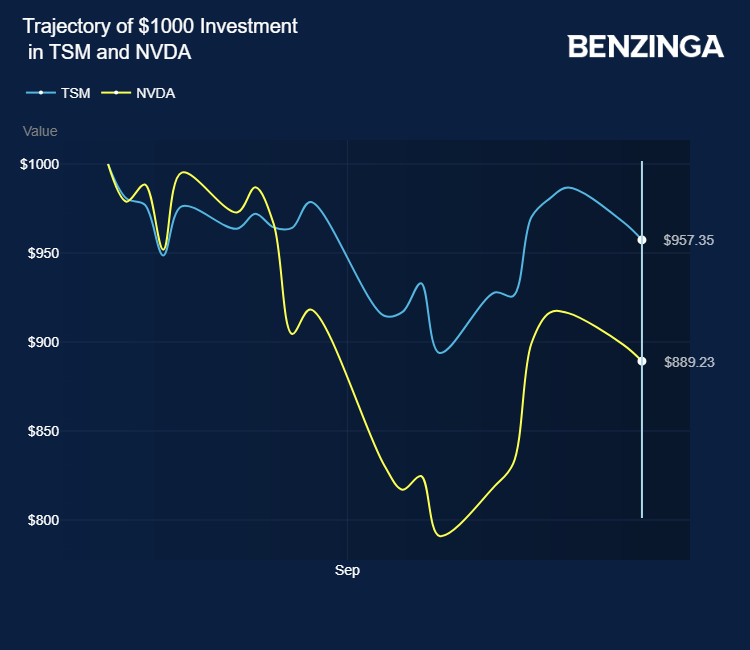

Taiwan Semiconductor Manufacturing TSMC The stock has fallen 4% over the past 30 days. Nvidia Corp shares have been volatile in the last month. NVDA Quarterly publications and more have been released.

VanEck Semiconductor ETF SMH and iShares Semiconductor ETF socksShares of Taiwan Semiconductor, a leader in the semiconductor industry, have fallen about 7% over the past 30 days. Let’s take a look back at what’s happened at Taiwan Semiconductor since Nvidia released its quarterly report.

On August 28, Nvidia reported that second-quarter revenue rose 122% to $30.04 billion, beating the analyst consensus of $28.68 billion.

Related article: Intel considers restructuring foundry business, wins big contract and government subsidy from US

The company forecast third-quarter sales of $31.85 billion, compared with the market’s expectations of $31.77 billion and $33.15 billion.

Still, the stock fell 6% in after-hours trading, dragging down chip stocks such as Taiwan Semiconductor and Advanced Micro Devices. Amand Super Microcomputer Corporation SMCIBut the print failed to make an impression on the city, and so its ratings dropped.

The sell-off in the semiconductor sector continued into September as geopolitical tensions between the US and China increased due to Western embargoes on Asian countries on artificial intelligence technology.

Meanwhile, Taiwan Semiconductor continued to invest in strengthening its advantages by localizing production of neon gas, a key material in semiconductor manufacturing that was disrupted by the Ukraine war, and accelerating the development of silicon photonics to meet the energy and data transmission speeds required for AI computing.

Taiwan Semicon predicted 50% growth in AI accelerators at the Semicon Taiwan Industry Forum in Taipei, despite concerns about the sustainability of the AI boom that are rattling the market. Broadcom’s AVGO Quarterly earnings and guidance did little to quell the semiconductor sell-off.

On the bright side, a contract chip maker has reported that production yields at its Arizona facility are on par with those at its Taiwanese facility.

Taiwan Semiconductor reported a 33% increase in sales in August 2024, a testament to a recovering smartphone market and continued demand for Nvidia AI chips. Analysts expect third-quarter revenue to rise 37%.

Taiwan Semiconductor’s major acquisitions in September included Alphabet Inc. Google Google Google’s smartphone deal includes Pixel 10 and Pixel 11 chips and Apple’s AAPL A16 chip from Arizona factory.

Taiwan Semiconductor grew more than 90% over the past 12 months to lead the global foundry market, capturing a 62% share in the second quarter of 2024.

Price Action: TSM shares closed at $167.28 on Wednesday.

Image courtesy of Shutterstock

Market news and data provided by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.