No company has won more than Nvidia (NASDAQ: NVDA) With nearly every technology company collectively pouring billions of dollars into developing generative AI (artificial intelligence) capabilities, the company’s GPU demand has seen its sales and profits soar, adding $2.5 trillion to its market cap over the past two years.

The chipmaker has been able to exercise incredible pricing power amid strong demand, as evidenced by its gross margins expanding to the high 70% range. And with its fast revenue growth, it has very high operating leverage, which has translated into strong profit growth. Indeed, Nvidia’s performance over the past two years has been phenomenal, not just as a stock, but as a company.

But Nvidia isn’t the only AI chip stock on the market, and CEO Jensen Huang explained why it might be worth owning another company rather than his own.

“Number one in the world by an incredible margin”

At an investor conference earlier this month, Huang praised Taiwan Semiconductor Manufacturing Co. (TSMC), one of Nvidia’s largest business partners. (NYSE:TSM)Known as TSMC.

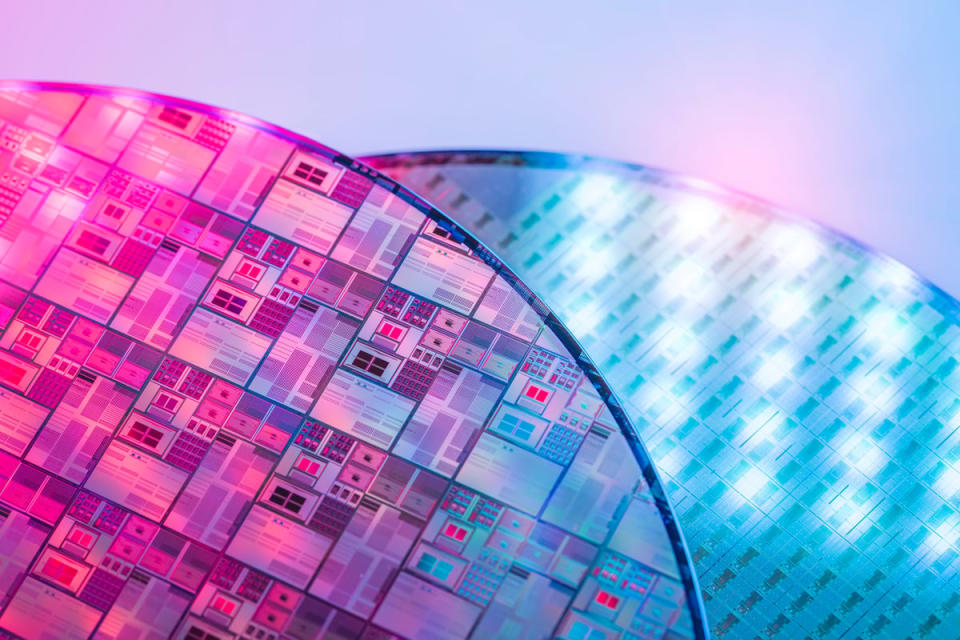

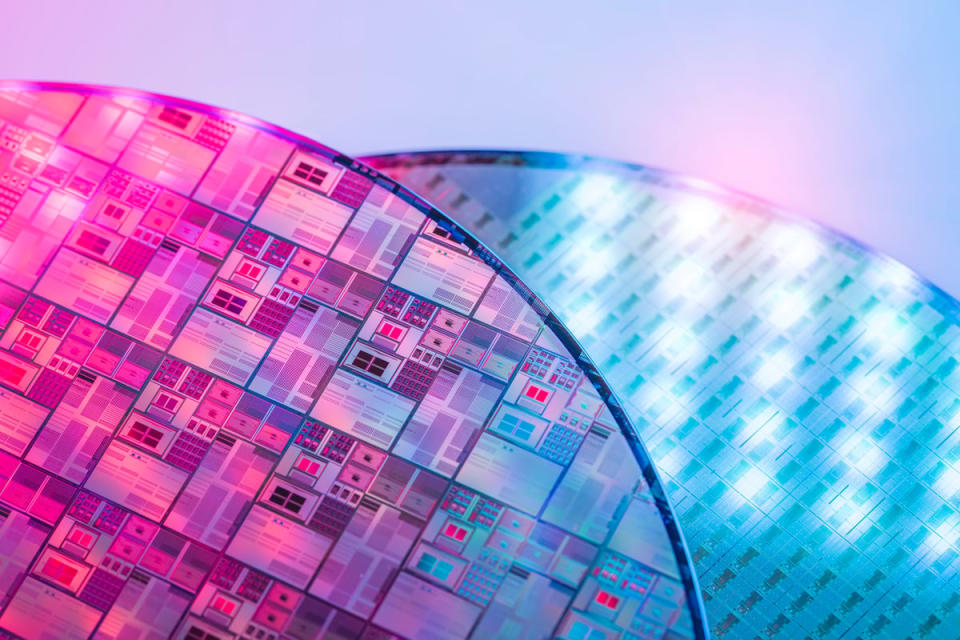

TSMC is the world’s largest semiconductor foundry, or factory. When a company like Nvidia designs a new chip, they bring that design to TSMC to actually print it onto silicon wafers. This requires incredible precision and innovative engineering. TSMC is the first choice for many chip designers, including Nvidia. TSMC accounts for more than 60% of global spending on chip foundries.

“We build at TSMC because they’re the best in the world,” Huang said. “And TSMC isn’t the best in the world by a small margin, it’s the best in the world by an incredible margin.”

That’s why Nvidia, and just about every company that needs to make cutting-edge chips, chooses TSMC over its competitors. Huang did say that Nvidia could switch to another foundry if it needed to, but he also said that competitors’ capabilities wouldn’t be able to match TSMC’s, which would lead to lower performance and higher costs.

He also praised TSMC’s ability to expand. When Nvidia’s demand for chips surged, TSMC helped the company meet that demand and capitalize on the opportunity. Companies that need to expand should work with TSMC.

Importantly, TSMC’s position as the market leader, which accounts for the majority of industry revenue, means it will be able to maintain its leadership position going forward. The company has more capital to reinvest in R&D and develop next-generation processes. Over time, this virtuous cycle will lead to more and more big contracts with major tech companies designing ultra-high-end chips.

The story continues

TSMC still has room to grow

TSMC may be the largest company in the industry, but it still has a lot of growth room to capture.

Tech companies across the board plan to increase spending on data center AI systems: IDC estimates that total spending on AI chip content and related systems is expected to reach $193.3 billion in 2027, up from $117.5 billion this year and representing an 18% compound annual growth rate over the next three years.

The key is that TSMC is completely unconcerned about that growth. Whether that growth comes from one of its competitors, Nvidia, or custom chips designed by its largest customers, TSMC is likely to win the majority of those contracts. In fact, the virtuous cycle and TSMC’s leadership in cutting-edge chips will allow the company to grow that part of its business even faster than the industry. What’s more, TSMC has room to improve its profit margins.

All of this is reflected in analysts’ forecasts for the company over the next five years. The average analyst expects TSMC to grow its revenue at more than 20% annually over the next five years. But you don’t have to pay a high price for that growth: The company’s shares currently trade at just over 20 times the 2025 consensus revenue forecast.

At this price, very few other companies offer the same level of growth potential, which means not only is this the best factory in the world by a wide margin, but investors can buy shares right now at an incredible price.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before buying Taiwan Semiconductor Manufacturing shares, consider the following:

The analyst team at Motley Fool Stock Advisor just identified the 10 best stocks for investors to buy right now, and Taiwan Semiconductor Manufacturing Co. isn’t on the list. These 10 stocks have the potential to generate huge gains over the next few years.

Consider when Nvidia created this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, you would have $722,320.!*

Stock Advisor offers investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts and two new stock picks every month. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of September 16, 2024

Adam Levy invests in Taiwan Semiconductor Manufacturing. The Motley Fool invests in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Nvidia’s CEO explains why it’s the artificial intelligence (AI) chip stock to own. This was originally published by The Motley Fool.