Everyone wants to retire from billionaires. But many people never recognize that vision. How do you see this future happen to you? Find a great company that you’ll invest in for decades at a time.

Today, the Artificial Intelligence (AI) revolution is creating some of the biggest growth opportunities in history. nvidia can be done (NVDA) 1.92%)) Is inventory the secret to a wealthy retirement? You may be surprised by the answer.

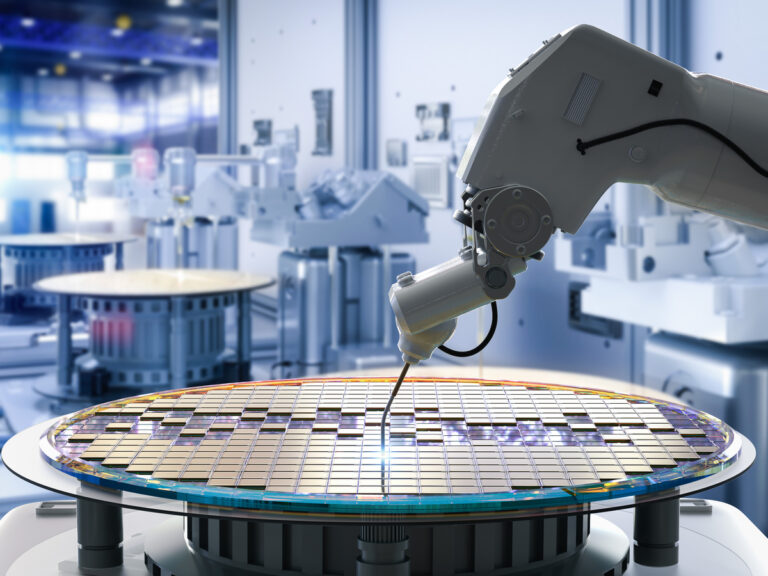

Nvidia’s journey to growth has just begun

Over the past few years, Nvidia’s revenues have exploded even higher. In 2023, the company had introduced sales of less than $40 billion. Today, annual sales exceed $130 billion, and the end of this growth trajectory is nowhere to be seen.

That’s because, in many ways, the AI revolution has just begun. And that’s great news for Nvidia. Considering that an important component for training and execution of AI models – is currently the most well thought out in the class, it is great news.

Global Consultancy McKinsey & Co. According to the company, investment in new AI software and services has become a huge hit in recent years. “Equity investments in generated AI increased from $5 billion in 2022 to $36 billion in 2023,” one of the company’s recent reports revealed. The 2024 figures could be significantly higher.

The company’s low estimates show that AI software and services revenues have risen from $85 billion in 2022 to $1.5 trillion in 2040. That high estimate shows that industry revenues have risen to $4.6 trillion by 2040.

I’ve written previously about how Nvidia’s CUDA developer Suite created a vendor lock-in effect that helps maintain the dominant market share of AI GPUs for years, if not decades. All this assembly means that Nvidia will grow rapidly and be sold to a truly huge market with the industry-leading products that developers need to become a reality. That’s a truly incredible position – the main reason why Nvidia’s valuation has skyrocketed to trillions of dollars.

To be fair, Nvidia’s inventory is very expensive on paper. It’s amazing to see trillion dollar businesses earning a price-to-sale ratio of 21.6. This is usually considered a noble plural, even if it is a significantly smaller company.

NVDA PS ratio data by YCHARTS

Does this stock make you a billionaire?

This raises the question: Are Nvidia stocks still shopping today? You may be surprised by the answer.

In the short term, anything is possible with Nvidia stock. Such high multiple market beloved people are prone to unstable changes in market emotions. In early 2025 we went through a swing like this. Thousands of billions of dollars wiped out Nvidia’s valuations in days, and Chinese startup Deepseek has announced a chatbot created with cheap chips.

But it’s here. Retiring rich people usually don’t happen overnight. And it doesn’t happen when you find a single, valuable investment. Retirement investment is a long game, and you stack the compound interest spell on your favor. This means you need to fill your portfolio with companies that can consistently grow your money over time. It requires a long retention period and a level of patience that you barely own.

Nvidia stocks are definitely expensive. However, long growth can make almost every multiple look attractive in hindsight. The company has a durable competitive advantage due to vendor lock-in, and its final market growth is incredible to see, even at the low end of estimates.

Those looking to retire from Rich should consider adding nvidia shares to their portfolio today. But don’t forget that it’s time and perhaps a balanced portfolio.

Ryan Vanzo has no position in any of the stocks mentioned. Motley Fool has a job at Nvidia and recommends. Motley Fools have a disclosure policy.