Analysts at Bank of America this week raised their price target on NVIDIA stock to $190 per share. They see the AI market growing to $400 billion, presenting NVIDIA with a “generational opportunity.” They point to NVIDIA’s strong lead among its competitors, helped by enterprise partnerships. .

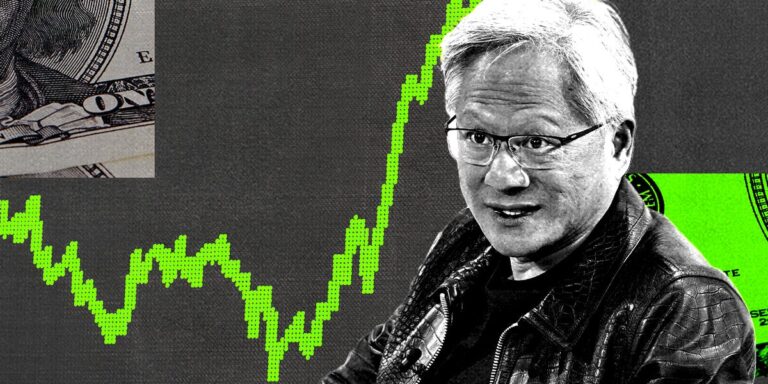

Nvidia stock has been down for the year, but investors can brace for more upside, Bank of America analysts say.

Analysts raised their price target on the company’s stock from $165 to $190 in a note Thursday. This represents a 38% increase from the stock’s price of about $138 per share as of midday Friday.

Analysts say the AI market will grow rapidly over the next few years, presenting Nvidia with a “generational opportunity” as the chip giant continues to strengthen its market lead. .

Analysts expect the AI accelerator market to grow to $280 billion by 2027 and more than $400 billion in the long term, up from $45 billion in 2023.

Analysts predict that computing needs will only increase as AI models continue to grow rapidly, with developers like OpenAI, Google, and Meta announcing new large-scale language models several times a year. .

They add that new major LLM generations, especially those developed to increase size and improve inference capabilities, will require higher training intensities.

“The pace of new model development continues to increase. LLMs in particular are being developed for both larger size and better inference capabilities, both of which require higher training intensity,” said the analyst. said.

They also point to Nvidia’s strong partnerships with enterprise customers such as Accenture, ServiceNow, and Oracle, which demonstrate the growing presence of AI in large enterprises and Nvidia’s role as a partner of choice. I am.

“NVDA’s work spans multiple industries (Accenture, ServiceNow, Microsoft, etc.), and services like AI Foundry, AI Hub, and NIM provide AI leadership not only on the hardware side but also on the systems/ecosystem side. ” said the analyst.

Analysts also said Nvidia’s financials are well-prepared for future profits. Considering that it generates free cash flow at a margin of 45% to 50%, nearly twice that of other Magnificent 7 stocks, NVIDIA could generate $200 billion in free cash flow over the next two years. they are writing.

After briefly dipping over the summer, Nvidia stock has soared this year, rising 187% as the AI boom continues. The sector has since recovered, with semiconductor stocks like Nvidia and TSMC trading at or near record highs in recent weeks.