The world’s most valuable stocks and companies have accurately see the worst day of January 27, 2025 earlier this week. For the past few years, NVIDIA’s stock superstars were surprising. Due to the fall on Monday, the $ 595 billion wealth has disappeared. It is as valuable as Pepsico, McDonald’s, Starbucks, or target.

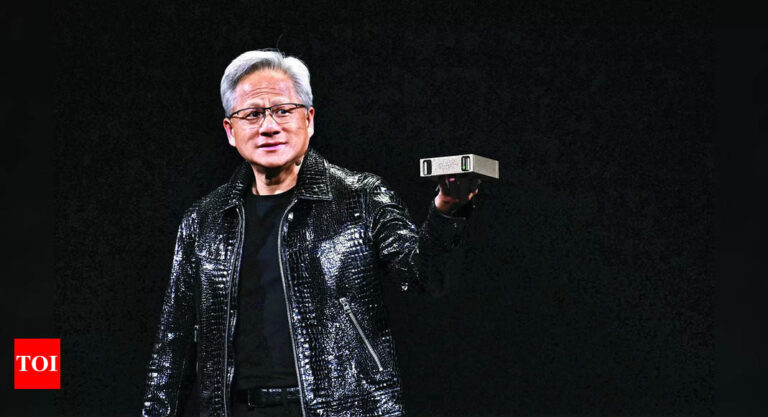

It is almost known that it is known only in games and encryption circles a few years ago, but since customers wanted chips to train chatbots and other artificial intelligence products, we saw a sudden increase in sales. Later, NVIDIA has been in the spotlight in the past two years. It was more than three times in 2023, more than twice in 2024. For this reason, some investors and analyst praised CEO Jensen Huang as the “AI Godfather”. NVIDIA has grown into a giant of over $ 3 trillion, trading a place with Titan like Apple, making it the most valuable company in Wall Street.

However, all of them have been stopped at least on Monday, but have developed a large -scale language model that can function like DeepSeek, a Chinese company that can function like ChatGpt and other US rivals. However, it is after the development of computing power, which is much less.

NVIDIA rise and rise

The roots of NVIDIA began in the game. In 1999, the Santa Clara, a high -tech company -based graphic processor unit (GPU invention), helped to grow the red -defined computer graphics. Currently, NVIDIA’s special chips are important components that help promote various forms of artificial intelligence, including the latest AI chatbots such as Chatgpt and Google Gemini.

HUANG calls AI the “next industrial revolution”, and NVIDIA’s GPU is designed to execute artificial intelligence tasks faster and more efficiently than general -purpose chips like CPUs. The high -tech giant is snapping the NVIDIA chips as you walk deep in AI. This allows cars to drive themselves and create stories, art, and music.

This demand helped to grow NVIDIA’s revenue at a level of eyes after quarterly. On February 23, 2023, after NVIDIA opened his hopes for the quarterly profit of the past, Huang stated that “AI is in a transformation point and aims for a wide range of hires to reach all industries.” Ta. The company’s quarterly revenue at that time was $ 6050 million.

It increased up to $ 7.19 billion in just three months later, almost $ 135.1 billion in three months. After that, the revenue was $ 35 billion in three months from October 2024.

The company’s stock prices have soared, and its total market value has passed rivals such as Intel and Microsoft. NVIDIA alone accounted for more than one -fifth of the total return of last year’s S & P 500 indexes. Other inventory was not approaching, and there was something more than the triple apple effect.

What changed to Monday

Unlike Dot-Com Boom, the real money is behind NVIDIA’s rapid increase, and its stock prices are expected more than ever. These expectations were questioned on Monday. Deepseek and its seemingly low cost projects have raised concerns about whether they need to spend a lot of dollars on the NVIDIA chips, as they had previously thought. The concern is a power company that wants to reduce stocks in the AI industry, including suppliers, and to electrify the chip industry and the vast amount of data centers that are expected to be built to execute them. However, NVIDIA was taking a spotlight because its stock became the brightest symbol of AI Bonanza.

Some of the Wall Street saw almost 17 % of the opportunity, rather than a signal of fate of nearly 17 % on Monday. As AI executions are cheaper, new types of customers and software innovation will be opened, eventually supporting the industry.

However, as John Belton, the portfolio manager of Gabelli Funds, said to the AP, “This is not the first time that the main technical shares have faced the existing questions for NVIDIA itself.” Meta, Google, Amazon, Amazon. And Netflix -A company that was once suspected but finally recovered. “