Nvidia stock is down 17% from its all-time high in November and is approaching bear market territory. The selloff intensified after recent comments from Microsoft’s CEO suggested the chip boom was easing. Wedbush analyst Dan Ives sees Nvidia’s decline as a temporary decline. , the future of AI is promising.

Nvidia stock is in correction territory, and some key changes in the artificial intelligence story could weigh on the stock as 2024 comes to a close.

The company’s stock is down 17% from its all-time high of $152.89 on Nov. 21. A bear market, as defined by Wall Street traders, is a 20% decline from its most recent high.

The decline in the AI darling’s stock accelerated late last week following comments from Microsoft CEO Satya Nadella.

In an interview with Bill Gurley and Brad Gerstner on the B2 Podcast, Nadella suggested that the frenzied demand for AI chips may be fading.

Asked if Microsoft was still subject to “supply constraints” in building AI technology, Nadella said: “I have the power (limited). Yes, we are not subject to supply constraints on chips. No,” he answered.

He added: “We were definitely constrained in 2024. What we’ve said on the street is that’s why we’re optimistic about the remainder of the fiscal year, the first half of 2025. “And I think it will happen after that.” The outlook is good as we will be in better shape heading into 2026. ”

Nvidia stock has fallen 7% since Nadella’s comments. Microsoft is considered Nvidia’s largest customer, accounting for an estimated 20% of the company’s revenue.

Nadella’s comments signal a shift in the supply-demand dynamics for Nvidia’s AI chips, which have seen huge demand over the past two years as companies race to build their own large-scale language models. .

The demand for Nvidia’s GPUs was so huge that the company had to choose which companies to give its chips to first, and the billionaire tech founder told Nvidia’s CEO over dinner. There was also a story that he begged Jensen Huang for more tips.

Nadella’s comments about chip supply constraints no longer necessarily mean demand for Nvidia’s flagship product set is waning. This may simply mean that supply is finally catching up to some of Nvidia’s core GPU products.

Indeed, recent analyst comments on Wall Street suggest that Nvidia’s next-generation Blackwell GPU chips already face at least a year’s backlog for new orders.

But Mr. Nadella’s comments clouded some of the most bullish views on Wall Street, which loves to hear that demand is outpacing supply of corporate goods. That one of Nvidia’s biggest customers says that’s no longer the case may give pause to investors hoping for another year of impressive growth for Nvidia.

There are other factors that may have weighed on Nvidia’s stock price in recent weeks, including comments from industry leaders in the AI field.

Alphabet CEO Sundar Pichai said earlier this month that progress in AI models will be even more difficult in 2025 because “the fruits of low returns are gone.”

“If we start scaling up quickly, we can put more compute into it and make a lot of progress, but we’re definitely going to need deeper breakthroughs to get to the next stage.” he said. “So it can feel like there’s a wall or a little barrier.”

OpenAI co-founder Ilya Sutskever also made comments last week that suggest AI development may face obstacles.

“The data has peaked, but it won’t go any further,” Sutskever said.

There are also increasing signs that the bold predictions for artificial general intelligence, seen as a major milestone in the technology, are far off the mark.

Finally, Wedbush’s Dan Ives says Broadcom’s impressive financial results on Friday may simply be driving rotation from some AI winners to other companies.

Broadcom said in its fourth-quarter earnings call that its AI business is performing well and expects it to continue doing so over the next several years. Broadcom develops custom AI chips for cloud companies like Amazon and Alphabet.

“A lot of people on the street are starting to play the second and third derivatives of AI Revolution and start selling NVIDIA,” Ives told Business Insider on Tuesday.

But he said Nvidia’s continued decline should be approached by investors as a buying opportunity.

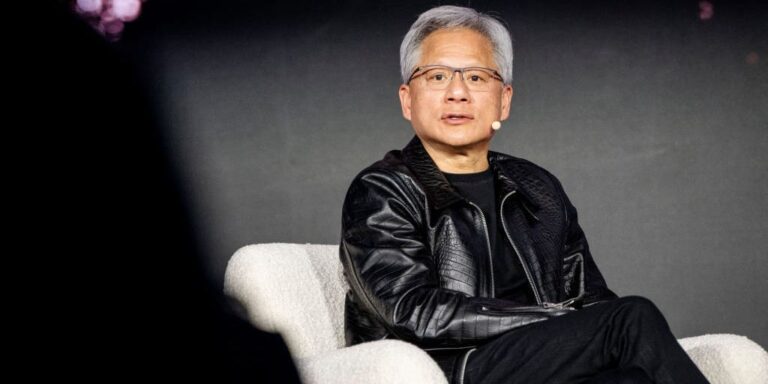

“This is a slowdown for Nvidia, and it won’t last long,” Ives said. “With Jensen, the Godfather of AI, leading the Fourth Industrial Revolution into 2025, we believe Nvidia is the preeminent AI name to own.”