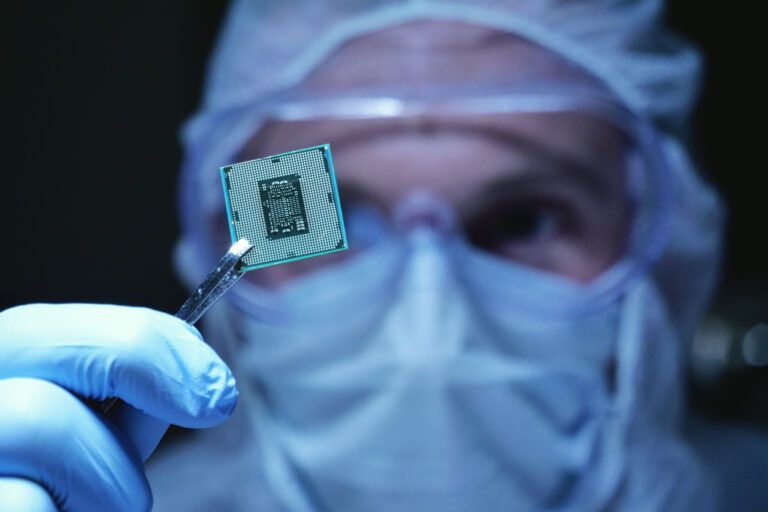

Demand for AI chips for semiconductor foundry services is rapidly increasing.

taiwan semiconductor manufacturing (TSM 1.26%) is the world’s largest chip foundry company. Without the company, many of the technologies we see today wouldn’t exist in the same way they did, and the company is arguably one of the most important companies in the world.

The company recently reported impressive quarterly earnings, but the CEO said something unbelievable on the quarterly conference call. Performance in one sector of the semiconductor market has blown away expectations, and investors should consider buying more Taiwan Semi shares if they haven’t already.

Demand for AI chips rapidly boosted TSMC’s performance

Taiwan Semiconductor’s products are used in all kinds of devices, but most notably, some of its biggest customers are Apple and Nvidia, the world’s two largest companies. Without TSMC’s chips, these two would grind to a halt. This shows how important TSMC is. Both companies are participating in an artificial intelligence (AI) arms race, which should increase TSMC’s sales in the AI chip space.

Taiwan Semiconductor sees this trend coming from afar, predicting that AI chips will grow at an average annual rate of 50% over five years, after which they will account for around 10% of revenue. I did. When it announced its guidance for Q2 2023, it seemed like an ambitious prediction, considering that AI chips accounted for about 6% of total revenue at the time.

However, we now see that the management was not ambitious enough. During the Q3 2024 conference call, CEO CC Wei said of the demand for AI chips:

We currently expect the revenue contribution of some of our AI processors to more than triple this year and represent a mid-tenth of our total revenue by 2024. Backed by our technology leadership and broad customer base, we are well-positioned to capture industry growth. chance.

So, just a year and a half after predicting that AI chips would reach a “low-teens percentage” within five years, the company is on track to reach a “mid-teens percentage.” This shows incredible demand for graphics processing units (GPUs), AI accelerators (custom chips that big tech companies use in-house), and AI chips used in CPUs.

Thanks to the tripling of AI revenue, management raised its full-year revenue forecast to 30% year-over-year growth. It’s clear that AI chips are having a huge impact on Taiwan Semiconductor, and it’s well-positioned to take advantage of it, but is that a reason to buy this stock now?

Stock prices are not cheap by any standard.

After this earnings report and the call, TSMC’s stock price rose about 10% the next day. However, since this report, the stock price has given up on rising significantly and is currently only increasing by about 4%. As a result, investors can buy stocks with a little more confidence now that prices are no longer as high as they used to be. The market has not turned a blind eye to the success of the Taiwanese Semi and is charging a premium price as a result.

TSM PE Ratio Data by YCharts

The trailing P/E ratio of the company’s stock is 31 times, and the 2025 P/E ratio is 22 times. The price tag for subsequent earnings is a bit high, but given the significant growth TSMC is expected to experience next year, the outlook isn’t too bad. So if you’re thinking long-term, the price you have to pay today may not be as high as you think, as long as TSMC can live up to expectations.

For a more historical perspective, Taiwan Semi’s stock price has only been significantly overpriced once in the past decade.

TSM PE Ratio Data by YCharts

In 2020 and 2021, TSMC maintained a strong reputation due to the chip boom driven by huge demand for consumer devices. The coronavirus pandemic had a major impact on this, and once demand was met, Taiwan Semiconductor’s stock price collapsed along with the rest of the market.

The demand for AI chips is likely to be more sustainable in the long run, as we have only scratched the surface of the computing power needed to reap significant profits in this industry. As a result, I think it’s safe to say that Taiwan Semiconductor is likely to trade at a premium price for some time.

Taiwan Semiconductor is one of the best ways to invest in the chip industry and a complementary way to invest in AI. This is one of my top holdings, and I think investors would be wise to own this as well.

Keithen Drury works for Taiwan Semiconductor Manufacturing Company. The Motley Fool has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.