(Bloomberg) – The Chinese government is ramping up pressure on Chinese companies to buy artificial intelligence chips made in China instead of Nvidia products as part of the country’s efforts to expand its semiconductor industry and counter U.S. sanctions. It is being strengthened.

Most Read Articles on Bloomberg

Chinese regulators are discouraging companies from buying Nvidia’s H20 chips, which are used to develop and run AI models, according to people familiar with the matter. The policy is a form of guidance rather than an outright ban, officials say, because the Chinese government wants to avoid disadvantaging its own AI startups and escalating tensions with the United States. The person spoke on condition of anonymity as the matter is public.

The move is aimed at allowing China’s domestic AI chip makers to capture more market share, while also allowing domestic tech companies to prepare for possible additional regulation by the United States, the people said. said. Major manufacturers of AI processors in China include Cambricon Technologies and Huawei. Earlier this year, the Chinese government directed local electric car makers to source more supplies from local chipmakers as part of a campaign to achieve self-sufficiency in critical products. technology.

Nvidia shares fell as much as 3.9% to $119.26 on Friday, extending earlier losses after Bloomberg reported the news. The stock price has more than doubled this year.

The U.S. government has banned Nvidia from selling cutting-edge AI processors to Chinese customers in 2022 as part of restricting the Chinese government’s technological advances. Santa Clara, Calif.-based Nvidia has modified subsequent versions of its chips so they can be sold under U.S. Department of Commerce regulations. The H20 line fits that criteria.

In recent months, multiple Chinese regulators, including the powerful Ministry of Industry and Information Technology, have issued so-called window guidance (instructions that are not legally enforceable) to reduce the use of NVIDIA, according to people familiar with the matter. . It added that the notice aims to encourage companies to rely on domestic vendors such as Huawei and Cambricon. Another person said the Chinese government amplified the message through local industry associations.

At the same time, Chinese authorities want local companies to build the best AI systems possible. People familiar with China’s AI policy say Beijing will tolerate it even if it means having to buy foreign semiconductors instead of domestic alternatives.

the story continues

Nvidia declined to comment. China’s Ministry of Commerce, Ministry of Information Technology and Cyberspace Administration did not respond to requests for comment by fax.

Separately, Nvidia CEO Jensen Huang said Friday that the company is doing its best to serve customers in China and stay within the requirements of U.S. government restrictions.

“The first thing we have to do is follow the policies and regulations that are being put in place,” he said in an interview on Bloomberg TV. “And at the same time, do our best to compete in the markets we serve. We have many customers who trust us, so we will do our best to support them. .”

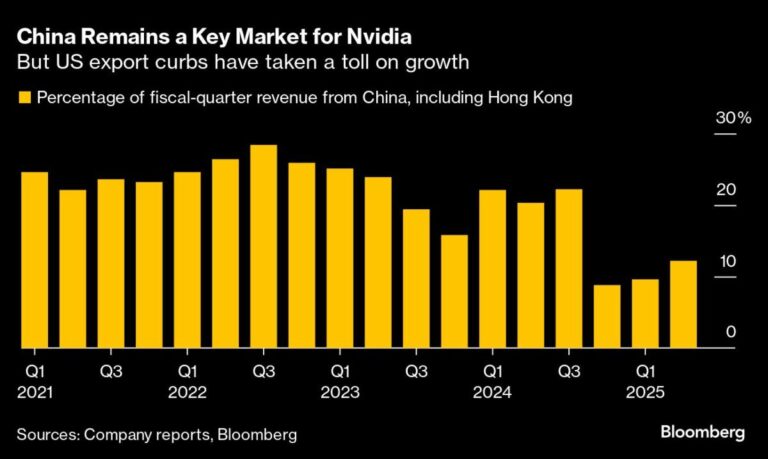

Nvidia, the world’s most valuable chipmaker, is seeing sales soar as data center operators around the world scramble to buy more of their processors. China continues to play a role in that growth, although it has been hurt by trade restrictions. In the July quarter, 12% of its revenue, or about $3.7 billion, came from Hong Kong and other countries. This was an increase of more than 30% compared to the same period last year.

“Our data center revenue in China continued to increase in the second quarter and is a significant contributor to our data center revenue,” Chief Financial Officer Colette Kress said on an August earnings call. Ta. “As a share of total data center revenue, it remains below the level it was before export restrictions were imposed. We expect the Chinese market to continue to be highly competitive.”

Nvidia chips are the gold standard for companies looking to develop artificial intelligence services. Meta Platforms Inc., OpenAI, Alphabet Inc. and others have competed to bring together their cutting-edge products to help build cutting-edge AI models. Several Chinese tech companies, including ByteDance and Tencent Holdings, stockpiled Nvidia chips before the export restrictions went into effect.

Meanwhile, Chinese chip designers and manufacturers are working to introduce Nvidia alternatives. The Chinese government has provided billions of dollars in subsidies to the semiconductor sector, but local AI chips still fall far short of Nvidia’s standards.

But despite U.S. regulations, the AI field is booming in China. ByteDance and Alibaba Group Holding Ltd. are investing aggressively, and a bevy of startups are vying for leadership. There are six so-called tigers in the development of large-scale language models, the key technology behind generative AI: 01.AI, Baichuan, Moonshot, MiniMax, Stepfun, and Zhipu.

While some companies are ignoring Chinese legislation to avoid using H20 chips and rushing to buy more chips ahead of expected US sanctions by the end of this year, they are also buying homegrown. said one of the people. Huawei chips make Beijing happy.

–With assistance from John Liu, Jessica Sou, Zheng Wu, Ian King, and Tyler Kendall.

(Updates Nvidia stock in fourth paragraph.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP