If you’ve heard this before, please stop. Nvidia’s earnings report Wednesday night is a big deal on Wall Street. The world’s most valuable chipmaker’s results will give investors the clearest picture of the state of the AI boom since the company last reported financials in late August. Enthusiasm for AI has been the main driver of the stock market rally over the past two years, attracting far more investment than just technology companies, since the launch of ChatGPT started a surge in investment . The winner’s circle includes industrial companies, such as those that make electrical components and energy-generating equipment, and even low-cost utility companies that are expected to benefit from increased power consumption in data centers. Now it looks like this. Still, no company is more synonymous with AI than Nvidia, which dominates the market for cutting-edge processors that power applications like ChatGPT. As a result, sales, profits, and market capitalization soared. It’s also created a dynamic in which the company’s quarterly earnings report is treated like a make-or-break event, with seemingly limitless expectations pushing stock prices toward the release. That’s why, despite Nvidia’s better-than-expected August results and solid outlook, the stock could still be down nearly 20% in just over a week. Then, buyers who thought it had gone too far pulled back and a new rally began. As of Tuesday, it was still ongoing. Nvidia stock is up nearly 40% from its recent low on September 6th. In the process, Nvidia dethroned Apple as the world’s most valuable company and never looked back. Now it’s profit time again. The curse of extraordinary expectations threatens to strike again. “I say own it, but don’t trade it,” Jim Cramer said Tuesday, peering through the hype thicket and trying to stay focused on Nvidia’s positive multi-year prospects. . He gave that “unique” designation to two stocks: Nvidia and Apple. “There are two things you need to know about Nvidia,” Jim continued. “One, there’s an incredible demand that far exceeds what they can handle. … And two, it’s a company that I really like (being a shareholder in the club) There’s no competition because no one is close to them, including AMD.”Here’s some information on NVIDIA’s fiscal 2025 third quarter report and subsequent conference call from 5 p.m. ET. Let’s take a closer look at the important questions. Overheated or overdone? Investors want to know if there have been any hiccups in the rollout of Nvidia’s next-generation AI chip platform, Blackwell. Specifically, we want to know whether recent media coverage of Blackwell’s overheating in certain configurations could cause the company’s revenue growth to be slower than expected. And that customer comes up with a solution. NVIDIA stock fell on Monday on the news. Few doubt that CEO Jensen Huang described Blackwell’s demand as “insane.” What is uncertain at this point is timing. Nvidia said it expects Blackwell’s revenue to be “in the billions of dollars” for the current quarter, which runs from November to January. Analysts currently expect companywide sales of $37.04 billion in the January quarter, according to FactSet. Nvidia’s guidance is crucial in shaping Wall Street’s reaction to quarterly results, and this one is no exception. “(Blackwell’s push) would be a problem if another company were to sneak up on it and eat it,” Jim said. “But that’s not the case. So there’s nothing to worry about other than the fact that we’re going to be ready in case they say, ‘Listen, we’re not going to increase production in January. I don’t think so.”We plan to start in earnest in April. ”If there are people who are dissatisfied with it and want to sell, we have to be prepared. ” Analysts at Trust Securities acknowledged in a note to clients on Tuesday that there may be technical and supply chain challenges facing Blackwell. Still, analysts said they feel everything they’re hearing from Nvidia, its partners and industry stakeholders is “overwhelmingly positive.” “While we expect Blackwell to be a source of revenue for both third- and fourth-quarter growth, we believe that a drop in Blackwell will likely be replaced by Hopper, which will protect against a downside in earnings. ”, the analysts wrote. Hopper is the name of Nvidia’s current generation AI chips, the H100 and H200. Margin health? Nvidia’s triple-digit revenue growth in recent quarters is widely expected to slow due to the law of large numbers. As a result, gross margins are becoming an increasingly important part of the investment story. In fact, NVIDIA’s third-quarter gross profit guidance, and its impact on the fourth-quarter numbers, was considered one of the few blemishes in the August quarterly report. Bank of America analysts told clients in a note Sunday: “We want you to keep an eye on GM (gross margin).” Analysts said Nvidia would need to report something in the 73% to 74% range to keep fiscal 2026 earnings per share on track and reach its bullish target of above $5. Ta. Here’s how to calculate gross profit: Start with the company’s revenue and subtract the cost of that revenue. This number is known as gross profit or total revenue. Find gross profit margin by dividing gross profit by sales and multiplying by 100. Nvidia’s gross margin for the most recent quarter was 75.7%. The Blackwell development was understood to be one factor that would weigh on margins in the near term, even before talk of potential thermal issues arose. “Looking ahead to FY26, we expect margins to decline to the low 70s as Blackwell’s margins rise at lower (production) yields than initially,” Susquehanna analysts said in a Nov. 14 note. ” he said. “In short, we expect another strong report, but note that expectations are high in the paper as the story surrounding Blackwell’s Lamp and GM is important to driving further stock price gains.” ” Sovereign and software strength? What do Japan, Indonesia, India and Denmark have in common? At least for our purposes, these places are based on Nvidia’s AI. It’s where I’ve been in recent weeks to promote the company and discuss country-specific initiatives in which it’s involved. These visits and announcements are all part of Nvidia’s broader strategy for sovereign AI. The concept refers to countries taking control of their own computing infrastructure and data in order to develop AI solutions that incorporate their own solutions. Nvidia said in August that it expected Sovereign AI to generate revenue in the low double digits this fiscal year. Any updates to this forecast are welcome and will help investors understand demand from this fast-growing customer group. US technology giants such as Microsoft, Meta Platforms and Amazon showed in recent earnings reports that they continue to spend billions of dollars on AI computing infrastructure. This is definitely great news for Nvidia. Sovereign AI represents a different kind of vehicle for growth in the coming years. Similarly, software is another long-term bet that could help Nvidia offset some of the cyclicality inherent in hardware sales. In a note to clients on Monday, Evercore ISI analysts said that in addition to overall guidance, investors are interested in the growth of Nvidia’s software, particularly its product called AI Enterprise, which provides a variety of tools to businesses. He said it is likely that he will have it. In August, Chief Financial Officer Colette Kress said Nvidia was on track to end the year with annual software and support revenue of about $2 billion. Kress said AI Enterprise contributed “among other things” to expanding the software. (Jim Cramer’s charitable trusts are long NVDA and AMD. See here for a complete list of stocks.) As a subscriber to Jim Cramer’s CNBC Investment Club, trade before Jim makes trades. Receive alerts. After Jim sends a trade alert, he waits 45 minutes before buying or selling stocks in his charitable trust’s portfolio. If Jim talks about a stock on CNBC TV, he will issue a trade alert and then wait 72 hours before executing the trade. The above investment club information is subject to our Terms of Use and Privacy Policy, along with our disclaimer. No fiduciary duties or obligations exist or arise from your receipt of information provided in connection with the Investment Club. No specific results or benefits are guaranteed.

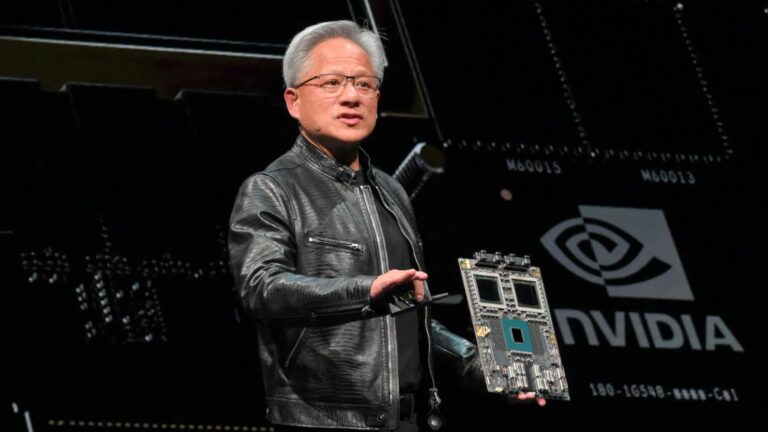

Nvidia CEO Jensen Huang will deliver a keynote speech ahead of Computex 2024 in Taipei on June 2, 2024.

Sam Yeh | AFP | Getty Images

If you’ve heard this before, please stop. Nvidia’s Wednesday night’s earnings report will be closely watched on Wall Street.

The world’s most valuable chipmaker’s results will give investors the clearest picture of the state of the AI boom since the company last reported financials in late August.