The chip stock is sliding and is too cheap enough for one key player to ignore.

Chipsets known as Graphic Processing Units (GPUs) are probably the most important hardware in today’s generation AI development. Over the past few years, investing in semiconductor stocks has generally been a great idea – as some form of exposure to GPUs or data centers is almost guaranteed.

However, 2025 has not been off to a great start for chipstock.

Whether it was a drama brought about by Chinese startup Deepseek, President Donald Trump’s new tariffs, or the expectations of lofty investors, many names in the Chip Realm have not gone as well this year. From a macro perspective, Vaneck Semiconductor ETFs have fallen by 4% so far in 2025 (as of March 3). For certain companies, please use Nvidia and Advanced Micro Devices. These microdevices have fallen in stocks so far this year by 7% and 17% respectively.

While many investors seem unable to look away from Nvidia or AMD, there are other stocks that have been caught up in a wider sales in the semiconductor landscape.

Explore why it looks like a lucrative opportunity to buy Taiwanese semiconductor manufacturing (TSM) 0.71%)) Reach over your fist.

Please do not underestimate the impact of Taiwanese cicadas in the chip area

When it comes to brand awareness in the chip market, investors need to look far less than Nvidia or AMD. These two juggernauts lead the accusations of the GPU revolution. Meanwhile, Broadcom plays an integral role in data centers with sophisticated chipware, but as AI data workloads become more and more complex, Micron technology’s high bandwidth memory storage solutions are becoming more and more important.

Many other names dominate the headlines and story points, so you wouldn’t be surprised if you weren’t aware of Taiwanese cicadas or TSMCs. The problem is that many leaders in the chip space, including Nvidia, AMD and Broadcom, should trust the Taiwan semi-finals for a large part of their success.

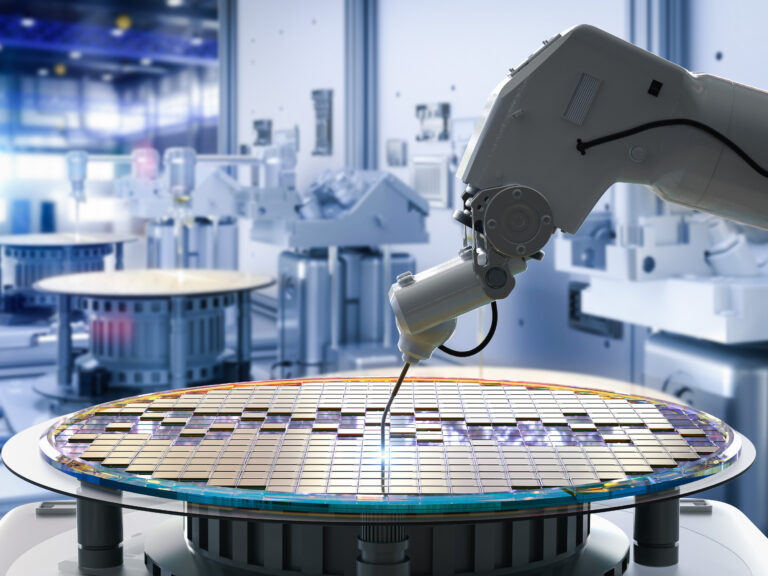

TSMC specializes in Foundry Solutions. This basically means that they are actually manufacturing chips and integrated systems for semiconductor companies. In other words, without TSMC, Nvidia’s chip architecture is more of an idea than a concrete product.

Given how much demand has been for GPUs over the past few years, it is not surprising that Taiwanese cicadas have risen in revenue and profits. That being said, I think the company’s growth has just begun in Gear.

Many of the “magnificent seven” companies, including Microsoft, Amazon, Alphabet and the Meta platform, are searching for custom silicon as a strategy to rely on Nvidia’s chipware to move around. These big tech giants and ChatGpt maker Openai are reportedly helping to work with TSMC to realize their vision.

Estimates of TSM revenues for current fiscal year data by YCHARTS.

Although TSMC has already gained almost two-thirds of the opportunities in the foundry market, I believe the emergence of more custom silicon, along with new architectures from NVIDIA and AMD over the next few years, will further strengthen the company’s leadership position and lead to a long-term stage of acceleration in revenue and profits.

Image source: Getty Images.

TSMC stock prices will be perfect

Despite TSMC’s strong market position and robust financial outlook, chip stock stock stocks are surprisingly cheap.

TSM PE ratio (forward) data by YCHARTS.

Currently, the average positive price (P/E) multiple for the S&P 500 is approximately 21. As the chart above shows, Taiwan Semi’s forward P/E is approximately 19. This disparity suggests that investors may see investments in the S&P 500 as lower risk than TSMC.

In my eyes, the two main risks that turn around investing in TSMC are:

The semiconductor industry is periodic. Geopolitical tensions between China and Taiwan.

I can understand these points in an academic sense, but I think the fear about those topics is exaggerated. Chip demand is not expected to be slow anytime soon as the market is expected to increase ten times over the next decade, reaching nearly $1 trillion.

In addition, TSMC’s business is not exclusive to Taiwan. In fact, the company announced in early March that it would invest an additional $100 billion to expand its manufacturing footprint in the US.

I think TSMC stocks are a great deal now. As the AI revolution continues to advance full steam, long-term investors may want to consider buying this stock on their fist before the company’s manufacturing operations grow even further.

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development, Facebook spokeswoman and sister to Metaplatform CEO Mark Zuckerberg, is a member of Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of the board of directors of Motley Fool. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. Motley Fool recommends advanced microdevice manufacturing, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Taiwanese semiconductor manufacturing. Motley Fool recommends Broadcom and the following options are recommended: A $395 call at Microsoft for January 2026 and a $405 call at short term Microsoft for January 2026. Motley Fools have a disclosure policy.