I’m not spooking anyone – I don’t have a positive outlook for Nvidia (NASDAQ:NVDA) stock in 2025. After a great few years, I think things are finally starting to change.

Over the past six months, the stock has remained flat as sales growth has begun to slow. I think this will continue into next year, which makes me pessimistic about Nvidia stock.

Nvidia’s stock price is up more than 2,000%, with most of the increase occurring in the past two years. And the reason is actually very simple.

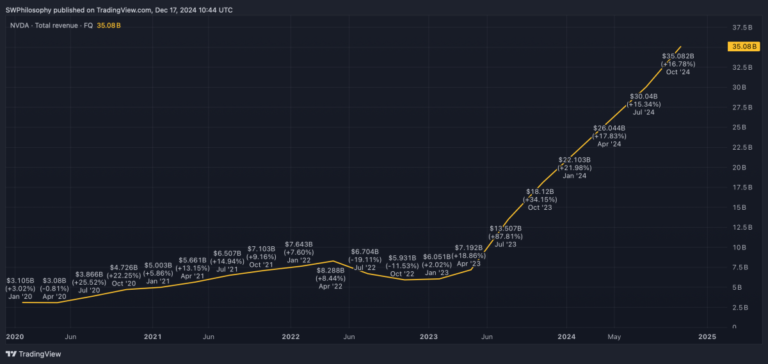

Since the beginning of 2023, the company’s sales have been increasing rapidly. After modest growth from 2020 to 2022, growth accelerated significantly and the stock price followed suit.

Nvidia Total Revenue 2020-24

Created with TradingView

However, this doesn’t tell the whole story. Specifically, there is no explanation as to why the explosive rise in stock prices over the past six months has stopped.

The reason is that although total sales are increasing, they are not growing at the same rate. Over the past few quarters, Nvidia’s revenue growth has actually declined.

Nvidia’s YoY sales growth rate 2020-24

Created with TradingView

It seems strange to think that investors might not be impressed by 93% revenue growth. But this is a move in the wrong direction for a company that posted a 206% return a year ago.

I think the graph above best describes Nvidia’s stock price over the past two years. So what investors need to know is what will happen in 2025?

At the risk of stating the obvious, it will be a big challenge for Nvidia to increase revenue growth. And I think this trend will only grow stronger as 2025 progresses.

Analyst forecasts appear to support this view. Revenue is expected to reach $50.81 billion by the third quarter of 2025, a 53% increase over the same period this year.

Created with TradingView

I’m not saying this is anything other than great from the underlying business. And I don’t think there are many companies whose earnings growth will disappoint this much.

However, my point is that this will likely be lower than the growth rate the company is currently achieving. This makes me pessimistic about stocks in 2025, especially as the year progresses.

Nothing is certain and Nvidia could surprise people, including me. The company’s new Blackwell chips are very impressive and give the company a very strong competitive advantage in a growing industry.

Nevertheless, the company already sells to some of the world’s largest companies (and in some cases entire nations), so it’s doubtful that the growth rate will be 94% in 2025. Therefore, we are cautious about the stock price.

story continues