Please let us know your free update

Simply sign up to MYFT DIGEST, and will be distributed directly to the reception tray.

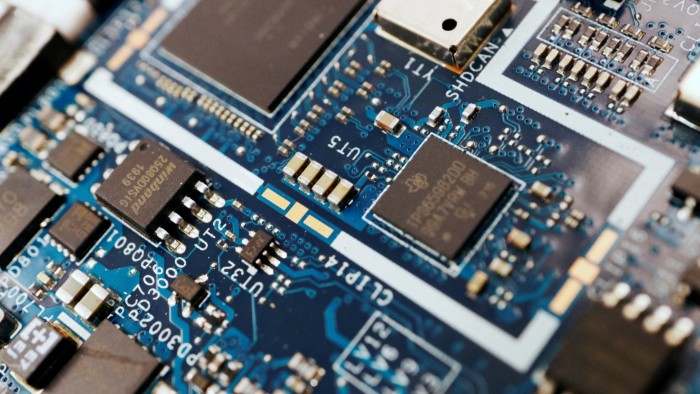

Asian and European chip manufacturers have rebelled on Wednesday after the powerful corporate revenue from Group ASML in the Netherlands was added to the previous day’s industry leader NVIDIA rally.

After our chip manufacturer NVIDIA concluded nearly 9 % on Tuesday, the recovery was heavy that wiped the market capitalization of nearly $ 600 million in the early week of the investor worried about the threat of China’s deep shak. We have regained some of the losses. US hegemony in artificial intelligence.

The appearance of DeepSeek, which promises to develop AI tools at a few minutes of rivals in the United States, is called modern “SPUTNIK moment.”

The StoxX EUROPE 600 benchmark increased 0.5 % and was led by ASML. Chip equipment manufacturers have announced their earnings to beat analysts and raised their shares by 10 % in Amsterdam.

Another chip stock ASM has risen by 7 %, the StoxX Europe 600 technology index has increased by 4.3 %, erasing the defeat on Monday.

“What happened on Monday was an extreme overreaction, amplified by extreme positioning,” said Elyas Galou, a global investment strategist in Bank of America, said President Donald Trump’s inauguration and this week’s revenue. It pointed out the crowded position of the heading global high -tech stock. From high -tech sheather including META and Microsoft.

“I saw many purchases yesterday, including retail investors who support today’s market,” added.

NVIDIA’s shares remained flat in front of the market on Wednesday. The futures market has pointed out further rebounds in the United States, and contracts have increased NASDAQ by 0.3 % to track S & P 500 flat.

Nippon Swang 225, which has a lot of Japanese technology, closed 1 % after rebounding between semiconductor stock and AI investor Softbank.

Mitur Koteca, the head of the Barclays market and Mitur Koteca, head of the foreign exchange strategy, states:

Goldman Sachs’s Asian Market Analyst wrote a note on Tuesday night that “excessive high quality stocks can also provide investment opportunities” and wrote that “strong companies will be stronger.” 。

In Tokyo, NVIDIA suppliers’ ADVANTEST closed 4.4 %, and TOKYO ELECTRON, a semiconductor company, increased by 2.3 %. SoftBank has ended a day with 2.4 % increase.

Other regions in Asia also had buoyancy on Wednesday. India’s Nifty 50 increased by almost 1 % in the afternoon, and Australia’s ASX 200 increased 0.6 %. China, South Korea, and Taiwan are closed for Lunar New Year holidays.

However, analysts warned that investors have not yet completely canceled the fall of Panic on Monday due to the meaning of heavy AI investment under US technology in light of Deepseek’s results.

“There was no rebound like” Oh, there was nothing. ” Barclays’s Koteka states: