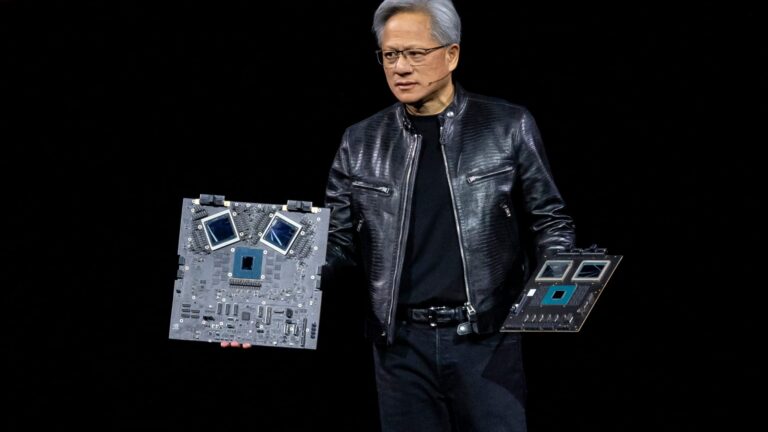

Citi has identified South Korean company Doosan Corp. as a key beneficiary of Nvidia’s next-generation AI chips and expects the company’s stock price to rise more than 40% over the next 12 months. The Wall Street bank initiated coverage on Doosan’s stock with a “buy/high risk” rating and set a target price for the stock at 330,000 Korean won ($234). The investment bank’s analysts emphasized Doosan’s unique position as the exclusive supplier of “copper clad laminates” (CCL) to NVIDIA. It is an essential component of the semiconductor giant’s upcoming Blackwell graphics processing units (GPUs). Nvidia’s next-generation artificial intelligence chip, Blackwell, is in high demand from companies like OpenAI, Microsoft, Meta, and others building AI data centers that power products like ChatGPT and Copilot. “As the sole CCL supplier of NVIDIA’s Blackwell chips, we expect Doosan to directly and materially benefit from Blackwell’s production throughout the (estimated period of 2025),” led by Josh Yang. Citi analysts said in a Nov. 13 note to clients entitled “Unique Direct.” Nvidia Blackwell Beneficiaries in South Korea”. CCL is a material used to manufacture printed circuit boards used in electronic devices such as servers and smartphones. Doosan’s CCL is manufactured by Doosan Electronics, a subsidiary that accounts for more than 70% of the company’s revenue. Citi said the electronics division is expected to see significant growth as Nvidia ramps up production of new AI chips. Citi predicted that Doosan’s AI-related revenue could reach 363 billion Korean won ($258 million) in 2025, leading to a 90% increase in operating profit for the same year. Analysts at the bank noted that Blackwell’s CCL content per chip is increasing and the total addressable market could be much larger than previous estimates, and this estimate I think it may be conservative. Doosan stock has already shown strong performance, rising nearly 150% this year and nearly tripling in value over the past year. The company is currently valued at approximately $2.5 billion on the Korea Stock Exchange. US investors can access stocks through ETFs such as the Schwab Fundamental International Small Company Index ETF and the Invesco FTSE RAFI Developed Markets Formerly US Small and Mid-Small ETF. Doosan is one of South Korea’s oldest conglomerates, operating subsidiaries across energy, robotics, construction, and real estate. —CNBC’s Michael Bloom and CJ Haddad contributed reporting.