A heated rally started with Nvidia stock (NASDAQ:NVDA) The growth is now almost two years into the end of 2022, and the semiconductor giant has achieved an 11x return over the last two years.

That means that just $100 invested in Nvidia stock a few years ago would be worth more than $1,100 today. More importantly, it looks like the company’s impressive performance could be sustained into 2025, thanks to developments in the artificial intelligence (AI) chip market.

Here, we take a closer look at why Nvidia’s incredible performance could continue next year.

Blackwell’s strong demand and improving supply will be a tailwind for NVIDIA next year

Consensus forecasts project that NVIDIA will end fiscal 2025 with revenue of $125.5 billion, which would represent a 125% increase from the prior year. However, KeyBanc analysts predict that the company’s revenue for the current fiscal year (ending in January 2025) will be $130.6 billion.

KeyBanc notes that Nvidia is on track for even stronger growth this year thanks to increased sales of its new Blackwell AI processors. This is not surprising, as Nvidia management noted on its recent earnings call that it expects to generate “billions of dollars in revenue from Blackwell” in the fourth quarter of fiscal 2025. .

At the same time, NVIDIA believes sales of its current generation Hopper chips, the H100 and H200 processors, are on track to increase in the second half of 2025 on the back of strong demand and improving supply. KeyBanc analysts also note that demand for these Hopper chips is very strong.

Even better, Nvidia’s suppliers are taking steps to help the semiconductor giant fill more orders. For example, contract electronics manufacturer Foxconn announced that it is building the world’s largest production facility for Nvidia’s GB200 Grace Blackwell superchip. This particular chip consists of two Nvidia’s B200 Tensor Core GPUs (graphics processing units) connected to a Grace CPU (central processing unit).

Each Nvidia GB200 superchip is expected to cost between $60,000 and $70,000. More importantly, server systems manufactured using multiple GB200 superchips are in high demand. Nvidia reportedly increased orders for Blackwell GPUs by 25% in July this year, and Foxconn’s announcement suggests demand remains strong.

Market research firm TrendForce estimates that Nvidia could ship 60,000 GB200 NVL36 servers next year, with a reported average selling price of $1.8 million for this particular configuration. What this means is that Nvidia could potentially sell $108 billion worth of GB200 NVL36 servers next year.

the story continues

Meanwhile, Japanese investment bank Mizuho predicts that Nvidia’s AI graphics cards will sell between 6.5 million and 7 million units next year, and the company is on track to generate nearly $200 billion in data center revenue in calendar 2025. (which coincides with most of the calendar year 2025). 2026). If that actually happens, NVIDIA could be on track to smash analysts’ revenue expectations for next year.

Stocks appear to be building for further gains in 2025

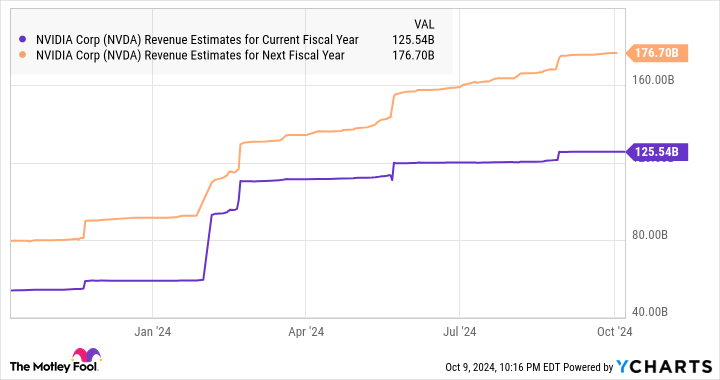

As the graph shows, analysts expect Nvidia to record $177 billion in revenue in fiscal year 2026.

As the year progressed, this estimate rose significantly. So, given the potential revenue Nvidia is expected to generate from data center chip sales alone, there’s a good chance it could actually break the $200 billion mark in the future. Nvidia’s healthy revenue growth should lead to equally impressive profit growth.

Analysts expect Nvidia to post earnings of $4.02 in fiscal 2026, a 41% increase from the current year’s earnings per share estimate of $2.84. However, next year’s profit estimates have increased significantly over the past 90 days. Three months ago, the consensus estimate was for Nvidia to earn $3.69 per share for the next fiscal year.

Overall, NVIDIA seems well-positioned to maintain healthy growth next year. The median 12-month price target for the stock is $150, according to 65 analysts covering the stock, implying a 13% upside from current levels. However, the street-high 12-month price target of $203 represents a 53% upside from this AI stock’s current levels, and the points discussed could help NVIDIA approach that level in 2025. is not surprising.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider the following:

The Motley Fool Stock Advisor team of analysts identified the 10 best stocks for investors to buy right now…and Nvidia wasn’t one of them. These 10 stocks have the potential to generate impressive returns over the next few years.

Consider when Nvidia created this list on April 15, 2005… If you invested $1,000 at the time of recommendation, you would have earned $826,069!*

Stock Advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month. of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of October 7, 2024

Harsh Chauhan has no position in any stocks mentioned. The Motley Fool has a position in and recommends Nvidia. The Motley Fool has a disclosure policy.

What will Nvidia stock do in 2025? Originally published by The Motley Fool