(Bloomberg) — A previously murky corner of the debt world has become one of the biggest winning trades in global financial markets, producing profits unlike anything most traders have seen in more than a decade.

Most Read Articles on Bloomberg

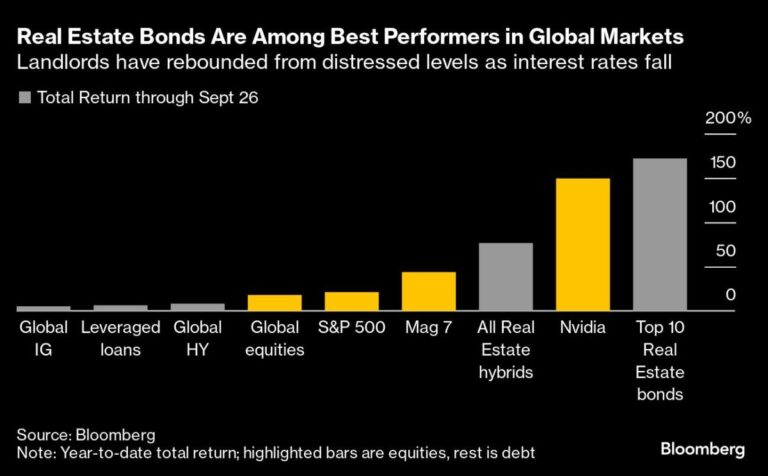

Hybrid operations, the riskiest part of a real estate company’s debt, have returned more than 75% this year. The top 10 securities, also known as subordinated debt, returned about 170% over the same period, 20 percentage points higher than the stock price of Nvidia, the darling of the AI boom.

It’s a quick turnaround that few could have predicted at a time when landlords around the world were struggling under the weight of rising interest rates and changing working practices in the wake of the coronavirus pandemic. Now, real estate debt is becoming an early winner as major central banks cut borrowing costs in a bid to prioritize the economy over fighting inflation.

“I can’t remember anything like this in my career,” said Andrea Seminara, CEO of London-based RedHedge Asset Management. He started working in the financial industry at the height of the 2008 global financial crisis. “The magnitude of the gains is unprecedented,” unless you look at the purely dire situation. ”

replacement cost

Subordinated debt to landlords had plummeted by nearly 50% after the central bank started raising interest rates in 2022. Rising borrowing costs have made it more expensive to replace bonds, leaving investors worried that repayments will be delayed indefinitely.

Companies may also skip coupons on notes without triggering a default, making them less popular with investors.

“These bonds were punished due to technical factors,” said Andreas Meyer, founder of Hamburg-based Fountain Square Asset Management. “There were bloodstains on the road.”

For Mr. Seminara, purchases at these subdued levels were effectively a bet that companies would be able to replace maturing debt and that falling inflation would allow central banks to cut interest rates. Both were proven correct.

Both companies face a so-called “maturity wall” that collapsed in historic fashion this year as money flooded into credit markets and landlords were able to issue new bonds to refinance old ones. Meanwhile, the Federal Reserve joined the European Central Bank and the Bank of England in lowering interest rates this month, leaving open the possibility of further significant rate cuts.

the story continues

Meyer’s event-driven funds also benefited, with returns of as much as 80% on hybrid bonds. He still has exposure in this field.

The main risk at the moment is that there is little profit left on the trade. Bank of America strategists Barnaby Martin and Ioannis Angelakis warned in a note last week that real estate credit is “clearly approaching full valuation.”

Still, buyers and sellers are increasingly convinced that the commercial real estate market is bottoming out. As the interest rate pain begins to ease, many people want to start leveraging their capital.

“We’ve lived through a terrible storm. No one has experienced more aggressive monetary policy in the last two years,” Ron Dickerman, founder of Madison International Realty, said in an interview. spoke. “A few rate cuts won’t create a market, but there is optimism.”

1 week review

China has unveiled a series of economic stimulus measures aimed at boosting the country’s sluggish growth. The company announced its biggest package yet to shore up the struggling real estate market, lowering borrowing costs for $5.3 trillion in mortgages and lowering down payment requirements for second homes to historic lows. Relaxed.

China is also considering injecting up to 1 trillion yuan ($142 billion) into its largest state-run bank to boost its ability to support its struggling economy.

Although some details are unclear, the unusual pace and intensity of stimulus announcements signals a sense of urgency on the part of the Chinese government to keep growth on track toward a target of around 5%, and market sentiment increased.

Separately, the country began selling euro-denominated bonds for the first time in three years.

U.S. companies and Asian issuers swooped into the bond market after the Federal Reserve decided last week to cut its benchmark interest rate by 0.5 percentage point.

A resurgence in M&A deals has accelerated the U.S. high-end bond market to its fastest pace of issuance since 2020, putting it on track to reach $1.5 trillion in sales.

Banks and other financial institutions are taking on more than 10 billion euros ($11.1 billion) in debt to back the acquisition of Sanofi SA’s consumer health division, as one of the year’s most anticipated sales reaches its final stages. I am holding.

Blue Owl Capital led the $3.2 billion private debt financing in support of Blackstone and Vista Equity Partners’ acquisition of software company Smartsheet, with participation from 20 other lenders.

Citigroup and Apollo Global Management have agreed to partner in the fast-growing private credit market and collaborate on deals valued at $25 billion over the next five years.

Atlas SP Partners, Apollo Global Management’s structured credit business, has obtained a broker-dealer license and is preparing to begin distribution transactions.

With the approval of bondholders, Country Garden Holdings has postponed payments on its nine yuan bonds for six months, giving it more time to plan a review of its domestic debt.

Credit Agricole SA is looking to raise money with bonds that must be repaid in just 10 years, adding to a number of recent long-term bonds as investors look to take advantage of the Federal Reserve’s interest rate cuts. There is.

Altice France is in talks with funds including Apollo Global Management about raising new debt to repay looming maturities, a move that could hurt existing creditors.

As Platinum Equity’s acquisition of GSM Outdoors struggles to attract demand from investors, a group of banks led by Bank of America are seeking leveraged financing to help Platinum Equity finance its acquisition of GSM Outdoors. – Relaxed loan conditions.

Dish Network Corp. is nearing a deal with some convertible debt holders that will provide the company with new capital and help extend debt maturities.

Hooters of America is in talks with lenders and advisors amid declining revenue that has forced the restaurant chain to close several locations.

On the move

Former Blackstone managing director Brian Sauveen has rejoined the Bank of Montreal’s financial sponsor group.

RBC Capital Markets has hired Sam Pfeiffer, formerly of Morgan Stanley, as head of U.S. investment-grade systematic credit trading.

M&G Investments has hired Joe Sullivan-Bissett as investment director for its £137bn fixed income division, reporting to David Parsons, head of the fixed income specialist team.

Alberta Investment Management Corp. has appointed David Scdellari, the fund’s head of international investments, to oversee private assets and strategic partnerships, and Justin Lord as senior executive officer, public markets. Meanwhile, chief investment officer Marlene Puffer is stepping down.

–With assistance from Eleanor Duncan and Dan Wilchins.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP