Many big tech companies are reporting earnings this week, but at least one clear winner has already emerged: Nvidia.

Big tech companies are expected to come under scrutiny for their AI investments during earnings calls this week, and some are already under scrutiny: During Microsoft’s earnings call on Tuesday, for example, the first question during the Q&A was about the company’s investments in generative AI and whether they are paying off.

For example, Microsoft’s fourth-quarter capital expenditures were $19 billion, with roughly half of that going to central processing units (CPUs) and graphics processing units (GPUs), which Microsoft buys primarily from Nvidia.

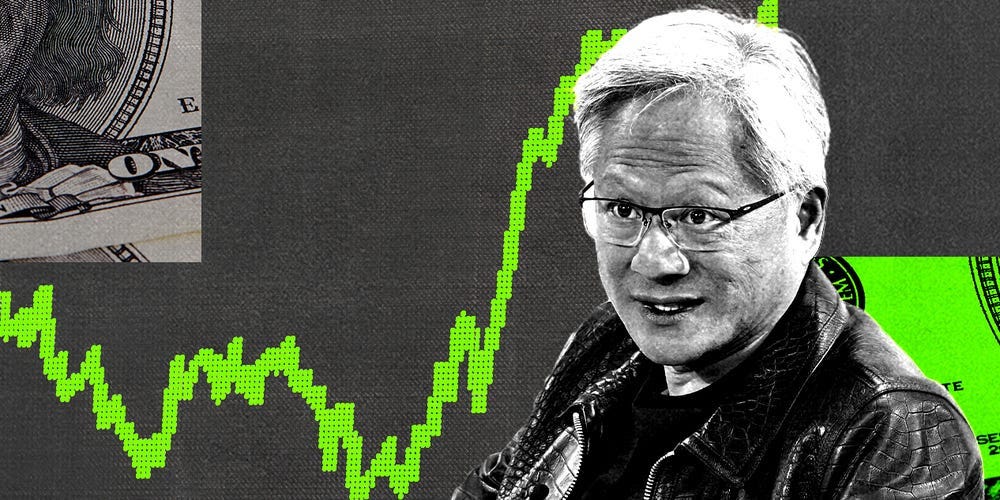

Nvidia shares were up more than 12% by midday Wednesday. Morgan Stanley analysts also named Nvidia a top stock to buy on Wednesday.

Meanwhile, Google’s parent company Alphabet faced similar AI-related questions earlier this month, with investors repeatedly pressing executives for details about the benefits of its AI investments.

As big tech companies continue to pour billions of dollars into AI but still see little revenue from it, Meta, Amazon and Apple are likely to face similar questions about their AI investments on their earnings calls this week.

Nvidia shares had been on a downward trend since the beginning of July but rebounded following Microsoft’s earnings report and mention of a big investment in processor units. CEO Jensen Huang’s company also had a strong performance in the last quarter’s earnings season.

References to “AI infrastructure” and “generative AI” were common during major tech company earnings calls last quarter, with many of the tech giants explicitly mentioning Nvidia.

Meta said in January it would buy 350,000 H100 GPUs from Nvidia this year, while Microsoft is targeting 1.8 million GPUs by the end of 2024, according to an internal company document.