We’re in for another intense tech earnings season, and there’s no doubt that AI will be at the forefront. And if there’s one company everyone’s watching, it’s Nvidia (NVDA).

The semiconductor giant’s stock price has risen more than 16% in the past month, and it is now on track to overtake Apple as the largest publicly traded company by market capitalization.

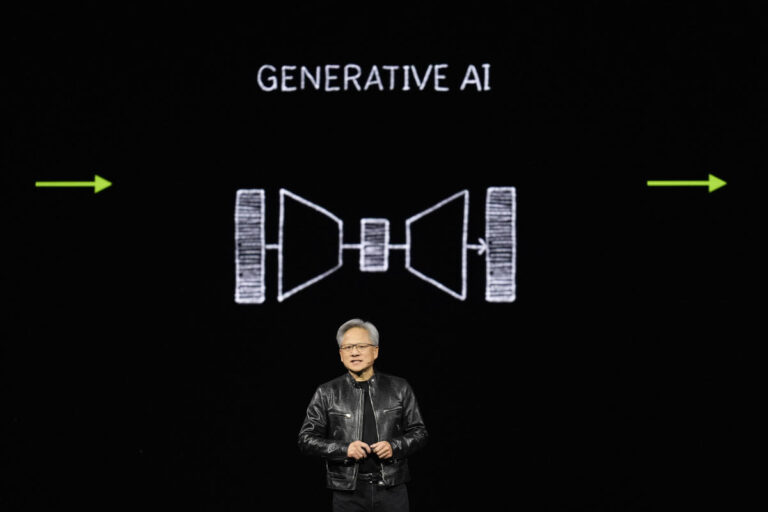

The jump comes after NVIDIA CEO Jensen Huang said in an Oct. 3 interview with CNBC that demand for the company’s next Blackwell chip is “insane.” Since then, NVIDIA stock has risen about 18%, hitting a high of $130. However, rallies briefly paused on Tuesday following reports that the Biden administration would cap the number of AI chips that can be shipped to certain countries, but recovered to some extent on Wednesday.

Nvidia’s incredible stock performance and sharp increase in data center sales over the last year have put the company in a difficult position heading into its next earnings release, which has not yet been formally scheduled.

In the company’s fiscal third quarter of 2024, overall revenue increased 206% to $18.1 billion, and data center revenue increased 279% to $14.5 billion. And while Nvidia isn’t facing a direct decline in revenue, its growth is likely to slow compared to the same period last year, which could surprise investors.

can’t believe it? Let’s take a look at what happened after the company announced its second quarter results in August. The company outperformed both revenue and earnings per share, with data center revenue up 154% year over year to $26.3 billion, but NVIDIA stock still fell more than 6% immediately after the announcement. It took more than a month for the company’s stock price to recover.

AI trade hasn’t lifted all boats either. Broadcom (AVGO) stock has risen 59% year-to-date, outpacing the broader S&P 500 (GSPC), which has risen 21%. Qualcomm (QCOM) rose 19%, while AMD (AMD) pushed its stock up just 6%. Meanwhile, Intel (INTC) fell an astonishing 55%.

Broadcom will benefit from its involvement in AI infrastructure such as server connectivity, while Qualcomm is seen as a potential beneficiary of the growth of on-device AI through AI smartphones and AI PCs. AMD is going head-to-head with Nvidia and serves as an alternative in both price and availability.

Then there’s Intel, which is struggling amid a massive turnaround effort that includes building third-party chip manufacturing capabilities and catching up with Nvidia and AMD in the AI processor space.

But NVIDIA remains the star of this earnings season. Investors will be looking for signs of continued AI spending from hyperscalers like Microsoft (MSFT), Google (GOOG, GOOGL), Meta (META), and Amazon (AMZN), which account for a large portion of AI sales. . It’s easy to see how Nvidia chips are selling.

story continues

They will also look at how other chip companies have performed this quarter ahead of Nvidia’s announcement, which tends to have much slower revenue cycles than its peers.

Wall Street will similarly be watching for information about Nvidia’s Blackwell rollout and whether the company faces supply constraints like it did with its Hopper chips. Either way, it’s going to be a tough few weeks. Fasten the buckle.

Email Daniel Howley at dhowley@yahoofinance.com. Follow @DanielHowley on Twitter.

Click here for the latest earnings report and analysis, earnings whispers and expectations, and company earnings news.

Read the latest finance and business news from Yahoo Finance.