Taiwanese semiconductors have doubled US manufacturing investments.

During President Biden’s tenure in the oval office, his administration emphasized that it would encourage investment in domestic manufacturing. One of the administration’s achievements came in 2022, when Biden signed the Chip and Science Act.

Over the past few years, Intel has emerged as one of the biggest beneficiaries of chip funding. Given the rise in investments in artificial intelligence (AI) infrastructure (particularly in data centers and chipware), I previously predicted that Intel could become a big winner under the new Trump administration.

However, recent announcements from Taiwan’s semiconductor manufacturing (TSM) 0.71%)) It makes me rethink my careful optimism about Intel.

Explore Intel’s latest fumble and evaluate why Taiwanese Semi’s latest announcement will be the ultimate checkmate move against American casting rivals.

It seems Intel can’t get out of his own way

Last year, Intel generated $53.1 billion in total revenue. This was a mere 2% decline from the previous year, but the results of the company’s casting business were even more surprising.

In 2024, Intel Foundry generated $17.5 billion in sales. This was a 7% decrease from the previous year. Foundry Business is in direct competition with Taiwan Semi, which owns nearly 60% of the global casting market. Given that Intel Foundry is slowing at a faster rate compared to the company’s overall business, Intel is not confident it can keep up with its aging rivals.

To add salt to the wounds, Intel has now announced that it will delay opening a new Ohio factory until 2030. For reference, the plant was supposed to be operating between this year and 2026.

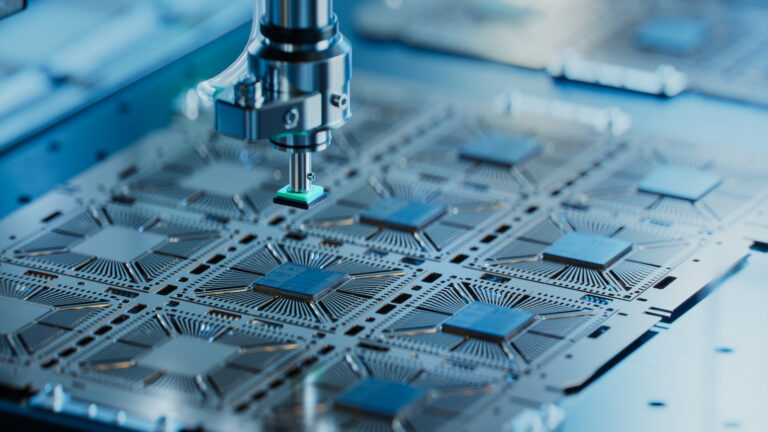

Image source: Getty Images.

Taiwan’s $100 billion move

On March 4th, the Taiwan semi-finals announced that they would invest $100 billion in the US to build three additional manufacturing plants, two packaging plants and a research and development (R&D) center. The investment comes shortly after an existing $65 billion project in Arizona where TSMC is building additional manufacturing capabilities.

TSMC’s US investment is intended to help strengthen operational relationships with key customers such as NVIDIA, AMD, Broadcom, and Qualcomm.

What does this mean for Intel?

Over the past few weeks, several tech giants from the epic Seven Group have published their own plans to invest in AI infrastructure over the next few years. On the surface, you might think that Intel can benefit from capital expenditures (CAPEX) from AI’s biggest contributors. Instead, TSMC is looking at Intel’s struggle and believes its new $100 billion investment is a move that could further strengthen the already dominant pulse in the foundry market.

Despite its close ties with the US government, Intel shows little progress (if any) from its Chips Act grants. This means it’s difficult to buy in the bull story around Inter at this point. There have been some rumours of potential partnerships between Intel and TSMC, but I have not yet made any specific details. In my eyes, a productive alliance with Taiwanese cicadas, or even a potential acquisition of Intel, could be the best outcome for the company today.

To me, Intel appears to be lost, and the company is lagging behind its biggest rivals during the true generation revolution that AI emphasized. Ultimately, I think TSMC’s investment in the US may just be a checkmate move towards Intel.

Adam Spatacco has a job at Nvidia. Motley Fool recommends advanced microdevice manufacturing, Intel, Nvidia, Qualcomm and Taiwanese semiconductor manufacturing. Motley Fool recommends Broadcom and the following options are recommended: Motley Fools have a disclosure policy.