After rapid growth over the past five years, perhaps no other stock has captured more investor attention than Nvidia. (NASDAQ: NVDA)The company has become a model for building artificial intelligence (AI) infrastructure, and no other company is reaping the benefits of AI more than NVIDIA.

With that in mind, it’s no wonder that many investors are wondering whether they should buy, sell, or hold Nvidia stock. Let’s look at each case.

Reasons to buy Nvidia

Nvidia’s rationale for the acquisition centers on the fact that while demand for its graphics processing units (GPUs) is already massive, the buildout of its AI infrastructure is still in its early stages. And there’s solid evidence to believe this is the case.

As large language models (LLMs) become more sophisticated, their training requires more computational power than GPUs can provide. This is evident not only in the fact that new LLMs require more GPUs to train than their predecessors, but also in the fact that the number is growing exponentially.

For example, xAI’s Grok-3 AI model is set to train with 100,000 GPUs, while Grok-2 was trained with 20,000 GPUs, while Meta Platforms says Llama 4 LLM may require 10 times the compute power of Llama 3, which was trained with 16,000 GPUs.

Meanwhile, capital expenditures (CAPEX) on AI projects continue to rise, with both Alphabet and Meta’s CEOs saying they see the biggest risk as underinvestment in AI. Meanwhile, Oracle CTO and Chairman Larry Ellison said in the company’s latest earnings call that he doesn’t see spending on AI training slowing down over the next five to 10 years. Thus, comments from Nvidia customers suggest that AI infrastructure buildouts are still in the early stages.

Meanwhile, NVIDIA has established a leadership position in the GPU space as its CUDA software has become the de facto standard for developers to learn to program GPUs. At the same time, it is at the forefront of innovation in the space and is looking to sell entire GPU servers rather than just chips. The company has accelerated the development cycle for its next-generation chips from once every two years to once a year, which should help it maintain its technological lead and pricing power.

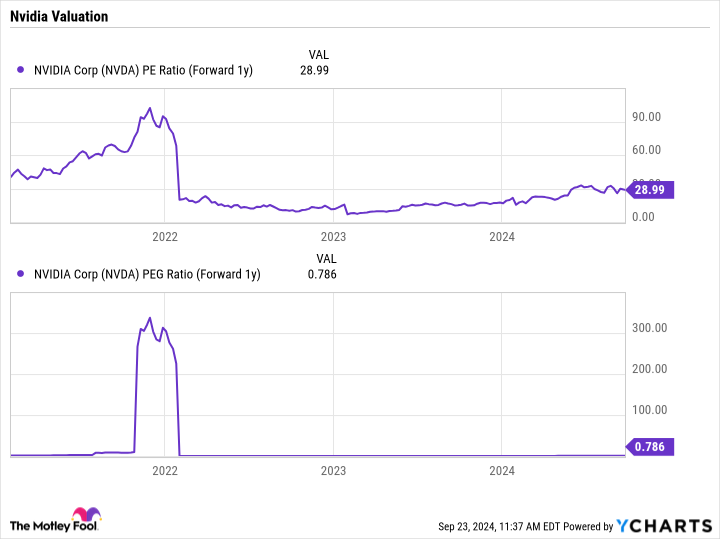

Even better, Nvidia’s stock is relatively cheap, with a forward price-to-earnings (P/E) ratio of just about 29 and a price-to-earnings growth (PEG) ratio of less than 0.8 based on analyst estimates for next year. A PEG ratio of less than 1 is generally considered cheap, while growth stocks generally have PEGs well above 1.

The story continues

The case for selling NVIDIA

The rationale for Nvidia’s selloff is rising demand for GPUs and AI infrastructure. Once the initial euphoria has passed, sales are likely to fall sharply from current levels. AI inference requires less compute power than AI training. Once AI models reach a level where they are deemed good enough, spending will shift to AI inference rather than training, requiring fewer GPUs.

Companies are currently spending huge amounts of money building infrastructure to handle AI applications, but these companies need to see a return on their investment. Nvidia can’t be the only AI winner. That goal needs to extend to its customers and their customers’ customers, too. Otherwise, AI spending will slow dramatically.

So far, hyperscalers like Microsoft and Alphabet have seen strong growth in cloud computing, while software and hardware companies have been a bit more mixed. Many software companies at the forefront of AI, such as Adobe and Microsoft, have seen modest, but not dramatic, growth in AI-related revenue. Meanwhile, there were initial concerns about iPhone 16 sales, but the integration of AI features into the model was expected to boost Apple’s sales.

Nvidia’s pending case

If you already own Nvidia, you have a good case for holding onto your shares. Chances are, unless you bought the stock recently, you’re in for some big gains that will likely continue to grow.

Nvidia could continue to rise given its reasonable valuation and the fact that the AI boom appears to still be in its early stages, and while it’s best to manage the position and make sure it doesn’t become too large a percentage of your overall portfolio, investors would be well-advised to continue holding the stock.

Verdict

While there is certainly a risk that spending on AI infrastructure could slow, comments and actions from Nvidia’s customers suggest that this is unlikely to happen anytime soon. Therefore, given the company’s valuation and future growth prospects, I consider Nvidia stock a buy.

Should I invest $1,000 in Nvidia right now?

Before you buy Nvidia stock, consider the following:

The analyst team at Motley Fool Stock Advisor has identified 10 stocks that investors should buy right now, and Nvidia is not among them. The 10 selected stocks have the potential to generate big gains over the next few years.

Let’s look back at April 15, 2005, when Nvidia created this list… if you had invested $1,000 at the time of our recommendation, you would have $712,454.!*

Stock Advisor offers investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts and two new stock picks every month. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of September 23, 2024

Randi Zuckerberg is a former director of market development and spokeswoman for Facebook and the sister of Meta Platforms CEO Mark Zuckerberg. She is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeffrey Saylor owns shares of Alphabet. The Motley Fool owns shares of and recommends Adobe, Alphabet, Apple, Meta Platforms, Microsoft, NVIDIA, and Oracle. The Motley Fool recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia Stock: Buy, Sell or Hold? was originally published by The Motley Fool.