In an unprecedented move to maintain its technological advantage, the United States enacted the most comprehensive semiconductor export controls in history, affecting everything from AI chips to manufacturing equipment. These complex regulations not only affect direct exports to China, but also affect entire global supply chains, leaving businesses around the world unaware that their products and activities are subject to regulation. poses compliance challenges. Anthony Rapa of Blank Rome says understanding these rules has become critical to business survival as the new presidential administration prepares to take office.

Over the past two years, the United States has implemented the most extensive and complex export controls on advanced computing items in history. artificial intelligence A distinctive aspect of the strategic competition between the United States and China is chip and semiconductor manufacturing equipment. These regulations pose a significant challenge for companies that are unaware that their items are subject to export controls, which are a top national security concern of the United States. Additionally, the rule broadly applies to downstream uses of U.S. products to support chip manufacturing in China and other countries, making due diligence particularly difficult for companies.

Those challenges could become even more pressing for companies caught up in U.S.-China relations as a new presidential administration prepares to take over the reins in Washington.

export control regulations

The U.S. Export Administration Regulations (EAR) are administered by the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) and control the flow of some dual-use items to certain countries and allow for certain end uses and end users. Supported. Specifically, the EAR applies to goods, software, and technology that (1) are located in the United States; (2) Originating in the United States, regardless of location. (3) does not originate in the United States, but incorporates “controlled” U.S. content at or above a “minimum” level; (4) Certain technology or software “direct products” that are manufactured outside the United States but are subject to the EAR. Additionally, the EAR governs certain activities by U.S. individuals anywhere in the world.

Overview of export regulations for the semiconductor industry

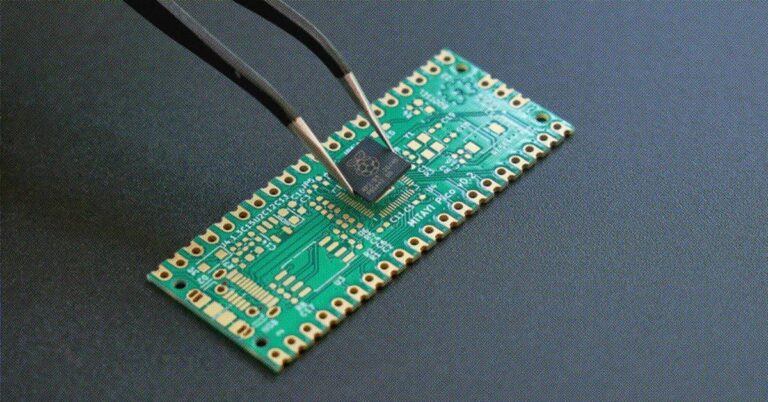

Through three rulemakings in October 2022, October 2023, and April 2024, BIS has identified (1) advanced node semiconductors that drive AI development, (2) semiconductor manufacturing equipment (SME), and ( 3) Development or production of advanced computing items and small and medium-sized enterprises. BIS’s measures restrict a wide range of transactions that directly or indirectly involve China, and also cover transactions with other countries, including the Middle East. This regulation is breathtakingly wide-ranging, covering virtually the entire semiconductor value chain around the world.

Why focus on semiconductors? In recent years, U.S. executive branch officials, members of Congress from both parties, and national security thought leaders have come to view advanced semiconductors and related small and medium-sized businesses as critical businesses. absolute conditionor downright essential in the development of AI for potential military applications. In particular, these concerns focus on China and its moves toward technological and military parity with the United States, which has significant implications for Indo-Pacific security and the global geopolitical order.

Accordingly, U.S. officials believe that BIS rules ensure the flow of critical U.S. technology and provide U.S. military advantages, which are a core concern of U.S. national security and have broad bipartisan support. It is intended to be a paradigm shift and a generational change in export regulations.

How do the rules work and how do they achieve these goals? In particular:

Specially controlled items/destinations

This rule specifically identifies the types of chips, computing items, and small businesses that are restricted from export to China and dozens of other destinations on the Commercial Control List (CCL) under the EAR. There is a risk of diversion to China and use of data centers. China, including Asia and the Middle East.

In particular, this includes Export Control Classification Number (ECCN) 3A090, which is a measure of “Total Processing Performance” (a computational measure of the processing units on a chip) and Performance Density (TPP divided by the area of the chip). target a specific integrated circuit based on silicon on a single integrated circuit).

For small and medium-sized enterprises, this regulation regulates certain equipment designed for epitaxial growth, etching equipment, deposition equipment, and inspection equipment.

Expansion of “overseas direct shipment” rules

The BIS action significantly expands the scope of the EAR to apply to a wide range of non-U.S. items that are “direct products” of U.S. technology or software. This has the effect of exercising the EAR’s jurisdiction over items around the world far beyond what the United States actually produces. This is a very important aspect of the strategy behind the rules. Although the United States produces a relatively small portion of the world’s semiconductors, it contributes significantly to the value chain in terms of know-how and design software, which BIS will maximize through the “Foreign Direct Product” rule. I am doing it.

Restrictions on companies headquartered in or having their ultimate parent company in a restricted country

This rule applies not only to exports to China and other restricted countries, but also to exports to companies in non-restricted countries that are headquartered in or have an ultimate parent company in a restricted country.

Restrictions for Americans

The EAR prohibits U.S. entities, U.S. nationals, and U.S. persons, including permanent residents anywhere, from assisting in the development or production of certain integrated circuits in certain jurisdictions.

End use management

BIS regulations require a license to export certain items subject to the EAR for use in:

Development or production of integrated circuits in “advanced node” facilities in China or other restricted countries.

DThe development, production, operation, installation, repair, overhaul, or refurbishment of “supercomputers” in China or other restricted countries. or

DDevelopment or production of certain “front-end” small businesses.

Compliance challenges

BIS intended this rule to have the maximum impact across the semiconductor value chain, thereby projecting U.S. jurisdiction over the industry to the maximum extent permitted by the EAR. In this respect, BIS has succeeded. This rule applies not only to advanced chips and small businesses, but also to: Downstream transactions that support the development or production of such items. Transactions with companies in non-restricted countries that are headquartered or have an ultimate parent company in China or other restricted countries. Non-U.S. products manufactured using U.S. technology or software.

this has important implications compliance It is a challenge for virtually all participants in the semiconductor industry. Consider:

Items manufactured outside the United States are still subject to the EAR because they are based on the incorporation of U.S. physical content or software, or because of the involvement of U.S. technology or software in the manufacturing process that triggers the “foreign direct product” rule. There is a possibility that . This may not be immediately obvious or intuitive for companies operating outside the United States.

Broad end-use restrictions could ultimately cover the development and production of advanced chips in China or other restricted countries, or downstream transactions that could benefit small and medium-sized businesses. Companies often need to conduct extensive due diligence.

Restrictions on third-country transactions with companies headquartered or with ultimate parent companies in China or other restricted countries can pose sensitive challenges for companies dealing with customers who do not wish to provide ownership information. there is.

U.S. employees in non-U.S. facilities may be subject to unique prohibitions that do not apply to employers, exposing both individual employees and non-U.S. employers to potential liability under the EAR. It will be.

As practical restrictions tighten, bad actors and small businesses seeking to obtain chips are resorting to illegal methods that are difficult for exporters to detect, such as the use of shell companies and straw buyers.

Notably, these compliance challenges loom in the midst of a change in presidential administrations and potential changes in U.S.-China relations, including tariffs and realignment. supply chain This could further complicate an already troubled geopolitical situation.

Corporate compliance procedures

Although the BIS regulations have significantly complicated the semiconductor industry’s compliance landscape, it is possible (and important) for companies to design reasonably tailored compliance mechanisms to address the risks. These include:

Jurisdiction/Classification Analysis: Companies in the industry should (1) evaluate whether their products are subject to the EAR and (2) if so, determine the ECCN that applies to their products. This is an important threshold consideration that indicates the nature and scope of the EAR requirements that apply to a company’s operations. Companies that produce goods outside the United States should focus on the potential application of “de minimis” and “foreign direct product” rules.

Due diligence of counterparties: It is imperative for companies in the semiconductor industry to conduct thorough due diligence on their business partners, including: (1) Specified on the transaction restriction list. (2) Organized within a restricted jurisdiction; (3) is headquartered or has an ultimate parent company in a restricted jurisdiction; (4) lacks sufficient integrity to ensure that it is a legitimate company and not a shell company or straw buyer;

Terms of Use/End User Certificate: Companies, especially downstream operators risk If you inadvertently contribute to development or production activities in China or other restricted countries, you should use the terms of your contract to require your trading partners to treat your products in accordance with the EAR. Additionally, it may be prudent for companies to obtain end-user certificates for their customers that positively describe the product’s end-uses and end-users and/or exclude certain restricted end-uses and end-users. Possibly.

Americans refuse: If appropriate, non-U.S. companies that engage in activities not subject to the EAR should consider avoiding the involvement of U.S. individuals in the restricted activities.