Despite an already strong stock price, Lattice Semiconductor Corporation (NASDAQ:LSCC) stock is on the rise, up 25% over the past 30 days. The bad news is that despite the share price’s recovery over the past 30 days, shareholders are still seeing their share price down around 8.9% over the last year.

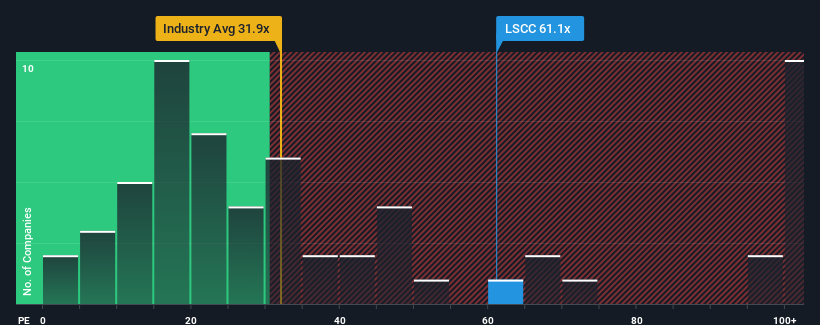

After such a large price increase, you might consider Lattice Semiconductor, at 61.1x, to be a stock to avoid altogether, considering that nearly half of U.S. companies have a price-to-earnings ratio below 19x. . ×PER. However, there may be a reason why the P/E ratio is so high, and further research is needed to determine if it’s justified.

The market has been seeing earnings growth lately, but Lattice Semiconductor’s earnings have been going backwards and aren’t all that great. One possibility is that the P/E ratio is high because investors believe this poor performance is a turning point. If not, existing shareholders could become extremely nervous about the viability of the stock price.

Check out our latest analysis for Lattice Semiconductor.

Want a complete picture of what analysts are forecasting for the company? Our free report on Lattice Semiconductor can help you uncover future developments.

Does growth equate to a high P/E ratio?

The only time a P/E as steep as Lattice Semiconductor’s is truly reassuring is when the company’s growth is clearly on track to outpace the market.

Firstly, looking back, the company’s earnings per share growth last year wasn’t anything to get excited about, with the company posting a disappointing decline of 32%. Yet, impressively, despite the last 12 months, EPS increased by a total of 70% compared to three years ago. Shareholders would therefore have liked to see continued performance, but would probably welcome medium-term profit growth.

Turning to the outlook, analysts monitoring the company estimate that the next three years should deliver annualized growth of 5.9%. Meanwhile, the rest of the market is projected to grow by 11% per year, which is significantly more attractive.

This information raises concerns that Lattice Semiconductor is trading at a higher P/E than the market. While most investors seem to be hoping for an improvement in the company’s business outlook, analysts are less confident that will happen. If the P/E declines to a level that is in line with growth prospects, these shareholders are likely setting themselves up for future disappointment.

Important points

Due to the strong jump in stock price, Lattice Semiconductor’s P/E ratio has also increased significantly. While it’s not wise to use the price-to-earnings ratio alone to decide whether to sell a stock, it can be a practical guide to a company’s future prospects.

After examining analyst forecasts for Lattice Semiconductor, we find that its poor earnings outlook doesn’t have as much of an impact on its high P/E ratio as we expected. At this point, we’re increasingly uncomfortable with high P/E ratios as expected future earnings are unlikely to support such positive sentiment over the long term. This puts shareholders’ investments at significant risk and puts potential investors at risk of paying an excessive premium.

A company’s balance sheet is another important area of risk analysis. Check out our free balance sheet analysis of Lattice Semiconductor, including 6 quick checks on some of these important factors.

Of course, you may be able to find a better stock than Lattice Semiconductor. So we recommend taking a look at this free collection of other companies that have reasonable P/E ratios and are growing earnings strongly.

New feature: AI stock screener and alerts

Our new AI Stock Screener scans the market for opportunities every day.

• Dividend powerhouse (yield 3% or more)

• Small-cap stocks that are undervalued due to insider purchases.

• High-growth technology and AI companies

Or build your own metrics from over 50 metrics.

Explore for free now

Do you have feedback on this article? Interested in its content? Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.