After a brutal sell-off last week, Nvidia (NVDA) rebounded strongly this week, rising more than 4.2% after a 4.1% drop the previous week. But should you buy Nvidia stock now?

↑

X

AMD executive touts AI chip superiority as battle with Nvidia heats up

Emotions can quickly take over and sway decisions, but some time-tested trading rules can increase the chances of success and help investors decide if Nvidia stock is worth buying now.

Shares surged 12.8% on Wednesday after Morgan Stanley analysts again named the AI chip giant a top pick, maintaining an overweight rating and price target of 144. CNBC quoted the analysts as saying they believe the recent sell-off is overdone.

Then, later on Wednesday, more good news came from Meta Platforms (META), whose AI investment plans gave the AI chip leader another boost. Meta is a big customer of Nvidia AI chips. CNBC reports that Meta plans to install 350,000 Nvidia H100 graphics cards by the end of the year.

After losing ground at its 50-day moving average about two weeks ago, Nvidia is trying to reclaim that key level on Thursday.

Demand for AI chips is on the rise

Last Tuesday, Nvidia announced a new AI Foundry service that supports Meta’s Llama 3.1, allowing developers to build large-scale language models using open-source models.

Nvidia said in June that it plans to roll out its most advanced artificial intelligence platform in 2026. The AI chip leader will also use next-generation memory to improve processing times.

Also in early June, Foxconn announced plans to build an advanced computing center in Taiwan using NVIDIA’s Blackwell chips. NVIDIA is partnering with Foxconn to build the data center as it expands into the autonomous and electric vehicle markets. Tesla uses NVIDIA chips but plans to custom build them in-house in the future.

NVIDIA stock split

The shares began trading on a split-adjusted basis on June 10th.

But a stock split could do more than just lower the price of each share: A lower price could make Nvidia a contender for the Dow Jones Industrial Average, a price-weighted index.

Previously, Apple (AAPL) and Amazon.com (AMZN) joined the Dow Jones Industrial Average after their stock splits.

The stock split will provide further momentum for the AI chip leader, creating what one analyst called a “generational buying opportunity.”

Strong first quarter performance

NVIDIA shares soared to a record high on May 22 after the company reported first-quarter earnings that again beat expectations. Revenues rose 262% to $26 billion and earnings per share increased 461% to $6.12.

The AI leader has partnered with Microsoft to make its latest AI software available on Nvidia’s graphics processing units.

Earlier, NVIDIA shares rose above a buy threshold after the Google AI conference showcased various ways artificial intelligence can improve search. The search giant also previewed an Android feature that will warn users of scams during phone calls. Google’s tensor processing units rival NVIDIA’s chips, but NVIDIA dominates the data center AI chip market.

Ahead of the earnings release, analysts at Baird, Susquehanna and Barclays raised their price targets for Nvidia.

Nvidia’s stock price Accumulation/Distribution Rating On a scale of A+ to E, it is rated E. This reflects the large scale selling by institutional investors in July.

AI products drive growth

Nvidia has a reputation for being a pioneer. The company pioneered graphics processors that many say dramatically improved computer gaming. Beyond gaming, Nvidia’s chips are now used in industries including medical, automotive and robotics.

In March 2023, generative AI received a breakthrough with OpenAI’s ChatGPT. Nvidia’s AI-enabled supercomputer paved the way for an “iPhone AI moment,” according to Nvidia CEO Jensen Huang.

This has helped Nvidia turn around its financial performance: The company reported three quarters of declining revenue and four quarters of declining profits year-over-year through late 2022 and early 2023. But it has since delivered record revenue and profit growth in the last two quarters.

According to a recent report from research firm Gartner, worldwide AI chip revenue is expected to grow 26% to $67.1 billion in 2024, up from $53.4 billion in 2023. This is expected to double to $119 billion by 2027.

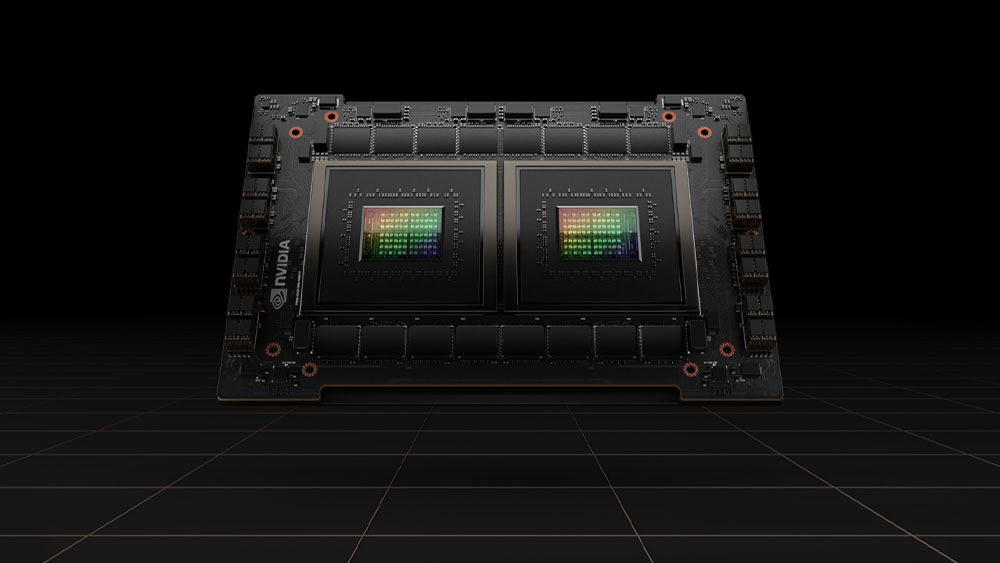

Nvidia’s graphics processing units help speed up computing in data centers and AI applications.

Top rated by Nvidia

Nvidia stock still boasts a strong Relative Strength Rating of 98. The EPS Rating and Composite Rating are an ideal 99.

Nvidia is also one of the Magnificent Seven that drove stock price growth in 2023. Some of these tech giants are customers that rely on Nvidia’s advanced chips. Nvidia is also one of the stocks predicted to outperform the market in 2024.

Is Nvidia Stock a Buy?

Chart patterns are a good way to determine whether to buy or sell a stock. Nvidia’s chart shows that the stock has broken out of a 92.22 buy point. According to IBD MarketSurge, the stock is already trading higher.

In 2023, AI stock Nvidia is up a massive 239% and is up more than 100% so far this year.

NVIDIA has risen above 20% and 25% profit-taking objectives and an alternative buy point of 97.40 from 92.20. The stock is attempting to re-rise above its 50-day moving average, which could serve as a potential resistance level.

On the other hand, it is best to wait for another base or subsequent buy point to take an initial position in AI chip stocks. Moreover, institutional support has room for improvement. This stock is not a buy at the moment, but it may become one soon.

You may also like:

See stocks on the Leaders list that are nearing a buy point

MarketSurge Find winning stocks with pattern recognition and custom screens

IBD Live: Learn and analyze growth stocks with the pros

Looking for the next big stock market winner? Get started with these 3 steps