(Bloomberg) — Nvidia Corp. shares could rise as a large amount of options positions expire on Friday, according to analysts at SpotGamma.

Most read articles on Bloomberg

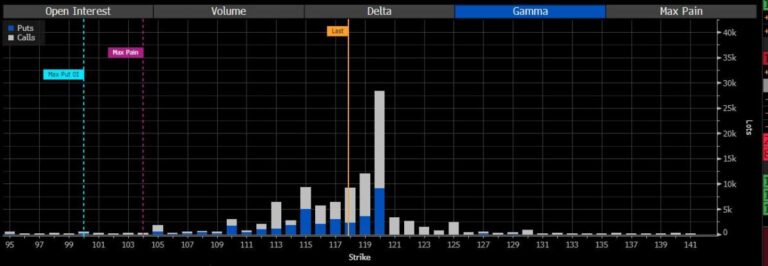

“There’s a massive underlying gamma of $2 billion at the 120 strike price,” the options expert noted, with about half of that disappearing on Friday. “This suggests that OPEX may be removing some resistance,” said the team led by founder Brent Koczuba.More than $5 trillion in contracts tied to U.S. individual stocks, ETFs and indexes are set to expire on Friday.

Gamma is a measure of how many additional shares of an underlying stock an equity options dealer needs to buy or sell to stay in balance and can act as a barrier or catalyst to market moves at different times. The semiconductor maker’s shares have been range-bound in September, failing to break above $120 and underperforming both the Nasdaq-100 and S&P 500 indexes this month.

More broadly, tech stocks have been out of favor this month, trading in line with the S&P 500, while investors are favoring some of this year’s laggards as the Federal Reserve embarks on a rate-cutting cycle.

Moreover, options implied volatility is relatively cheap, especially for calls, with one-month skews at 90-day lows. “Calls could be a risk-clear way to bet on Nvidia’s comeback,” Spot Gamma suggests.

–With assistance from Jan-Patrick Barnert.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP