Jensen Huang’s NVIDIA Corporation NVDA recently achieved another milestone and is now part of an elite club. And with NVIDIA stock hitting new all-time highs, investors must be lamenting not owning the stock. But it’s never too late to buy stocks! Let’s see why –

NVIDIA reaches $3.5 trillion market capitalization

Among semiconductor stocks, NVIDIA stood out after its stock rose 4.1% on Monday and closed with a market capitalization above $3.5 trillion for the first time. In June, NVIDIA’s market value exceeded $3 trillion, making it more valuable than Apple Inc. AAPL.

However, Apple became the first company to reach the $3.5 trillion milestone and is now valued at $3.6 trillion. Nevertheless, NVIDIA’s recent impressive performance may soon overtake Apple. NVIDIA stock is up 243% in the past year and an impressive 543% over the past three years, largely due to the advent of artificial intelligence (AI).

4 reasons why NVIDIA’s stock price continues to rise

Extraordinary demand for NVIDIA’s most popular and cutting-edge Blackwell B200 chip, which has higher AI throughput than the current Hopper H100 chip, will push the stock higher. NVIDIA is ramping up production of Blackwell chips as demand soars among the likes of Microsoft Corporation MSFT and Alphabet Inc. GOOGL.

Growth in NVIDIA’s data center business is likely to push up the stock price. The H100 chip is expected to be widely used to power generative AI applications such as ChatGPT. Big technology companies continue to show strong interest in AI data centers, which is encouraging for NVIDIA. For example, Microsoft indicated in its latest 10-K annual report that it will spend $108.4 billion on data centers over the next five years.

NVIDIA’s dominance in the graphics processing unit (GPU) market segment also gives the company a competitive edge over its competitors. Most developers prefer NVIDIA’s CUDA software platform to its archrival, Advanced Micro Devices, Inc.’s AMD ROCm software platform. According to Precedence Research, NVIDIA has 80% of the GPU market, which is expected to grow from $75.77 billion today to $1,414.39 billion by 2034.

Finally, the Fed’s recent aggressive rate cuts are a tailwind for NVIDIA stock, with further rate cuts expected as price pressures subside. That’s because lower interest rates reduce borrowing costs, boost profits, and keep much-needed cash flow intact for growth strategies. (Read more: NVIDIA and 2 other AI stocks to benefit from lower interest rates) .

NVIDIA stock to buy Hand Over Fist

From the Fed’s dovish stance to its pioneering position in the GPU market, to its blossoming data center business and huge demand for AI chips, NVIDIA’s stock looks attractive with all the prospects for further north. It is a good buy material.

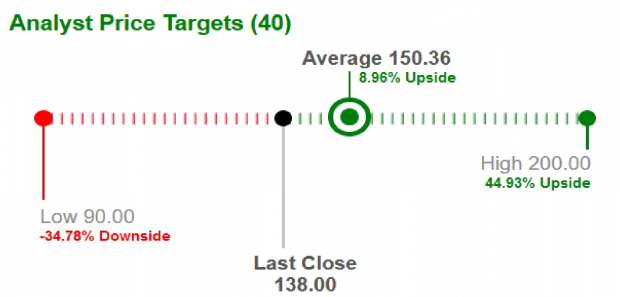

Brokers collectively raised their average short-term price target for NVDA stock to $150.36, up nearly 9% from its previous closing price of $138. The highest short-term price target for the stock is $200, representing an upside of 44.9%.

Image source: Zacks Investment Research

NVIDIA’s strength in AI recently forced Bank of America Corporation BAC analyst Vivek Arya to raise his near-term price target for the semiconductor giant from $165 to $190. Last week, CFRA Research also raised its short-term price target for NVIDIA from $139 to $160.

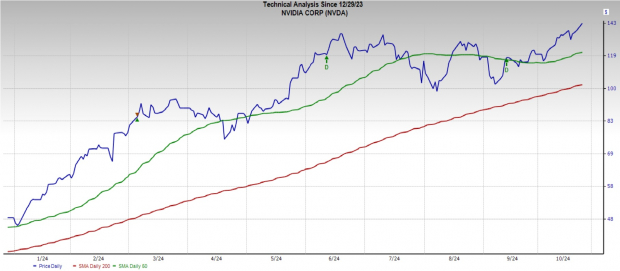

Additionally, NVDA stock is currently trading above both its short-term 50-day moving average (DMA) and long-term 200-DMA, indicating a bullish trend and making it a good time to consider investing in the stock. It shows that there is.

Image source: Zacks Investment Research

Additionally, NVDA stock is currently trading at a forward price-earnings ratio of 51.0x, which is lower than the Semiconductor General industry’s forward earnings ratio of 55.8x. Therefore, buying the stock will burn less of a hole in your pocket than its peers.

Image source: Zacks Investment Research

NVIDIA currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank #1 (Strong Buy) stocks here.

Infrastructure stock boom sweeping the US

A massive effort to rebuild America’s crumbling infrastructure will soon begin. It is bipartisan, it is urgent, and it is inevitable. Trillions of dollars will be spent. Good luck will come your way.

The only question is: Can you get into the right stocks early, when the potential for growth is highest?

Zacks has released a special report to help you do just that. Today it’s free. Meet five special companies looking to maximize profits from building and repairing roads, bridges, and buildings, as well as freight transportation and energy conversion on an almost unimaginable scale.

Free Download: How to profit from trillions in infrastructure spending >>

Want the latest recommendations from Zacks Investment Research? Today, you can now download the Double 5 Stock Set. Click to get this free report

Bank of America Corporation (BAC): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free stock price analysis report

Click here to read this article on Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.