taiwan semiconductor manufacturing (NYSE:TSM) It’s been on fire lately. After the company announced its third quarter results on October 17, the stock price rose 10% due to the strong performance.

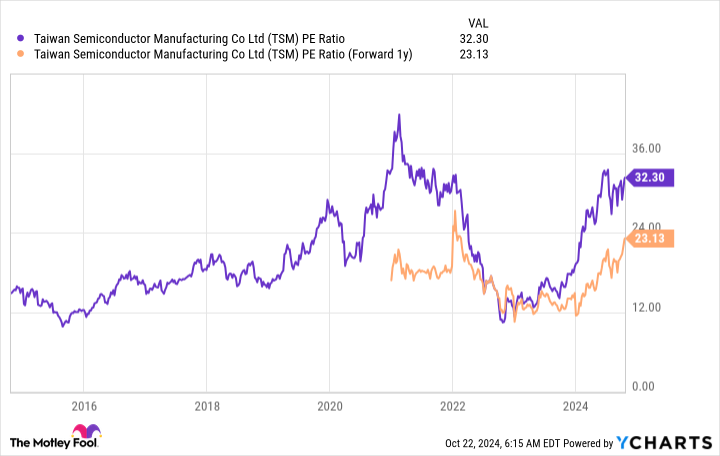

Some investors may think they have missed the boat and be discouraged from buying Taiwanese semi stocks. But that’s not really the case, as even after seeing the market’s reaction to the earnings results, there are still multiple strong reasons to buy the stock.

Taiwan Semiconductor is one of the world’s leading chip manufacturing companies. The company makes the chips that go into Apple’s iPhone, Nvidia’s graphics processing units (GPUs), and essentially other technologically advanced devices.

Since Taiwan Semi is a chip manufacturing company, it does not take sides in the current technology competition. Rather, investing in Taiwan Semiconductor is essentially a bet that consumers will use more advanced digital devices in the future. This seems like an easy investment, and the company’s performance backs it up.

In the third quarter, Taiwan Semi’s revenue increased 36% year over year to $23.5 billion. 20% of this revenue came from 3 nanometer (nm) chip technology, the company’s most advanced product. 3nm chips only started contributing to Taiwan Semi’s revenue in the third quarter of last year, so this rapid expansion is quite impressive.

This should also get investors excited about TSMC’s next launch, a 2nm chip. N2 chips are expected to launch in 2025 and ramp up in 2026, and the technology is expected to significantly improve efficiency. These chips offer only a 10% to 15% power improvement when configured to consume the same amount of energy, but a 25% to 30% efficiency increase when configured at the same power level as 3nm chips. It will come true.

As power consumption becomes an issue, especially for artificial intelligence (AI) related chips, these 2nm chips and the products they power can become a must-have upgrade as they pay for themselves in energy savings. Demand for the interim 2nm chip has already exceeded previous generations (3nm and 5nm technologies), and it’s clear that customers are also excited about this launch.

Although this is not scheduled to start until 2025 (with an increase expected in 2026), investors can know that a 10% daily change in TSMC stock is not a reason to avoid buying the stock. . While new products are providing a big tailwind, TSMC has yet to scratch the surface of how AI-related chips will boost its business.

In the first quarter, management said it expects sales of AI-related chips to expand at a compound annual growth rate (CAGR) of 50% over the next five years. After this growth, they expected it to account for more than 20% of the company’s total revenue.

story continues