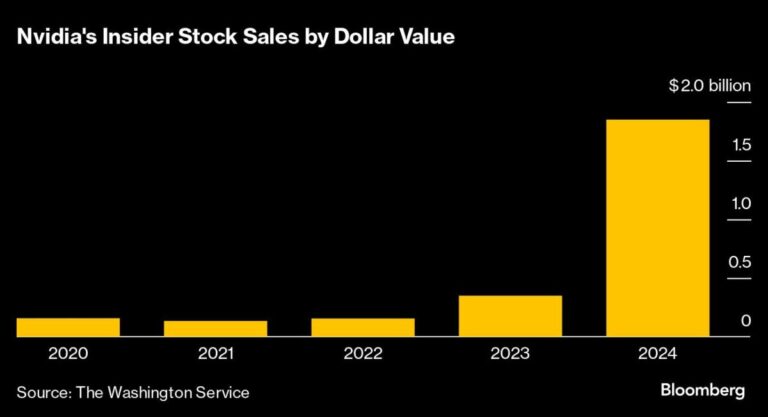

(Bloomberg) — Nvidia Inc. (NVDA) insiders have picked up more than $1.8 billion worth of stock so far this year, and more selling is on the horizon.

Most Read Articles on Bloomberg

About 11 million shares were sold by Nvidia executives and directors in 2024, the most in a year since at least 2020, adjusted for stock splits, according to data compiled by the Washington Service. The sale represents a small portion of the company’s 24.5 billion shares outstanding, but the sale comes as investors are already nervous about delays to NVIDIA’s Blackwell chips and prolonged spending on artificial intelligence. .

Further sales are planned. CEO Jensen Huang recently completed the sale of 6 million shares under a pre-arranged trading plan, while a trust managed by director Mark Stevens said he sold 1.6 million shares this year. In addition to the stock, the company applied to sell an additional 3 million shares. That filing.

A representative for Nvidia declined to comment on the insider sales.

“Seeing this level of insider sales definitely doesn’t inspire confidence, but if you look at what else is going on, I think I would definitely argue that.” For investors considering whether now is a good time to buy Nvidia stock, “there’s probably one less reason to buy.”

This year’s biggest seller is Huang, whose 10b5-1 plan was adopted in March. These plans predetermine sales on a specific date and are independent of news or stock price movements. 10b5-1 plans typically have a three-month waiting period before being allowed for first sale.

Under that plan, Huang released about $713 million in stock between mid-June and mid-September. During this period, Nvidia stock fell about 5% amid a shake-up of Big Tech companies and increased scrutiny of the AI frenzy.

Even after implementing his plan, Huang still owns more than $100 billion worth of Nvidia stock.

Other big-ticket sellers include Mr. Stevens and fellow board member Tench Cox, who sold shares totaling about $390 million and $525 million, respectively, this year.

There have been a number of other pressures on Nvidia stock over the past few months. The biggest factor, said Denny Fish, a portfolio manager at Janus Henderson, is concerns about how long the heavy spending on AI computing will last.

story continues

“We’ll see the numbers as we get into 2025 and the verdict is out and Blackwell is released,” he said, referring to new processor products that NVIDIA expects will contribute billions of dollars to fourth-quarter sales. Probably.”

Nvidia stock has been on a roller coaster since June, with the company’s market capitalization briefly surpassing Microsoft Corp. and Apple Inc. to become the world’s most valuable company. Since then, the company has twice experienced drawdowns of more than 20% amid concerns about the tech giant’s spending on AI. Still, the stock has rebounded each time, and is currently up about 10% from its June 18 peak.

Although an increase in insider selling is on the horizon, investors should not necessarily view selling, especially pre-planned selling, as a bearish sign.

“Over the long term, whether the CEO is buying or the CEO is selling doesn’t have a very good correlation with stock price performance,” said Ken Mahoney, CEO of Mahoney Asset Management. “NVIDIA’s CEO isn’t selling stock because he thinks growth is slowing. He thinks just the opposite.”

top technology stories

OpenAI has completed a deal that raises $6.6 billion in new funding, giving the artificial intelligence company a $157 billion valuation and ramping up its efforts to build the world’s leading generative AI technology.

Masayoshi Son, founder of SoftBank Group Corp., has laid out one of the most aggressive timelines for artificial intelligence adoption ever, envisioning a near future where technology powers every household.

Global semiconductor manufacturers have reduced supplies of high-purity quartz, a critical material for the industry, after Hurricane Helen halted production at two North Carolina mines that produce most of the world’s supply. is being monitored.

U.S. prosecutors are widening their investigation into potential price-fixing by German software maker SAP SE and technology reseller Carahsoft Technology Corp., opening new court records showing the scope of the investigation, as well as a new investigation into potential price-fixing by German software maker SAP SE and technology reseller Carahsoft Technology Corp. We are looking into the efforts of both companies. It’s much larger than previously known.

Earnings will be paid on Thursday

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP