Key Takeaways

Shares of semiconductor giant Nvidia (NVDA) fell on Monday, shedding some of last week’s gains as the company continued to struggle with uncertainty.

Nvidia shares, which surged nearly 16% last week on upbeat comments from CEO Jensen Huang and analysts, closed down about 2% on Monday. Tech stocks underperformed the broader market on Monday, led by Micron (MU), which fell more than 4% after Bank of America issued a warning about the memory chip market, and Broadcom (AVGO), which fell 2%.

Nvidia’s Unsettled Summer

Nvidia shares have been in turmoil for months as Wall Street’s once-bound optimism about artificial intelligence has eased. The company’s shares were pressured in July and early August by changing interest rate expectations, rebounded during August, and then fell again at the end of the month after the company’s second-quarter earnings report disappointed investors despite beating expectations on paper.

That slump came amid a semiconductor selloff that sent stocks plummeting nearly 10% earlier this month, the biggest one-day drop in market capitalization on record. The recent rebound was marked by below-average trading volume, which may signal limited institutional participation in last week’s bargain buyout.

Analysts remain bullish on Nvidia

But since the chipmaker’s earnings report, analysts have reiterated their bullish stance on the stock, with Bank of America arguing that the post-earnings selloff was a “good buying opportunity” and Bernstein analysts recently called Nvidia “the best way to harness AI.”

Wedbush analysts argued in a Monday note that the Fed’s imminent shift to rate cuts, widely expected to begin on Wednesday, should support tech stocks in the coming months.

“With the Fed and Chairman Powell initiating a rate cutting cycle this week, a macroeconomic soft landing still on the way, and a generational spending cycle with tech spending on AI just beginning to land in the tech sector, we believe the stage is set for tech stocks to rally through the end of the year and into 2025,” the analysts wrote.

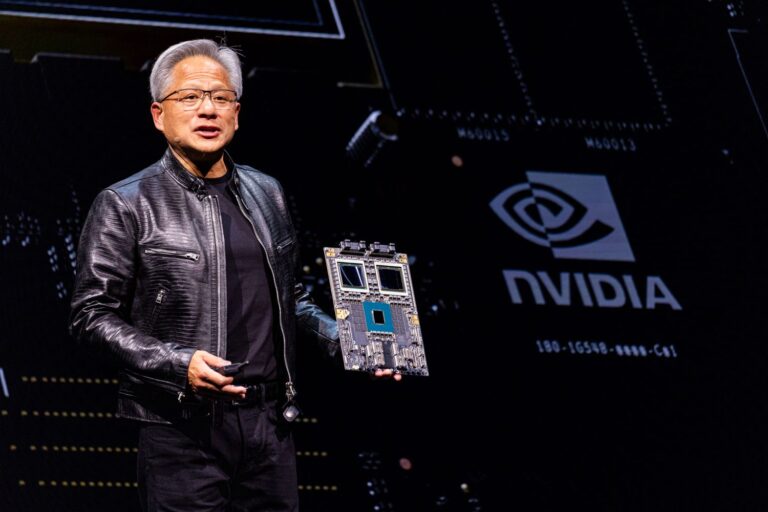

They argue that Nvidia is effectively the “only choice” when it comes to AI chips and is well-positioned to capture most of the estimated $1 trillion that will be spent on AI infrastructure over the next few years.