Ken Griffin of Citadel Advisors just amassed 11 million semiconductor stocks not named Nvidia.

Hedge funds typically have a reputation for being quiet about their investment moves and rarely providing much insight to retail investors. However, institutional investors are required to file a Form 13F with the Securities and Exchange Commission (SEC) once a quarter. This document basically provides a summary of all the stocks and holdings that the fund bought or sold in the last quarter. The end of it.

Citadel Advisors, run by billionaire investor Ken Griffin, is one of Wall Street’s most prestigious hedge funds, while the firm was reviewing its 13F filing on Nov. 14. I realized something. The fund increased its stake in non-NVIDIA semiconductor stocks by 172% in the third quarter.

Should retail investors follow Griffin’s lead, or should they stay on the sidelines?

Citadel made a very big statement

Citadel significantly increased its position in Intel during the third quarter. (INTC 0.24%). The table below shows Citadel’s ownership stake in Intel as of the end of the past five quarters.

Indicators Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Number of Intel shares held (million shares) 3.8 3.7 5.4 6.8 18.5

Data source: Hedge Follow

As the data above shows, Citadel has been scooping up shares of the chipmaker over the past three quarters. But what’s interesting is that the company has bought 11.7 million shares in the past three months, nearly tripling its holdings.

Why is Citadel so bullish on Inter?

It is well known that one of President-elect Donald Trump’s major campaign themes was support for more investment in American-made products and domestic manufacturing. But President Trump isn’t exactly a glowing supporter of President Biden’s CHIPS Act, which would inject $280 billion worth of government aid into expanding the country’s semiconductor manufacturing capacity.

Still, I personally don’t think President Trump will do much to change the CHIPS Act after he takes office in January. As it turns out, the CHIPS Act does exactly what President Trump wants: encouraging semiconductor companies to expand their manufacturing capacity in the United States.

And perhaps no U.S.-based chipmaker has benefited more from the CHIPS Act than Intel. In my opinion, Intel is well-positioned to receive more business from the federal government over the next four years.

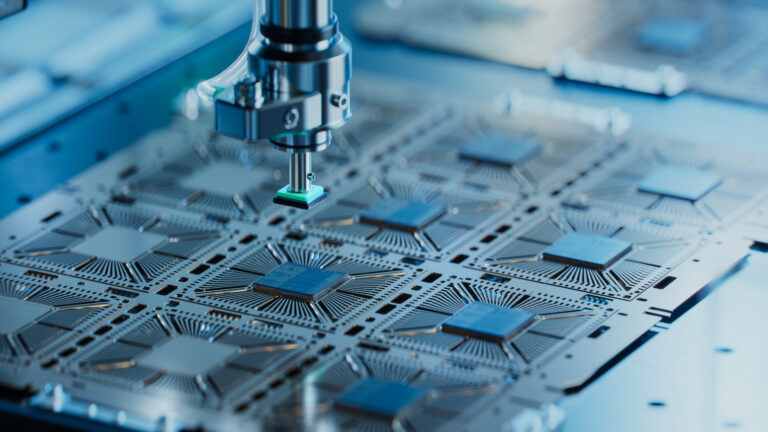

Image source: Getty Images

Should you buy Intel stock now?

As of this writing, Intel stock is down more than 50% this year. I tend to view the story surrounding Intel as “one step forward, two steps back.” Over the past few years, the company has lost significant market share to competitors, and its foundry process does not impress potential partners. Just recently, Intel replaced Nvidia in the Dow Jones Industrial Average.

INTC data by YCharts.

Against a backdrop of operational stumbling blocks, the semiconductor giant has undertaken a number of cost-cutting efforts (i.e. layoffs), and reports were even swirling a few months ago that Intel might be acquired. None of these factors make it a particularly attractive investment prospect.

So why would Mr. Griffin double down on Intel stock when there are smarter opportunities elsewhere?

My suspicion is that Mr. Griffin thinks Intel stock may have bottomed out. And now that President Trump is back in Washington, I think he’s likely to follow in his predecessor’s footsteps and give Intel even more business to reignite its growth. If so, Intel stock could be poised for a big rebound over the next year.

That being said, Intel is still in a rebuilding phase and is definitely not something you can buy out loud. If the stock does shift into a higher gear, it’s likely to be based on a comeback story rather than a significant short-term improvement in business performance. For these reasons, I honestly wouldn’t be surprised if Citadel sold much of its Intel stock for a quick profit rather than holding on to the stock for the long term.

At the end of the day, the chipmaker’s outlook remains highly speculative. I’d like to pass on Intel for now.

Adam Spatacco holds a position at Nvidia. The Motley Fool has positions in and recommends Intel and Nvidia. The Motley Fool recommends the following options: $24 November 2024 short call on Intel. The Motley Fool has a disclosure policy.