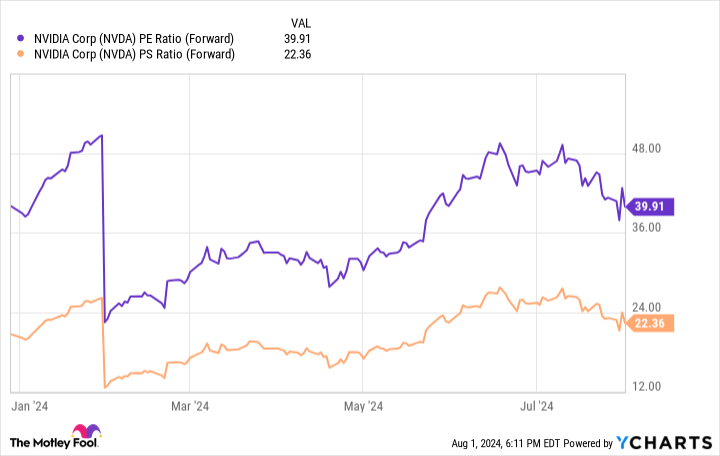

After Thursday’s offering, Nvidia’s stock is trading at about 40 times this year’s expected earnings and about 22 times expected sales. Notably, the company’s price-to-earnings ratio is less than two times its price-to-sales ratio, which reflects the impressive margins the company has been offering of late. But the company remains a high-risk, high-reward stock.

Fueled by continued demand for its AI technologies, NVIDIA is likely to continue posting strong revenue and earnings growth for the remainder of this year and into 2025, but its outlook beyond that is a bit unclear. The company’s business has historically been shaped by cyclical trends, and it’s not entirely clear where it is in the current artificial intelligence investment cycle or what the macro backdrop will be.

The story continues

Meanwhile, the long-term outlook for demand for AI-related hardware and services remains very promising. If you’re looking to build a position in the artificial intelligence space and are willing to accept some short-term volatility, it could be worth taking advantage of Nvidia’s dip.

Should I invest $1,000 in Nvidia right now?

Before you buy Nvidia stock, consider the following:

The analyst team at Motley Fool Stock Advisor has identified 10 stocks that investors should buy right now, and Nvidia is not among them. The 10 selected stocks have the potential to generate big gains over the next few years.

Consider the date when Nvidia made this list: April 15, 2005… if you had invested $1,000 when it was recommended, you would have made $717,050!*

Stock Advisor gives investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts, and two new stock picks every month. The Stock Advisor service has more than quadrupled S&P 500 returns since 2002*.

View 10 stocks »

*Stock Advisor returns as of July 29, 2024

Randi Zuckerberg is a former director of market development and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg and a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Advanced Micro Devices, Meta Platforms, Microsoft, and NVIDIA. The Motley Fool recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia Stock Dropped Today — Is It Time to Buy Low? was originally published by The Motley Fool.