Nvidia’s NVDA Blackwell’s chips will not be available by early 2025, impacting major customers such as Amazon.com. AMZN cloud unit.

Production challenges for artificial intelligence chip designers forced Amazon Web Services to wait until chips were produced in large quantities for its data centers.

Matt Garman, head of Amazon Web Services, warned on Bloomberg TV of delays due to Nvidia’s production restart.

Related article: Microsoft Azure, Office 365 and gaming drive low double-digit growth: Analyst

Dell Technologies, Inc. Dell It also announced a similar timeline for the availability of Blackwell-based servers.

Recently, Nvidia CEO Jensen Huang allayed concerns about the progress of Blackwell GPU development, citing strong demand for Nvidia’s Blackwell GPUs, with production proceeding as planned. KeyBanc analyst John Bing predicted Blackwell would generate more than $7 billion in revenue in the fourth quarter.

I/O Fund’s Beth Kindig predicted that Blackwell’s chip could drive Nvidia to a $10 trillion valuation by 2025. JPMorgan analyst Harlan Sarr downplayed the impact Blackwell’s production delays will have on hyperscalar demand for AI.

Earlier this week, Amazon.com signed a five-year agreement with AI and data startup Databricks to provide companies with more affordable AI development tools. The collaboration focused on leveraging Amazon’s Trainium AI chips, a cost-effective alternative to Nvidia’s widely used GPUs.

Databricks aims to transfer the cost savings from using Amazon’s chips to its customers, allowing it to counter Nvidia’s dominance in the market.

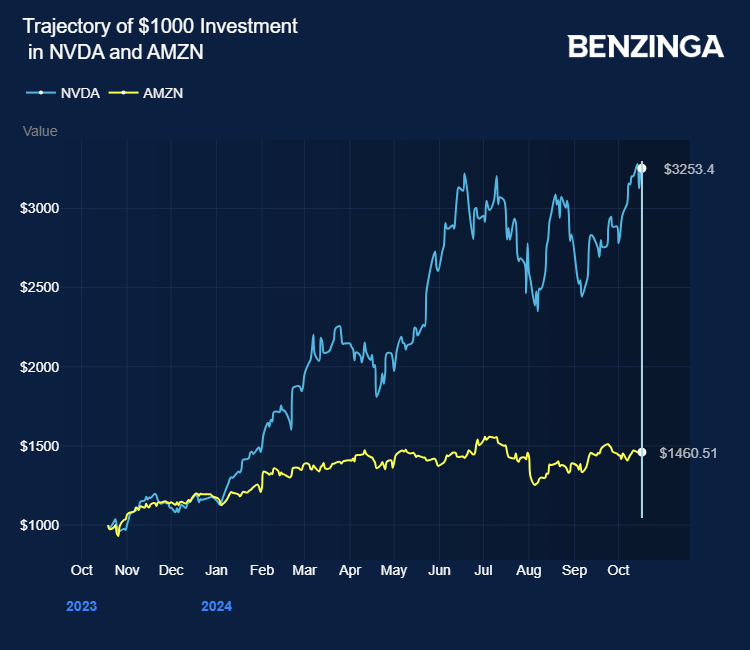

Nvidia stock has risen more than 227% in the past 12 months. Major Supplier Taiwan Semiconductor Manufacturing Co., Ltd. TSM Upbeat quarterly newspapers also contributed further to the rise. Contract chip manufacturers recognized the insane demand for AI. Demand for high-performance computing chips for servers is expected to more than triple in 2024, Nikkei Asia reports.

Investors can gain exposure to Nvidia through SPDR Select Sector Fund – Technology XLK and iShares S&P 500 Growth ETF IVW.

Price Action: NVDA stock was up 0.84% at $138.09 at last check on Friday.

Also read:

Photo credit: Sundry Photography (via Shutterstock)

Market news and data powered by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. Unauthorized reproduction is prohibited.