Important points

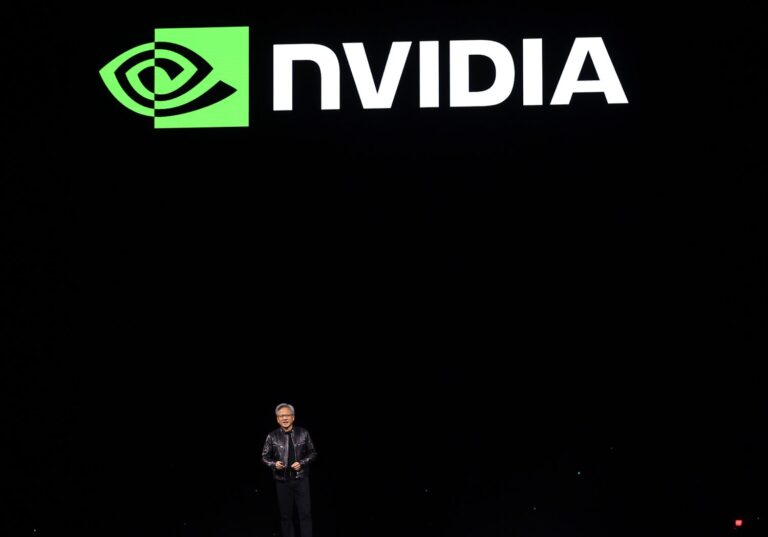

This week, investors will focus on the quarterly earnings report from Nvidia (NVDA), now the world’s most valuable company. This week, Walmart (WMT), Lowe’s (LOW), Target (TGT) and others are scheduled to release quarterly financial updates.

Remarks from Chicago Fed President Austan Goolsby and Cleveland Fed President Beth Hammack could provide insight into whether the Fed may change its rate-cutting schedule.

Economists will focus on housing market data this week, including housing starts, existing home sales and homebuilder confidence. Consumer sentiment for November will be released on Friday, along with the Purchasing Managers’ Index (PMI) survey of manufacturing and services sectors.

Monday, November 18th

Home Builder Confidence Index (November)

Chicago Fed President Austan Goolsby gives a speech

AECOM (ACM) Reports Earnings

Tuesday, November 19th

Number of housing starts (October)

Building confirmation (October)

Walmart (WMT), Lowe’s (LOW), XPeng (XPEV), Report your earnings

Wednesday, November 20th

Nvidia, TJX Companies (TJX), Palo Alto Networks (PANW), Target corporation, and snowflake (SNOW) Report your earnings

Thursday, November 21st

Number of new unemployment insurance claims (week ending November 16th)

Leading economic indicators (October)

Philadelphia Fed Manufacturing Survey (November)

Used home sales results (October)

Cleveland Fed President Beth Hammack speaks

Intuit (INTU) John Deere (Germany), Copart (CPRT), Ross Store (ROST), Baidu (BIDU), Report your earnings

Friday, November 22nd

S&P Global Bulletin US PMI (November)Consumer Psychology – Final Edition (November)

Investors focus on Wednesday’s Nvidia earnings, reports from Walmart and Target

Nvidia’s earnings report Wednesday comes as the company recently became the world’s most valuable company due to growing demand for artificial intelligence (AI)-enabled products. Analysts rate the stock highly, and Mizuho recently raised its price target to $165, slightly above the analyst consensus of around $160, according to Visible Alpha. Nvidia’s report is also its first since joining the Dow Jones Industrial Average.

Walmart’s Tuesday report came after the retail giant raised its full-year outlook on the back of better-than-expected quarterly profits. The large-scale retail chain reported a 43% drop in net income last quarter, but sales at both Walmart and Sam’s Club stores increased.

Lowe’s Tuesday report came amid weak sales of big-ticket items, and the home improvement retailer lowered its full-year outlook. Target is scheduled to release a report on Wednesday after disclosing higher quarterly sales and raising its full-year profit forecast. Discount retailer TJX Companies, parent company of TJ Maxx and Ross Stores, is also expected to report this week. Combined, retail revenues could provide a detailed picture of consumer health heading into the holiday season.

Tax preparation software maker Intuit will report earnings on Thursday after reporting an unexpected loss in its previous earnings report. Tractor maker John Deere’s Thursday report will give investors a look at the agriculture and construction sectors. Chinese internet search engine Baidu will also report on Thursday.

Another notable report will come from Xpeng, a Chinese electric car maker that competes with Tesla (TSLA) for sales in China.

Housing Market Data, Fed Speech Highlights Economic Calendar

Housing market data released this week will focus on sectors of the economy that continue to suffer from high mortgage rates. The Home Builder Sentiment Survey, released Monday, will show whether contractors are preparing for more construction, and Tuesday’s housing starts and building permit data will provide insight into the volume of construction projects. Dew. On Thursday, October data on existing home sales will show whether transactions are up from a 14-year low.

Comments from Chicago Fed President Austan Goolsby and Cleveland Fed President Beth Hammack on Monday will provide insight into how the Fed views recent reports showing inflation rising in October.

Friday’s Consumer Sentiment Report provides the first indication of how the public is reacting to the election of Republican Donald Trump as president, with primary polls ending in early November before voting.