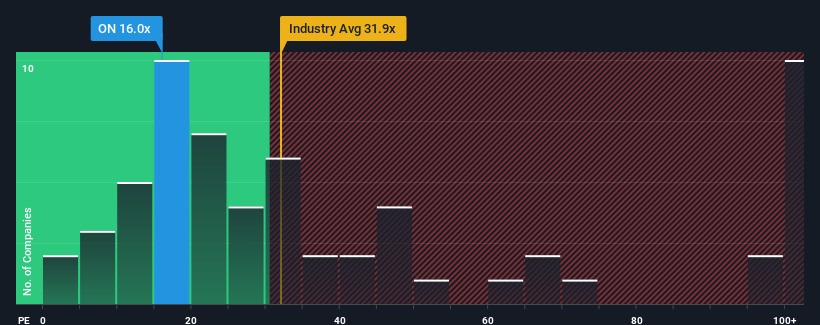

Considering that nearly half of all U.S. companies have a P/E ratio of 16x, ON Semiconductor Corporation (NASDAQ:ON) may be sending a bullish signal at the moment. there is. It is not uncommon for multiples to exceed 20x and P/E ratios to exceed 35x. However, it would be unwise to take the P/E ratio at face value, as there may be an explanation as to why it is limited.

While most other companies are seeing positive earnings growth, ON Semiconductor’s performance could be even better, as it has seen a recent setback. The P/E ratio is probably low because investors believe this poor performance will not get any better. If you still like the company, you’ll probably wish it wasn’t so that you can pick up shares while it’s out of favor.

Check out our latest analysis for ON Semiconductor.

Wondering how analysts think ON Semiconductor’s future compares to its industry? Then our free report is the best place to start.

Does growth equate to a low P/E ratio?

ON Semiconductor’s P/E ratio is typical for a company that expects limited growth and, importantly, to perform worse than the market.

Firstly, looking back, the company’s earnings per share growth last year fell by a disappointing 20%, which isn’t something to get excited about. Still, despite the last 12 months, impressively, EPS increased by a total of 158% compared to three years ago. Shareholders would therefore have liked to see continued performance, but would probably welcome medium-term profit growth.

Looking ahead, analysts who follow the company say that EPS is expected to grow 16% annually over the next three years. Meanwhile, the rest of the market is expected to grow by only 11% annually, making it significantly less attractive.

With this in mind, it’s strange that ON Semiconductor’s P/E is lower than most other companies. Most investors don’t seem to have any confidence that the company will be able to meet its future growth expectations.

What can we learn from ON Semiconductor’s P/E ratio?

Generally, we like to limit our use of price-to-earnings ratios to establishing what the market thinks about a company’s overall health.

It turns out that ON Semiconductor’s expected growth rate is higher than the broader market, so ON Semiconductor is currently trading at a much lower P/E than expected. There are large unseen threats to earnings that may cause the P/E ratio to not match the positive outlook. At least the price risk appears to be very low, but investors seem to believe that future returns can vary widely.

There can be many potential risks within a company’s balance sheet. Check out our free balance sheet analysis of ON Semiconductor, including 6 quick checks on some of these important factors.

It’s important to make sure you look for great companies, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E ratio).

New feature: AI stock screener and alerts

Our new AI Stock Screener scans the market for opportunities every day.

• Dividend powerhouse (yield 3% or more)

• Small-cap stocks that are undervalued due to insider purchases.

• High-growth technology and AI companies

Or build your own metrics from over 50 metrics.

Explore for free now

Do you have feedback about this article? Interested in its content? Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.