Taiwan Semiconductor (NYSE:TSM) It’s one of the best investments in tech right now — it’s performing well over the long term, but the biggest tailwinds it’s seen in years are just starting to blow — but how much can investors expect from the chipmaker?

Taiwan Semiconductor is facing a major tailwind

Taiwan Semiconductor is in a unique position among tech companies. As a contract manufacturer of chips, it acts as a manufacturing partner for many competing companies. For example, the company makes chips for both Nvidia and Advanced Micro Devices. Currently, Nvidia dominates the data center GPU market, which is booming due to high demand for artificial intelligence (AI), but AMD could reclaim some of its market share in the future. Either way, TSMC will benefit from the overall market boom.

As a neutral investment, Taiwan Semicon won’t experience the same ups and downs as companies competing on the open market. But as long as the technology prevails, TSMC will be a successful business. This is a fairly easy and obvious investment trend to capitalize on, making Taiwan Semicon one of the best stocks to invest in.

The company also sees big tailwinds approaching.

First, TSMC’s largest customer is Apple, which accounts for about a quarter of the company’s annual revenue. However, this has been an issue recently as iPhone sales have not been as strong as they used to be. However, now that Apple has announced its AI efforts, with “Apple Intelligence” available only on the latest generation of phones, TSMC’s smartphone business may recover.

Second, TSMC thinks AI-related chips will be a big hit, with management predicting a 50% compound annual growth rate through 2027. By that time, AI-related chips will account for more than 20% of TSMC’s total sales, which is a lot of growth for an emerging field.

Finally, Taiwan Semiconductor will launch a new chip design starting in 2025. The 2-nanometer (nm) chips are TSMC’s next-generation technology following the 3nm chips launched last year. How much performance improvement can be achieved by reducing the chip node by 1nm? Quite a bit, actually. Management claims that the 2nm chip design can be configured to achieve 10% to 15% speed improvement over the previous generation at the same power consumption rate.

But that’s not the only reason customers are buying it. The biggest improvement is energy efficiency. When configured at the same speed as a 3nm chip, the 2nm chip delivers an astounding 25% to 30% power reduction. This is a significant improvement that should drive demand, especially considering the energy operational costs that these large-scale AI services consume. Management has already seen demand for this new technology being higher than for previous releases of the 3nm and 5nm architectures.

The story continues

TSMC has a lot of big events coming up, so it’s no wonder the company is one of the best tech stocks to invest in right now.

This stock is not much higher than the S&P 500

Even the best companies can be a disastrous investment if bought at the wrong price, and the good news is that TSMC can be bought at a fairly reasonable price.

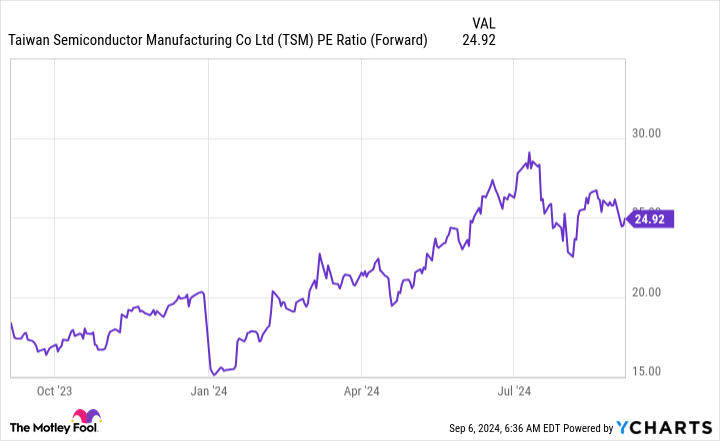

TSMC’s 25 times forward earnings represents barely a premium to the broader S&P 500 index, which trades at 23 times forward earnings. Given TSMC’s market positioning and significant headwinds, I am fairly confident that TSMC is a much better investment than the average S&P 500 company.

As a result, I believe Taiwan Semiconductor could be one of the best investments in the technology sector right now, as it offers a balanced approach to capitalize on the various AI tailwinds.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before buying Taiwan Semiconductor Manufacturing shares, consider the following:

The analyst team at Motley Fool Stock Advisor just identified the 10 best stocks for investors to buy right now, and Taiwan Semiconductor Manufacturing Co. isn’t on the list. These 10 stocks have the potential to generate huge gains over the next few years.

Let’s look back at April 15, 2005, when Nvidia created this list… if you had invested $1,000 at the time of our recommendation, you would have $662,392.!*

Stock Advisor offers investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts and two new stock picks every month. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of September 9, 2024

Keithen Drury invests in Taiwan Semiconductor Manufacturing. The Motley Fool invests in and recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The post Is Taiwan Semiconductor the Best Investment in Technology? was originally published by The Motley Fool.