Palantir was the top two tech stocks of 2024 (NASDAQ:PLTR) and Nvidia (NASDAQ:NVDA). In terms of stock price performance, Palantir is the clear winner in 2024, with its stock up about 325% as of this writing, while Nvidia is up about 180%. Both are incredible returns.

However, the question is which stocks are most likely to outperform the others in 2025? Let’s look at some criteria to help you decide.

Nvidia already has a wide moat

Companies with wide moats are generally considered desirable. In the simplest terms, a moat is an advantage over competitors that allows a company to remain competitive and maintain market share.

Nvidia has been the biggest winner in the artificial intelligence (AI) infrastructure space because it has built a wide moat around its business through its CUDA software platform. The platform was born as a way for the company to expand its use of graphics processing units (GPUs) beyond speeding up the rendering of graphics, such as video games, for which the chip was originally designed. The CUDA platform allows chips to be programmed to handle other tasks better, leading more developers to learn to program and making it the de facto platform for learning to program GPUs. It has become.

This led to the wide moat the company sees today and is the reason why the company has nearly 90% market share in the GPU space.

Palantir’s moat is less clear. The main reason for this is that the AI software field that Palantir is involved in is still in its infancy. However, the company’s AI platform (AIP) is gaining significant traction in the commercial space, and growth is starting to re-accelerate in the government space as well. Meanwhile, the company has established itself as a key part of the government’s mission-critical missions, with its technology used to combat terrorism and track coronavirus cases during the pandemic.

While many large technology companies struggle to develop the best AI models, Palantir believes that AI models have become commoditized and that true differentiation lies in the application and workflow layers that we focus on. . The company believes that its expertise in analytics and pattern recognition allows it to rigorously test AI applications and quickly move from proof of concept to AI-powered software solutions.

We believe that this is our moat. So far this seems to be working, but more time is needed before it becomes conclusive.

Image source: Getty Images.

Both are experiencing strong growth

Nvidia has experienced explosive revenue growth this year, which is even more impressive given the large revenue base from which it started. In the first nine months of this year, the chipmaker was able to grow its revenue by an impressive 135% to $91.2 billion. Revenue for the third quarter of 2025 increased 94% to $35.1 billion. On the other hand, we have achieved a solid profit margin of approximately 75%.

Demand for the company’s chips continues to be strong, with demand for the latest GPU architectures outpacing supply. Growth is expected to continue high as major technology companies continue to race to create more sophisticated AI models. These models require exponentially more compute power to train, often newer models that use 10x more GPUs to train than previous versions.

Looking ahead, analysts expect Nvidia’s revenue to increase by more than 50% to $195.4 billion in 2025.

Palantir hasn’t grown as fast as Nvidia, but its revenue growth has accelerated throughout the year. The company’s first quarter sales increased 21% year over year, accelerated 27% in the second quarter and 30% in the third quarter to $726 million.

But some of the company’s businesses are growing faster, with U.S. commercial revenue increasing 54% and U.S. government revenue increasing 40% last quarter. However, international markets are lagging behind.

With strong customer growth, up 39% in the last quarter, Palantir is poised for continued revenue growth as the company has significant revenue opportunities to move customers from prototyping to full-scale production. It may accelerate. However, this is not currently factored into analysts’ forecasts, with 2025 sales expected to increase by approximately 24% to $3.47 billion.

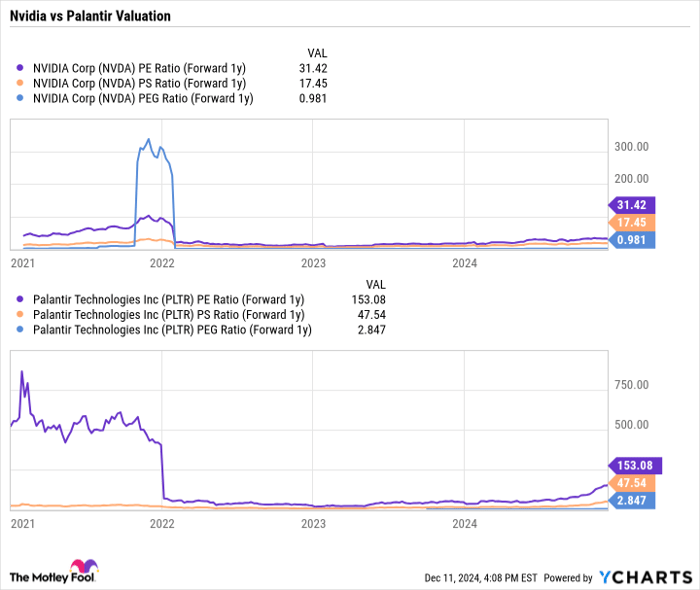

Valuation reveals clear winners

From a valuation perspective, NVIDIA is the clear winner by a wide margin. The company trades at an attractive valuation, with a forward price-to-earnings ratio (P/E) of just over 31x and a price-to-earnings ratio (PEG) of approximately 1x based on analyst forecasts for 2025. Growth stocks often have a PEG ratio well above 1, although stocks below 1 are generally considered undervalued.

On the other hand, Palantir’s expected price/sales (P/S) ratio for next year is approximately 47.5 times higher than analysts’ forecasts. That’s a strong valuation for a company with 30% revenue growth, and more than its historical SaaS (software-as-a-service) peak multiple.

NVDA PE Ratio (Forward 1y) Data by YCharts

judgment

Nvidia is the clear winner on paper, as it has higher revenue growth, an established moat, and a more attractive valuation. That’s why I prefer Nvidia for 2025. If analyst forecasts are in line with the general expectations for both stocks, then Nvidia should be. Exceed.

That being said, unforeseen circumstances may determine a different outcome. If Palantir can prove that its AI platform is the best, gets widespread adoption, and revenue growth soars, it could outperform again. On the other hand, if spending on AI infrastructure unexpectedly declines, Nvidia’s results could suffer. I’m sticking with Nvidia, but these are scenarios to watch out for in 2025.

Don’t miss out on this potentially lucrative second chance

Have you ever felt like you missed out on buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our team of expert analysts will issue a “Double Down” stock recommendation on a company we think is about to crash. If you’re already worried that you’re missing out on an investment opportunity, now is the best time to buy before it’s too late. And the numbers speak for themselves.

NVIDIA: If you invested $1,000 when it doubled in 2009; You’d get $361,233!* Apple: If you invested $1,000 when it doubled in 2008, you’d get $46,681!* Netflix: It doubled in 2004 If you invested $1,000, you would get $505,079!*

We currently have “double down” alerts on three great companies, and we may not see an opportunity like this again anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

Jeffrey Seiler has no position in any stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.