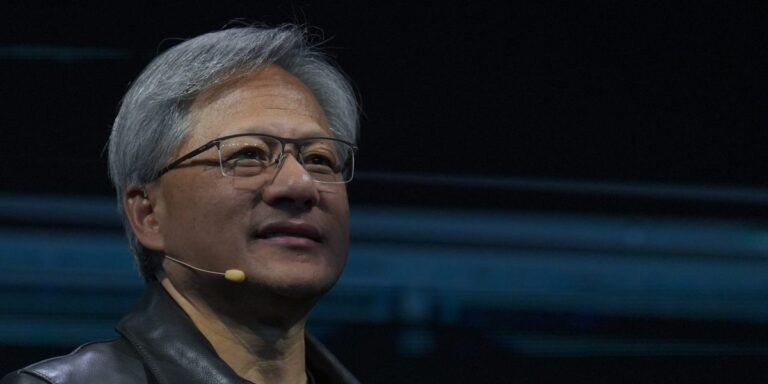

Nvidia Corp.’s soaring stock price is posing a challenge for Jensen Huang’s charitable foundation. As the stock price rises, the amount you have to donate also increases.

The Jensen and Lori Hwang Foundation says its assets, made up mostly of Nvidia stock, more than tripled to $3.4 billion at the end of 2023, according to newly released tax filings. To account for growth, it will need to contribute at least $120 million this year, the filing shows. This is double the level from last year.

“Foundations need to spend more money,” said John Seitz, founder of FoundationMark, a company that tracks foundation investment performance.

The foundation, named for the Nvidia co-founder and his wife, gave away $59.7 million last year, down from $66.3 million in 2022. Most of that money, along with a $10 million donation, went to a separate philanthropic fund run by Hwang and his wife. He went to his alma mater, Oregon State University. His next largest donation, $900,000, went to Friends of Magen David Adom in the United States, which supports Israel’s version of the Red Cross.

“The Huang Foundation supports higher education, public health and STEM initiatives across the United States, along with local community organizations in the San Francisco Bay Area,” a spokesperson for the Huangs said in a statement. “By taking a long-term approach, the Foundation ensures its resources continue to support important causes into the future and maximizes the impact of its philanthropy over time.”

The Internal Revenue Service requires private foundations to give away at least 5% of their assets each year, which can be a big goal for charities with high-flying stocks. Records show that the Huang family’s foundation met the distribution requirements required on the 2022 tax return in 2023.

The foundation’s requested donations are likely to jump again in 2025, as Nvidia’s stock price has risen nearly 200% this year, boosting both its wealth and Mr. Huang’s personal net worth. He is currently the 11th richest person in the world, with a fortune of $128 billion, an increase of $84 billion this year, according to the Bloomberg Billionaires Index.

Based on the 68.5 million shares held by the foundation at the end of 2023, which corresponds to Nvidia’s June stock split, the foundation’s assets will be approximately $10 billion. Per IRS reporting guidelines, the Foundation will not report its 2024 financial statements until November 2025.

Huang’s foundation is a very lean operation, with him and his wife the only employees. They each log just one hour of work per week and receive no compensation.

Read more: Nvidia CEO Huang has billions of dollars in foundation and logs an hour a week

The majority of donations go to funds recommended by donors. This is a common giving strategy among billionaire foundations to meet their annual distribution requirements by effectively moving funds from one charity to another. Unlike foundations, DAFs are classified as public charities and are not subject to IRS annual distribution requirements, so assets in such accounts can be invested indefinitely.

Schwab Charitable, which manages Huangs’ GeForce fund, controls $4 billion worth of Nvidia stock, at least some of which is held in GeForce, according to filings. In 2023, the Jensen & Lori Hwang Foundation awarded $46.5 million worth of equity grants to GeForce Fund, in addition to the $125 million previously awarded to DAFs.