apple company AAPL Taiwan Semiconductor Manufacturing Company’s ‘Made in America’ processor chip is in final stages of verification TSM Factory located in Arizona.

The first batch of commercial chips is likely to be shipped by this quarter, Nikkei Asia reported.

The 2020 pandemic prompted countries including the United States, Europe, and Japan to strengthen their semiconductor positions by leveraging chipmakers such as Taiwan Semiconductor Corp. and Intel Corp. INTCSamsung Electronics Co., Ltd. SSNLFthereby reducing dependence on China.

Also read: Taiwan Semiconductor begins production of 4nm chips in Arizona, aims for $11.4 billion in fourth-quarter profit

Additionally, the United States began restricting China’s access to advanced semiconductor technology, which the US government claimed was being used by China to advance its military position.

The US government also restricted China’s access to advanced NVIDIA NVDA and Taiwan Semiconductor’s artificial intelligence chip.

The country has also reached out to its allies, including Taiwan and the Netherlands (home of chip equipment maker ASML Holding). ASMLrestricting semiconductor trade with China.

Meanwhile, Taiwan Semiconductor will capture a 64% share of the global foundry business in the third quarter of 2024, up from 62% in the second quarter, the Taipei Times said, citing an article by Counterpoint Research. .

Last November, Counterpoint said Taiwan Semiconductor had built a moat thanks to high utilization rates of its 5nm and 3nm processes, demand for artificial intelligence (AI) accelerators and smartphone sales.

Taipei Times cited an article by Counterpoint that Samsung took second place with a 12% share, supported by its 4nm and 5nm processes.

China’s Semiconductor Manufacturing International secured 6% on the back of its 28nm process, taking third place, the Taipei Times cited a Counterpoint article.

United Microelectronics Corporation UMC Partnered with GlobalFoundries Inc. GFS It has a 5% share, supported by demand from the Internet of Things and communications infrastructure markets.

The 3nm process took second place with a 13% share in the third quarter, thanks to Apple and Qualcomm making full use of the production capacity of Taiwan Semiconductor. QCOMInter gained momentum.

5nm and 4nm processes captured the number one position in the third quarter, capturing 24% of the market, driven by demand for Nvidia’s Blackwell graphics processing units.

Taiwan Semiconductor plans to begin production of the 2nm process at its factory in Baoshan Township, Hsinchu County in 2025.

Goldman Sachs expressed optimism about Taiwan Semiconductor’s outlook, citing growth in AI demand and advanced nodes. As Taiwan Semiconductor increases prices for 3nm and 5nm nodes in 2025 (while Intel and Samsung struggle to develop AI technology moats), profit margins could rise to over 59% .

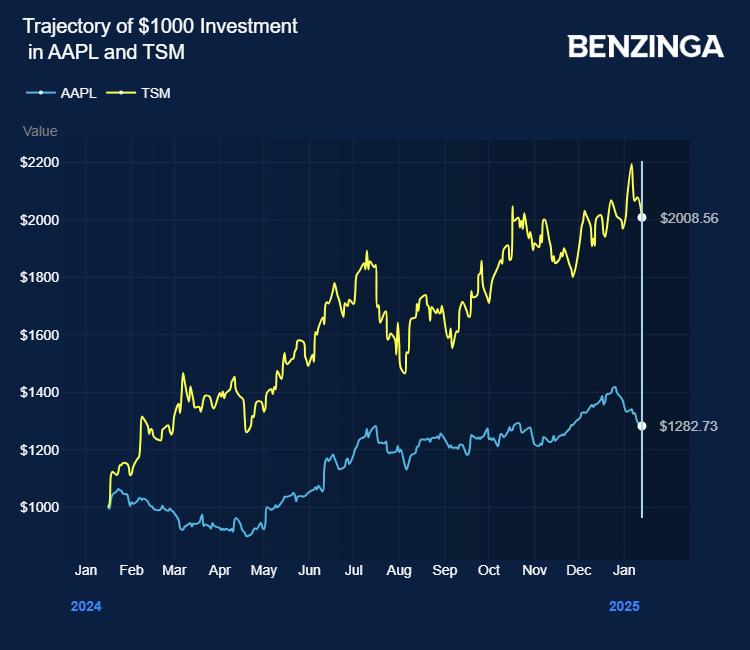

Taiwan Semiconductor’s stock price has risen more than 98% in the past 12 months. Investors can gain exposure to stocks of semiconductor manufacturing companies through the VanEck Semiconductor ETF SMH and iShares Semiconductor ETF socks.

Price Action: TSM stock was down 0.65% at $200.05 at last check on Tuesday.

Also read:

Image via Shutterstock

Market news and data powered by Benzinga API

© 2025 Benzinga.com. Benzinga does not provide investment advice. Unauthorized reproduction is prohibited.