The Nvidia H100 chip remains the tech world’s hottest commodity, but unfortunately, the same can’t necessarily be said about its stock.

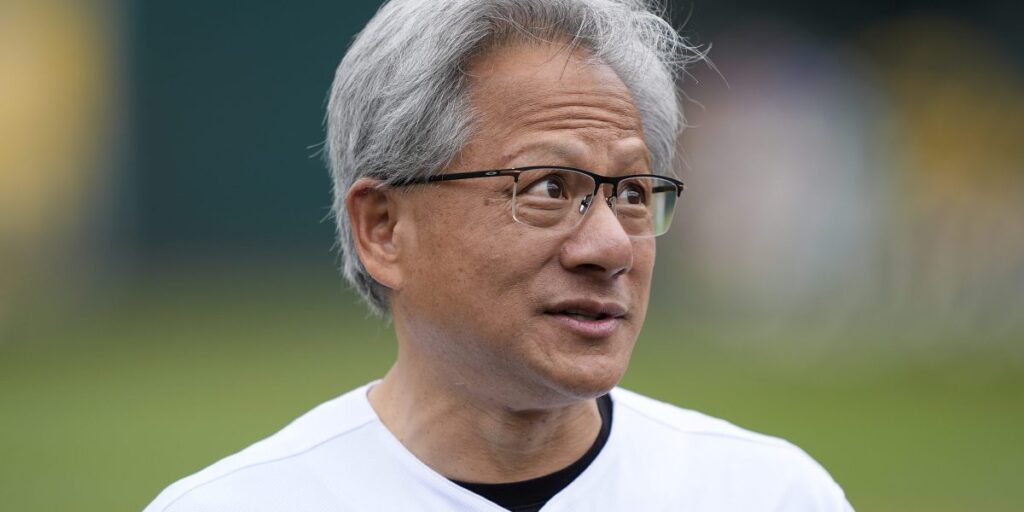

Shares in Jensen Huang’s semiconductor company have fallen 20% from their all-time high hit on June 18, the day that is usually seen as the start of a bear market. Already, it has lost more than $780 billion in market capitalization, an amount equal to the entire market capitalization of Elon Musk’s Tesla, or the market capitalization of Eli Lilly, the pharmaceutical group that developed the GLP-1 weight-loss drug Zepbound.

Shares surged on Wednesday, buoyed by a sense of relief, but are only back to last week’s levels and the gains may be short-lived as sentiment across the industry remains fragile.

Futurum Group, a tech industry research and consulting firm, told the Financial Times that the weakness was more likely due to a rotation out of sectors that had performed well throughout the year, rather than anything related to underlying fundamentals.

“I think the outflow from big tech companies is because they’ve had such an incredible run-up,” CEO Daniel Neumann said. “Obviously, that’s created some room for selling.”

Nvidia sells graphics processors ideal for training neural networks, such as the Transformers used to develop OpenAI’s GPT-4 and other large-scale language models. The company’s cutting-edge chips are so powerful that the United States has imposed export controls to keep them out of the hands of strategic rivals such as China.

But in recent weeks, concerns have grown that major cloud-computing providers, including hyperscalers Amazon, Microsoft and Google, as well as other mega-cap companies that have invested heavily in AI, such as Meta and Tesla, may not see sufficient returns on their investments.

Microsoft Corp. said it expects revenue growth for its Azure cloud business to slow in the first quarter from 29% in the three months through June but accelerate in the second half of the fiscal year.The company’s shares tumbled on Wednesday, significantly underperforming the gains of the S&P 500 Index.

“Kicked out”

Another major customer Nvidia has disappointed recently is Tesla, which needs AI training chips to solve the self-driving problem that CEO Elon Musk has promised he’ll finally solve this year or next. (He previously promised that Tesla cars would be able to drive cross-country on their own by the end of 2017.) So far this year, he’s spent $1.6 billion to ramp up the computing clusters that train on images sent by cameras in every Tesla car.

During an investor call last week, Musk said the lack of a reliable supply of Nvidia H100 chips has forced the company to focus on Dojo, its own silicon optimized for vision-based machine learning. Musk has spoken about “Dojo-as-a-service,” a company that would rent out its spare training compute to third parties, which Morgan Stanley estimates could be worth hundreds of billions of dollars. If successful, his custom silicon would pose a threat to Nvidia.

Even after its stock price fell, Nvidia’s value has more than doubled since the beginning of January, but it’s still a long way from the heady days of this spring when the company overtook Apple and Microsoft to become the world’s largest company with a market capitalization of more than $3.3 trillion at one point.

The weakness is also affecting Taiwanese production partner TSMC, the world’s largest foundry that makes microchips outsourced by third parties such as Nvidia. The company’s shares have fallen about $200 billion in the past two weeks after briefly topping the $1 trillion mark. It too is rising in relief.

“Nvidia stock has become a wilderness,” investor Jim Cramer, host of CNBC’s Mad Money, said Tuesday. “Nvidia hasn’t benefited from lower interest rates, which is why the stock price is declining in this environment.”

Nvidia did not respond to Fortune’s request for comment.

The Federal Reserve is expected to prepare to cut interest rates in September, its first since March 2020, later on Wednesday.