In the wake of Wednesday’s revenue report, stocks slid on Thursday measured by chip giant Nvidia (NVDA) and led semiconductors and lowered other AI stocks.

Nvidia’s shares closed more than 8% on Thursday, bringing its shares down more than 10% this year. Fellow chipmakers Broadcom (AVGO) and Micron (MU) both fell by more than 6%, while the PHLX Semiconductor Index (SOX) dropped by 6% ITSEF.

Nvidia’s slump has put a wide strain on major stock indexes. Tech Heavy Nasdaq Composite fell 2.8%, while the S&P 500 was 1.6% off, with seven of the 11 sectors turning red.

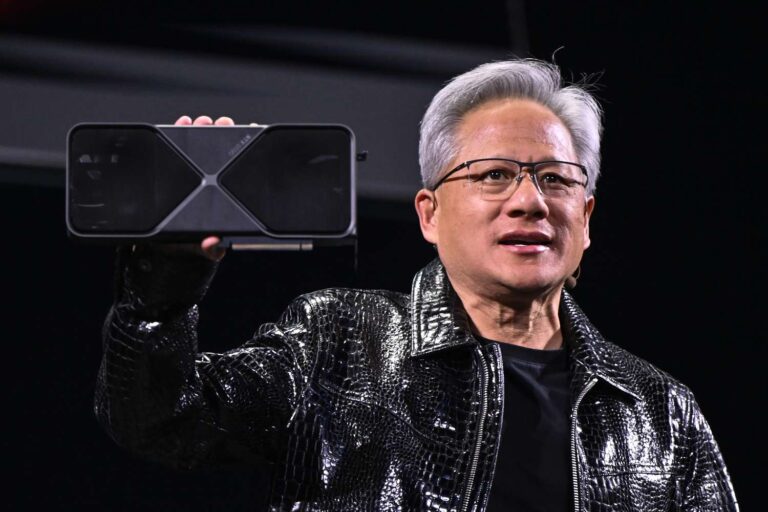

Nvidia surpassed street expectations in its fourth quarter income report on Wednesday evening. Revenues at the company’s data center, which represent AI demand, have almost doubled from the same period last year. But the stocks were shaking, looking between profits and losses in extended trading last night and this morning.

Market participants on Wednesday afternoon were priced for options that are expected to rise or fall by 8% by the end of this week in preparation for a stock move after a massive earnings post-revenue.

The sale on Thursday implies that Nvidia’s results were not sufficient for investors as excessive AI spending and concerns about economic conditions have stolen winds from AI trade sails in recent weeks. Investors sold AI stocks at a rich price last week. This is a trend that continued with a quick clip during the sale on Thursday.

Super Micro Computer (SMCI) shares fell 16% as they surged yesterday after AI server manufacturers slightly met their deadline to avoid removing the stock from Nasdaq. Nuclear provider Vistra (VST), which rose more than 200% last year, fell 12% as a wider AI slump overshadowed revenue reports better than expected. Another of Wall Street’s favorite AI plays, Palantir (PLTR), skated 5%.

This article was updated because it was originally published to reflect fresh stock price information and context.