President Donald Trump may threaten the introduction of trade tariffs in foreign semiconductors, and may affect the Taiwanese semiconductor manufacturing company (TSM). Details of tariffs have not been disclosed, but investors will notice that other Trump threats include 25 % of Canada and Mexico.

President Trump is not the only product to target with his latest tariff threats in planning to attack Asian steel and pharmaceuticals. This is part of his plan that encourages the manufacturing industry in the United States to avoid a large amount of tariffs.

The propulsion that President Trump brings the manufacturing industry to the United States has already been some of the success since his first term. TSMC has already developed a manufacturing facility in Arizona, but most of its production remains in Taiwan. This is one of the biggest customers, which has a negative effect on high -tech companies such as NVIDIA (NVDA) and Apple (AAPL).

What does this mean to TSMC?

TSMC is the world’s largest manufacturer in the semiconductor, and North America is the largest customer. In other words, Trump’s tariffs can affect US business and residents’ lives, and as TSMC takes time to expand business outside of Taiwan, product prices can increase.

However, Taiwanese leaders do not expect major issues from President Trump. The Taiwanese Ministry of Economy said to Trump’s threat, “pay attention to future US policies.” In order to guarantee that Taiwan and the United States industry and national interests can be developed and developed, there is close contact and cooperation between both sides. A method facing a global issue. “

Are TSM stocks buying, selling, or holding them?

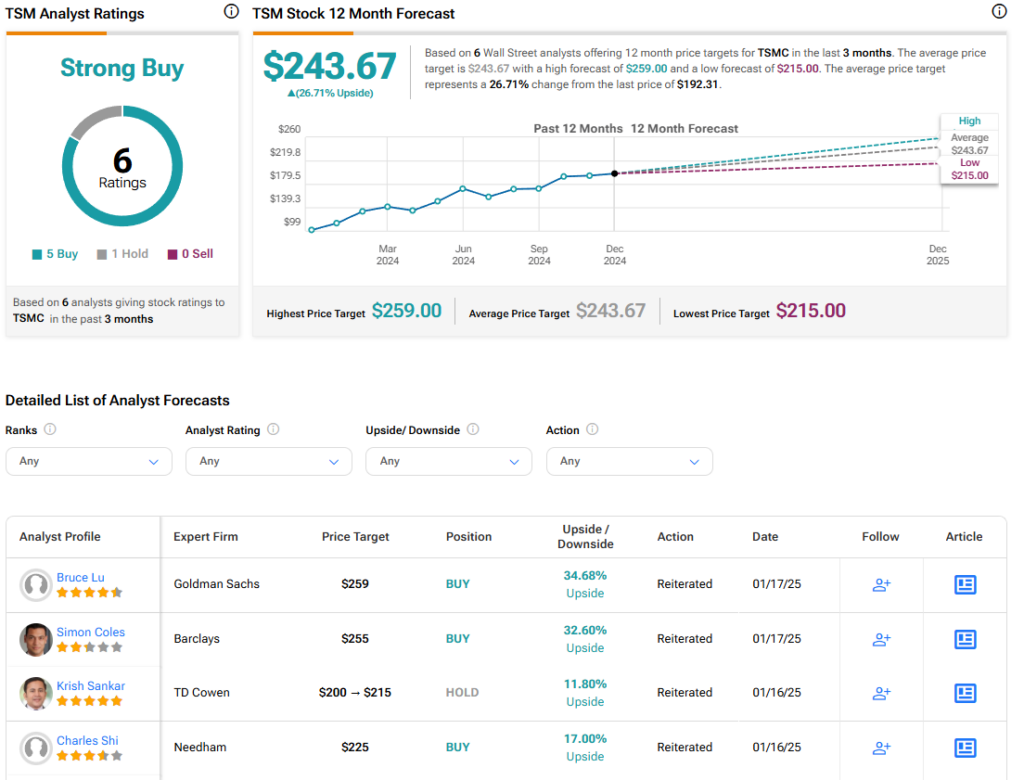

Looking at Wall Street, the consensus rating of the Analyst of Taiwanese semiconductor manufacturing companies is a strong shopping based on five buying and one pending evaluation in the last three months. This costs $ 243.67, up to $ 259, and a minimum of $ 215. This represents the potential 26.71 % upside of TSM stocks.

See more about the evaluation of TSM stock analysts