Reaching a $1 trillion market capitalization is such a difficult milestone that only a handful of companies have achieved it. The list includes several technology giants such as Nvidia. (NASDAQ:NVDA)Metaplatform (NASDAQ:Meta)apple (NASDAQ:AAPL),Amazon (NASDAQ:AMZN)Microsoft (NASDAQ: MSFT). This elite club is very exclusive, but eventually more companies will join. Stocks heading in that direction may be worth serious consideration. Let’s look at two: Visas. (New York Stock Exchange: V) and Novo Nordisk (NYSE:NVO). These companies could become $1 trillion stocks by 2030.

1. Visa

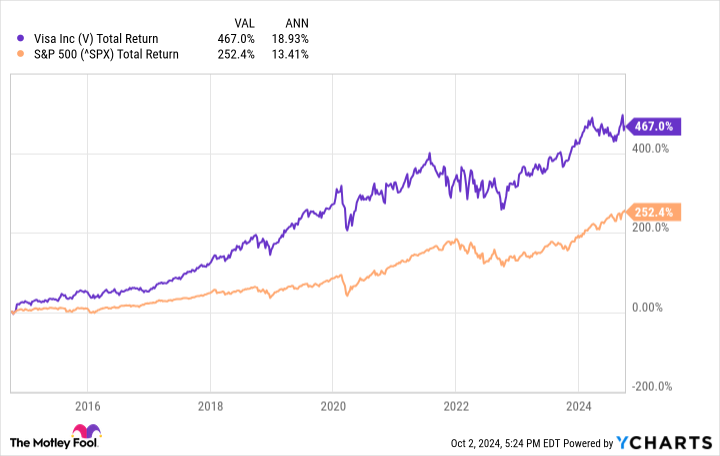

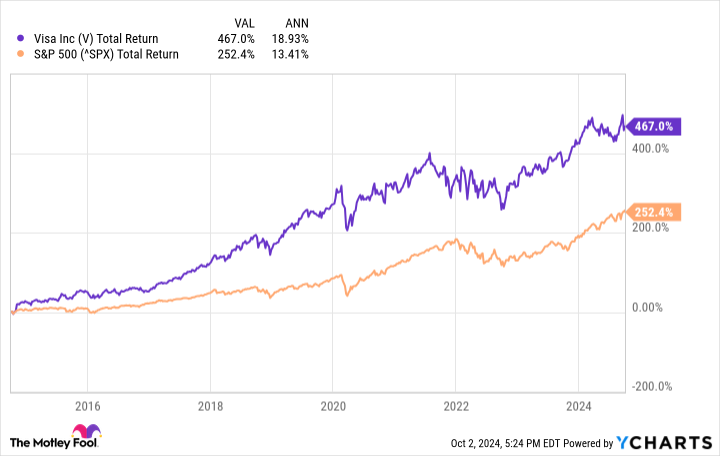

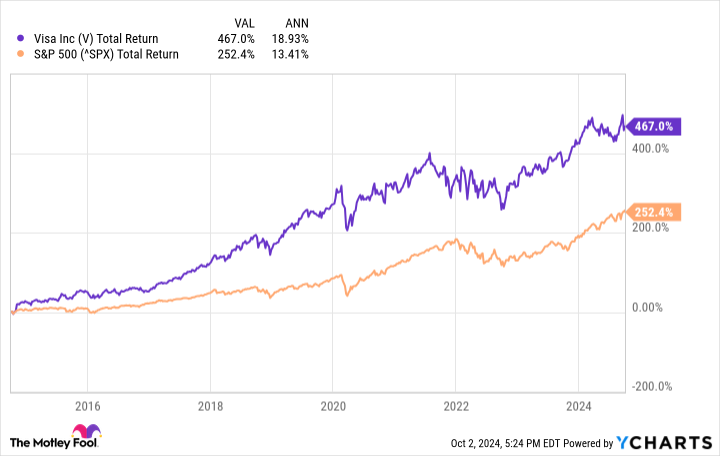

Visa operates one of the world’s largest payment networks, facilitating millions of credit card transactions every day. The company has delivered strong returns over the past decade as cash transactions continue to replace other forms of payment. As of this writing, Visa’s market capitalization is just under $550 billion, so it would need a compound annual growth rate (CAGR) of about 10.5% to become a $1 trillion company by the end of 2030. That is well within the company’s authority. First, Visa’s performance is much better than it has been over the past decade.

Of course, that doesn’t guarantee that the company will deliver the same profits in the future, but some of the fundamental factors that led to this business’ solid performance in the past are still in place. Visa continues to be the industry leader, with its only notable competitor being Mastercard. (New York Stock Exchange: Massachusetts). Visa still benefits from network effects. The more people carry credit cards with the company’s logo, the more attractive the ecosystem becomes to merchants, and vice versa. This ensures that the company remains a major player in this industry for some time.

Visa still has a lot of room to grow. Credit card penetration is relatively high in many developed countries, but not in others. Developing countries have even greater potential. Visa sees a $20 trillion opportunity across the various payments that can be captured. The company’s sales for the subsequent 12 months were about $35 billion, a small percentage of that total. If Visa can make headway in addressable markets, its revenue, earnings and stock price should trend in the same direction as they have for the past decade.

The company is well-equipped to achieve a CAGR of over 10.5% by 2030.

2. Novo Nordisk

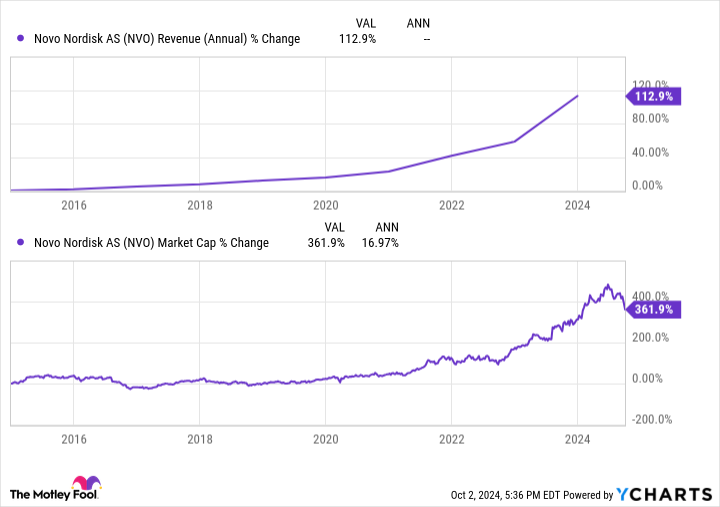

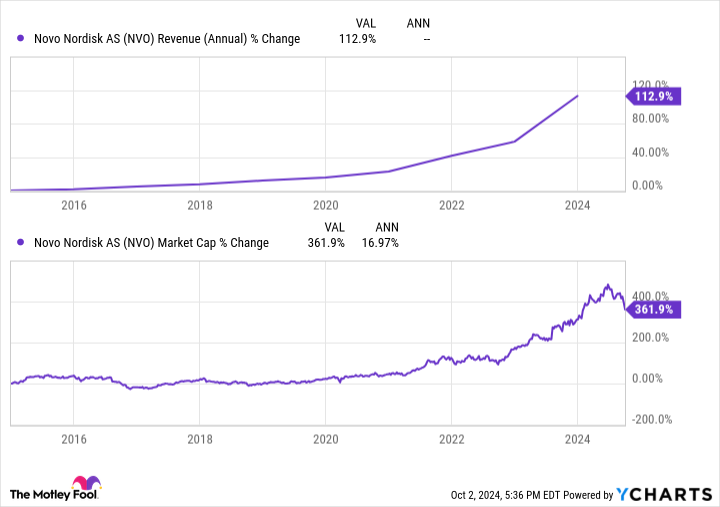

As of this writing, Novo Nordisk has a market capitalization of approximately $400 billion. To reach $1 trillion, a CAGR of approximately 16.5% is required. That’s an impressive average to maintain over six years, but Novo Nordisk’s recent results are even more impressive. Brand names such as Wegovy and Ozempic became famous. Both are GLP-1 drugs that treat obesity and diabetes, respectively. Novo Nordisk is one of the pioneers in the GLP-1 weight loss market, which is currently attracting pharmaceutical companies left and right.

the story continues

Some analysts expect the weight loss drug market to reach $150 billion by the early 2030s, but last year the market was worth just $24 billion. And while there will be many challengers, Novo Nordisk’s pipeline in this space is second to none. The company’s most promising programs include an oral drug called amicretin and Kaglisema, which some estimate could generate up to $20.2 billion in revenue by 2030.

However, this only scratches the surface of Novo Nordisk’s pipeline. Semaglutide (the active ingredient in Wegovy and Ozempic) is being tested in the treatment of Alzheimer’s disease and nonalcoholic steatohepatitis, two areas of high unmet need. The company is also developing several other diabetes and obesity treatments, as well as a wide range of treatments for a variety of rare diseases. Novo Nordisk’s revenue has grown rapidly over the past five years, and so have its stock price and market capitalization.

The drug company needs to win important approvals in the coming years, which will help the company continue to generate strong financial results until the end of the decade. Novo Nordisk is well within reach to become a $1 trillion stock by 2030, and should continue to beat the market thereafter.

Should you invest $1,000 in Visa right now?

Before buying Visa stock, consider the following:

Motley Fool Stock Advisor’s team of analysts identified the 10 best stocks for investors to buy right now…and Visa wasn’t one of them. These 10 stocks have the potential to generate impressive returns over the next few years.

Consider when Nvidia created this list on April 15, 2005… If you invested $1,000 at the time of recommendation, you would have earned $765,523.!*

Stock Advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month. of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. Prosper Junior Bakiny holds positions at Amazon and Meta Platforms. The Motley Fool has positions in and recommends Amazon, Apple, Mastercard, Meta Platforms, Microsoft, Nvidia, and Visa. The Motley Fool recommends Novo Nordisk and recommends the following options: January 2025 $370 long calls on Mastercard, January 2026 $395 calls on Microsoft, January 2025 $380 short calls on Mastercard, and January 2026 calls on Microsoft. This is a $405 short call. The Motley Fool has a disclosure policy.

“Prediction: These 2 stocks will join Nvidia, Meta, Apple, Amazon and Microsoft in the $1 trillion club by 2030” was originally published by The Motley Fool.